- About 8.9M BTC is underwater, the very best degree of provide in loss since Jan 2023

- Bitcoin dropped under $65.5K after breaking underneath $67K earlier within the session

- US Bitcoin ETF inflows have fallen sharply since their October 2025 peak

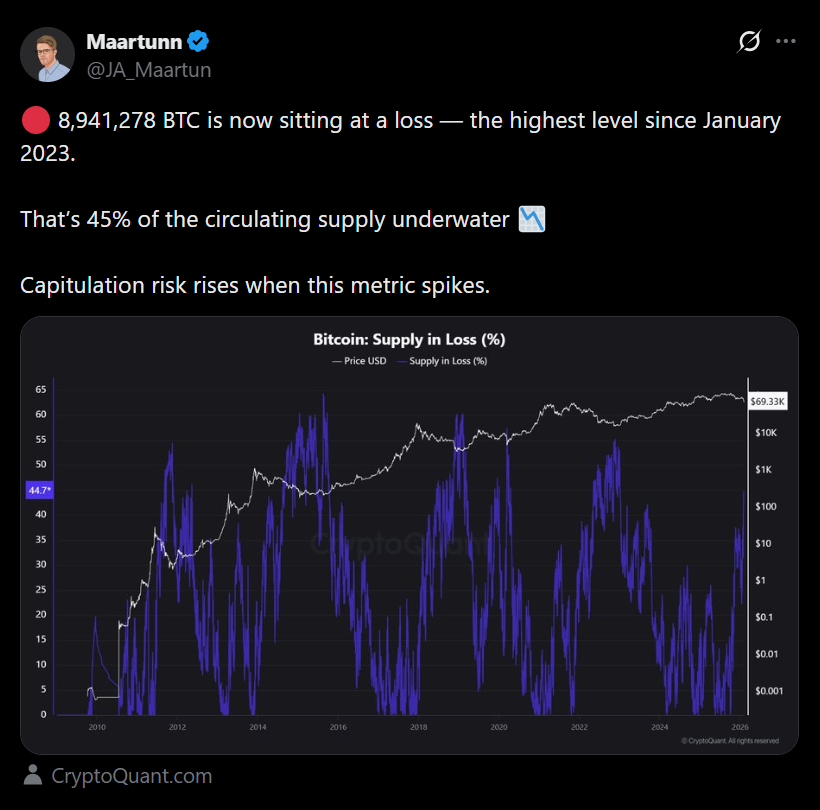

Round 8.9 million Bitcoin, roughly 45% of the circulating provide, is now underwater, in keeping with CryptoQuant analyst J.A. Maartun. That’s the very best share of provide in loss since January 2023, and traditionally, spikes on this metric have a tendency to lift capitulation threat. When extra holders slip into purple territory, stress builds, not at all times instantly, however mechanically.

This doesn’t assure a collapse. But it surely does change the market’s emotional steadiness. When almost half of provide is underwater, weak palms turn into simpler to shake out, and even long-term holders begin paying nearer consideration to draw back ranges.

Bitcoin Breaks Under $67K and Slips Below $65.5K

Bitcoin fell roughly 10% prior to now 24 hours, dropping under $65,500 on the time of reporting. The transfer adopted an earlier breakdown underneath $67,000, which had already been appearing as a key psychological line after the latest selloff. As soon as that degree failed, the decline accelerated shortly.

This sort of drop tends to convey out the worst model of crypto markets. Not as a result of fundamentals out of the blue modified, however as a result of leverage and sentiment each unwind on the identical time. Value strikes quicker than narratives can catch up, and that’s when panic trades begin showing.

ETF Outflows Add One other Layer of Stress

US Bitcoin ETFs additionally noticed renewed stress in late January 2026, recording internet outflows that marked the second- and third-worst weeks in ETF historical past. That move information issues as a result of ETFs have been broadly seen because the stabilizing drive of this cycle. After they begin bleeding, it alerts that even slower institutional capital is trimming publicity.

Cumulative inflows have now declined by about 12.4% from their peak in October 2025. That doesn’t imply the ETF story is over, but it surely does counsel this section is not about pleasure. It’s about endurance.

Capitulation Threat Is Rising, however the Market Isn’t Damaged

A rising “provide in loss” metric is usually much less about worth itself and extra about psychology. The market turns into extra delicate, sellers get louder, and patrons turn into hesitant, even when they nonetheless consider within the long-term thesis. That’s sometimes when capitulation turns into doable, not assured, however doable.

If Bitcoin stabilizes and begins rebuilding construction, this era might later be seen as a painful reset. If it fails to carry key ranges, the stress might deepen. Both manner, the market is coming into a zone the place persistence turns into an actual edge, and impatience will get punished quick.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.