Market members are dealing with a pointy volatility spike because the Bitcoin value reacts to aggressive deleveraging throughout the crypto house.

loading=”lazy” />

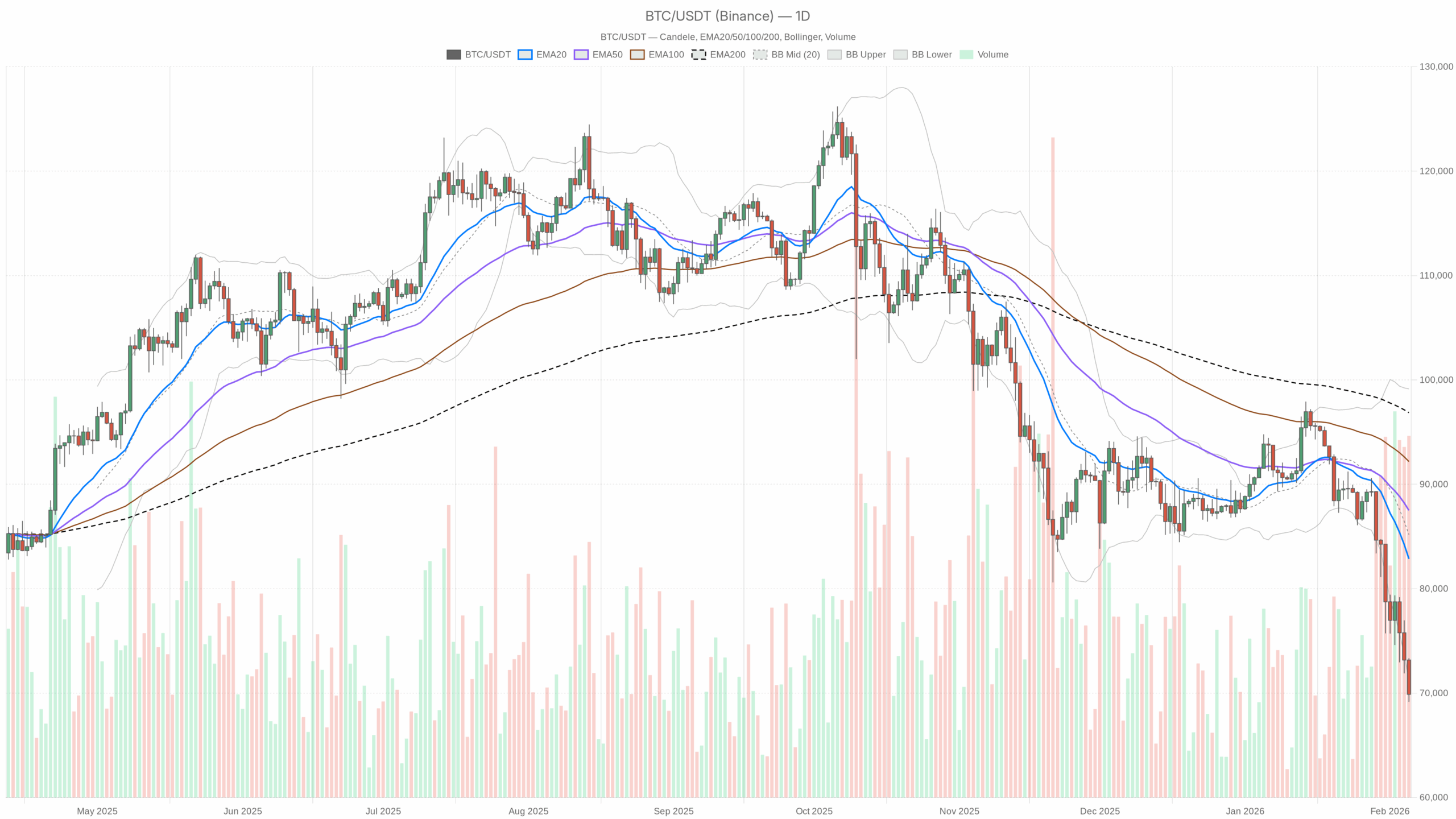

loading=”lazy” />Every day Construction: Clear Downtrend, Early Indicators of Capitulation

Development & EMAs (D1)

– Worth: $69,882.91

– EMA 20: $82,859.92

– EMA 50: $87,498.27

– EMA 200: $96,861.46

Bitcoin is buying and selling far beneath all key EMAs. The 20-day is greater than $13k above spot, the 50-day virtually $18k above, and the 200-day over $25k increased. That’s not only a pullback; it’s a full-blown bearish macro regime the place momentum has damaged and development followers are exiting or shorting rallies. The gap from the 20-day EMA additionally means the market is stretched to the draw back; sharp snapback rallies are solely doable, however they’d be corrections inside a broader downtrend till at the least the 20-day begins flattening and value reclaims it.

