- ETF holders are sitting on losses however not dashing for the exits

- Outflows look giant in headlines however small versus whole inflows

- Lengthy-term conviction is being examined greater than worth ranges

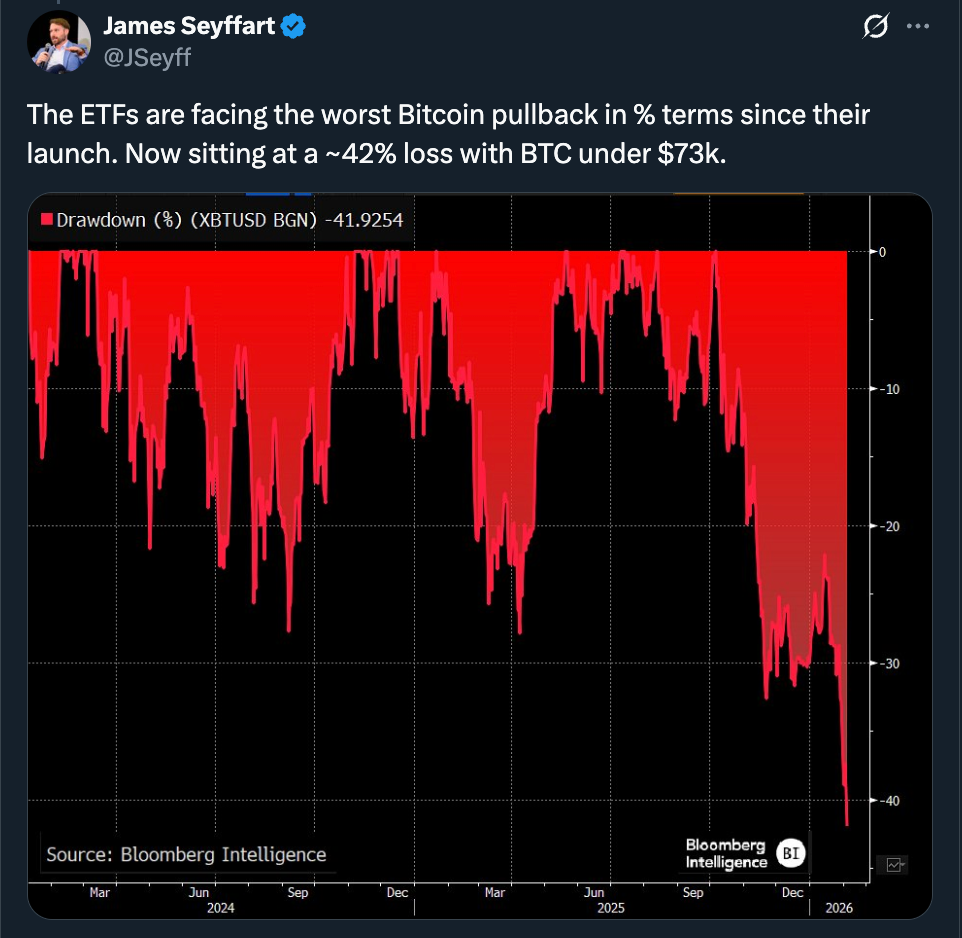

Bitcoin spot ETF holders are actually going through their deepest paper losses since launch. With BTC hovering within the low $70,000 vary, the typical holder is roughly 24% underwater. In earlier crypto cycles, that sort of drawdown would have sparked aggressive promoting and emotional exits nearly instantly. This time, it hasn’t.

Outflows are occurring, however they’re managed and sluggish. There’s no cascade, no stampede, no sense of urgency on-chain or in fund information. That distinction alone suggests the customer profile has modified in a significant means.

The Larger Movement Image Tells a Calmer Story

Zooming out shifts the narrative. Earlier than the downturn, spot Bitcoin ETFs pulled in additional than $62 billion in inflows. Even after months of weak point, web inflows are nonetheless hovering close to $55 billion. That’s not capital fleeing, it’s capital digesting.

Three straight months of outflows sound dramatic when remoted. In opposition to the size of prior inflows, they give the impression of being far much less alarming. Losses really feel sharper once they comply with euphoria, however that doesn’t robotically make them structurally essential.

This Section Is Testing Time Horizons, Not Perception

A lot of the nervousness comes from short-term framing. Bitcoin is down roughly 25% in a month, so sentiment flipped shortly. However zoom out additional and the image adjustments once more. Since 2022, BTC continues to be up multiples in comparison with gold or silver, even after these metals posted their strongest years in many years.

ETF consumers have been by no means day merchants. They have been allocators. Allocators don’t react to each drawdown if the thesis nonetheless holds. What’s being examined proper now isn’t Bitcoin’s long-term case, it’s persistence.

Boredom Appears to be like Like Weak point Till It Doesn’t

ETF holders are underwater and nonetheless holding. That isn’t denial, it’s self-discipline. Markets typically confuse discomfort with failure, particularly in crypto the place reactions are normally excessive.

This section isn’t capitulation. It’s boredom. And tedium is usually the place longer-term positioning quietly will get constructed, not destroyed.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.