ARK Make investments CEO Cathie Wooden stated she would “make a shift from gold into Bitcoin” after gold’s run left the steel trying prolonged on a key liquidity-adjusted measure, arguing that bitcoin’s provide dynamics and long-term adoption case nonetheless favor the crypto asset regardless of a sluggish 12 months.

Talking on a Feb. 2 episode of The Rundown interview, Wooden framed the decision as a part of a broader “nice acceleration” thesis specified by ARK’s newest “Large Concepts” report, which expects AI-driven capital expenditure to surge and spill into robotics, power storage, blockchain, and life sciences by way of what she described as converging S-curves.

Promote Gold, Purchase Bitcoin Now?

Wooden pushed again on the concept bitcoin has “misplaced its mojo” as gold has outperformed lately, beginning with a statistical level. “Very first thing you need to know, Bitcoin and gold should not correlated. We did the evaluation […] the correlation […] is as near zero as you may get so no correlation,” she stated, including that within the final two market cycles, gold led bitcoin earlier than the crypto asset caught up.

Associated Studying

Her extra forceful warning was directed at gold’s positioning versus broad cash. “You’ll discover this […] a chart displaying gold divided by M2. It has solely been—it has by no means been larger. It hit a brand new all-time excessive this week,” Wooden stated, arguing the setup resembles historic extremes that coincided with very completely different macro regimes. “Gold might be using for a fall […] The final two occasions it was wherever close to this was within the huge inflation […] within the 70s early 80s and […] the Nice Melancholy.”

Wooden stated the stablecoin increase has absorbed a few of bitcoin’s “rising markets” transaction narrative, however she characterised that as a payments-layer substitution fairly than a savings-layer alternative. “That’s only for the equal of a checking account. When they need actual financial savings, they’re going to purchase Bitcoin, we imagine,” she stated, tying the view to ARK’s long-term upside case. She referenced a bull-case goal of $1.5 million by 2030 within the dialog, alongside the agency’s beforehand mentioned seven-figure framework.

Associated Studying

Her core comparative declare towards gold centered on issuance. “The provision development of Bitcoin is 0.8% per 12 months and it’ll drop to 0.4 in one other two years,” Wooden stated, contrasting it with gold provide development she pegged at about 1% on common and suggesting mining output might run larger than bitcoin’s deterministic issuance fee. She additionally pointed to “intergenerational wealth switch” as a possible tailwind for bitcoin over time.

Wooden additionally supplied a extra tactical rationalization for why bitcoin has struggled to maintain upside momentum, pointing to what she described as an October 10 “flash crash” tied to a software program glitch at Binance and an auto-deleveraging cascade. “There was a flash crash brought on by a software program glitch at Binance and there was an auto deleveraging occasion,” she stated. “Individuals have been simply […] margin known as to the tune of about 28 billion {dollars} […] and we expect that’s simply now washing by way of the system.”

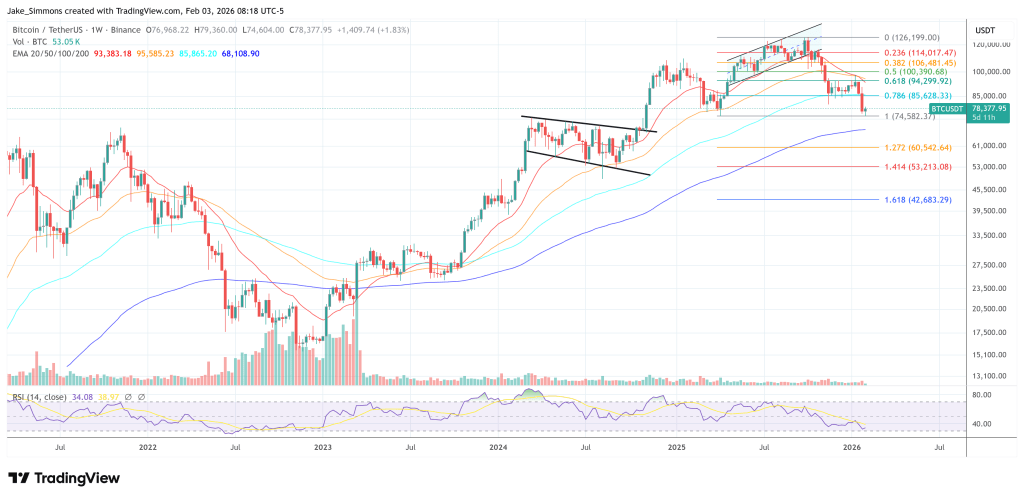

As a result of bitcoin is “probably the most liquid of all crypto property,” Wooden argued it turns into “the primary margin name,” making it the first supply of compelled promoting throughout broad deleveraging. She recommended that overhang is now fading, however her feedback got here earlier than Monday’s downdraft that noticed bitcoin slide to $74,600. Within the interview, she stated the market was “testing […] round 80,000 once more” and anticipated it to “maintain within the 80 to 90,000 vary” absent a significant geopolitical shock. “Except all hell breaks unfastened in Iran […] then possibly we’ll see the shop of worth come again for Bitcoin,” she added.

At press time, BTC traded at $78,377.

Featured picture from YouTube, chart from TradingView.com