Foremost state of affairs from D1: Bearish. The upper-timeframe development is down. Any bullish stance right here is tactical and counter-trend, not a confirmed reversal.

RSI (D1)

– RSI 14: 20.03

Every day RSI round 20 is deeply oversold, in basic capitulation territory. This stage of compression usually doesn’t final lengthy; it typically marks both the tail finish of a drop or the beginning of a unstable consolidation the place bounces are violent however not essentially sturdy. In plain phrases, the market is closely one-sided brief or hedged, so it’s susceptible to a face-ripping squeeze, however from a structurally weak base.

MACD (D1)

– MACD line: -4,589.18

– Sign line: -2,780.01

– Histogram: -1,809.17

The MACD is deeply detrimental with the road properly beneath the sign and a giant detrimental histogram. Momentum stays decisively bearish; sellers are nonetheless in management on the day by day chart. There is no such thing as a seen signal but of a momentum crossover or flattening, so whereas value is oversold, the underlying impulse of the transfer continues to be down.

Bollinger Bands (D1)

– Mid-band (20 SMA): $85,173.23

– Higher band: $99,138.17

– Decrease band: $71,208.28

– Worth: $69,882.91 (beneath decrease band)

Bitcoin is buying and selling beneath the decrease day by day Bollinger Band. That’s basic overshoot conduct: value has damaged out of the latest volatility envelope to the draw back. Two implications:

1) The present transfer is statistically excessive relative to the final 20 days.

2) Imply reversion odds improve, not essentially a full development reversal, however at the least a transfer again towards the band or the mid-line over time.

In apply, this setup typically results in one in all two issues: a quick bounce again contained in the bands, or a “strolling the band” section the place value grinds decrease hugging the decrease band. Given how far beneath the EMAs the market is, a brief, sharp aid rally wouldn’t be shocking, however it will nonetheless be swimming towards a powerful present.

ATR & Volatility (D1)

– ATR 14: $3,938.39

An ATR close to $4,000 on the day by day means volatility is elevated. Day-to-day ranges of $4k or extra are regular on this setting, which amplifies each draw back air pockets and upside squeezes. Place sizing and leverage tolerance have to replicate this; a “regular” cease can simply be run in a single 4-hour candle.

Every day Pivot Ranges (D1)

– Pivot level (PP): $70,795.70

– Resistance 1 (R1): $72,428.39

– Help 1 (S1): $68,250.21

Worth is at the moment simply beneath the day by day pivot and hovering nearer to S1. That units up a quite simple native battle: so long as BTC stays beneath $70.8k, intraday merchants will deal with bounces as alternatives to promote into. Furthermore, a sustained reclaim of the pivot and a push towards $72k (R1) can be the primary signal that promoting stress is stress-free. Conversely, a clear break beneath $68.2k opens the door to a different leg down, with no robust day by day help from this mannequin till the market will get properly into the mid-60s.

Hourly Context: Bearish, However Promoting Strain Is Easing

Development & EMAs (H1)

– Worth: $69,816.59

– EMA 20: $71,469.19

– EMA 50: $73,558.05

– EMA 200: $79,013.92

On the 1H chart, Bitcoin is beneath the 20, 50, and 200 EMA, so the intraday development is according to the day by day: bearish. The hole to the 20 EMA (~$1.6k) is sizeable however not outrageous on this volatility regime, and it tells you short-term merchants are nonetheless promoting rallies somewhat than shopping for dips.

RSI (H1)

– RSI 14: 30.16

Hourly RSI sitting close to 30 is weak however not but absolutely washed out. The final leg of promoting has eased; the market is now not at sub-20 panic ranges on this timeframe. That helps the concept draw back momentum is cooling brief time period, probably establishing both a consolidation vary or a corrective bounce again towards the 20 EMA round $71k and above.

MACD (H1)

– MACD line: -1,258.54

– Sign line: -1,222.34

– Histogram: -36.20

The MACD stays detrimental on the hour, however the histogram is barely barely beneath zero. Bearish momentum continues to be there however has largely flattened. Sellers are now not accelerating; the development is down, however the push decrease is much less aggressive than it was. If this histogram flips constructive over the subsequent few candles, that may affirm a short-term aid construction towards the prevailing day by day downtrend.

Bollinger Bands (H1)

– Mid-band: $71,504.77

– Higher band: $74,033.75

– Decrease band: $68,975.80

– Worth: $69,816.59

On the hourly, value has re-entered the bands and is sitting barely above the decrease band. That may be a basic “stabilizing after a flush” posture: the market is now not in full breakdown mode however has not reclaimed the center of the vary both. It helps the thought of a fragile base forming between roughly $69k and $72k the place short-term bulls and bears can each play, however the place the higher-timeframe bears nonetheless personal the narrative.

ATR & Pivot (H1)

– ATR 14: $967.49

– Pivot level (PP): $69,939.38

– R1: $70,189.83

– S1: $69,566.14

The hourly ATR just below $1,000 strains up with the day by day volatility image: swings of $1k per hour are solely regular right here. Intraday, BTC is principally clinging to the hourly pivot space ($69.9k) with S1 just some hundred {dollars} beneath. This marks a short-term resolution zone: sustained buying and selling above $70k ideas the dimensions towards a bounce into $71–72k; repeated rejections right here probably see one other push towards and beneath $69.5k.

15-Minute Execution Layer: Micro Bearish, However Compressing

Development & EMAs (M15)

– Worth: $69,816.59

– EMA 20: $70,167.27

– EMA 50: $70,996.54

– EMA 200: $73,742.70

On the 15-minute chart, BTC is beneath the 20, 50, and 200 EMAs, so the microstructure continues to be bearish. Nonetheless, the space to the 20 EMA is now only some hundred {dollars}. That may be a signal of value compression, often a prelude to a short-lived breakout transfer in both path. Given the broader context, the default expectation is one in all two issues: a fast squeeze into $70.5–71k that sellers fade, or a minor breakdown towards $69k that both extends or will get purchased for a scalp reversal.

RSI & MACD (M15)

– RSI 14: 41.41

– MACD line: -482.91

– Sign line: -445.72

– Histogram: -37.19

RSI on the 15-minute is round 41: weak, however not oversold. The short-term MACD stays detrimental with a small bearish histogram. This configuration often seems in sideways-to-down consolidations, the place bounces are shallow and sellers are patiently leaning in overhead. There is no such thing as a clear intraday reversal sign on this timeframe but.

Bollinger Bands & Pivot (M15)

– Mid-band: $70,402.36

– Higher band: $72,141.84

– Decrease band: $68,662.89

– Worth: $69,816.59

– Pivot level (PP): $69,939.38

– R1: $70,189.83

– S1: $69,566.14

On the 15-minute, value is contained in the bands and sitting between the decrease band and the mid-band. Mixed with the close by pivot cluster round $69.9–70.2k, this seems like a short-term equilibrium zone the place liquidity is constructing. That’s usually the place bigger gamers determine the subsequent impulse: take in remaining promote stress and squeeze increased, or reload shorts and push for contemporary lows.

Sentiment & Market Context

The broader crypto market has shed over 5% of its whole market cap in a day, whereas quantity is up greater than 23%. That’s basic high-volume liquidation conduct somewhat than a delicate rotation. BTC dominance close to 57% reinforces that Bitcoin is main the transfer; altcoins are passengers, not drivers.

The Excessive Worry studying on the concern and greed index (worth: 12) tells you positioning has flipped from euphoria to panic. Traditionally, these readings are related to engaging longer-term entries however are uncomfortable to stay by means of, as a result of they typically coincide with headlines like “disaster of religion” and “freefall” – precisely what the information movement is saying now. It doesn’t assure the low is in, nevertheless it does counsel most late patrons have both been shaken out or are significantly questioning their thesis.

Bullish State of affairs for Bitcoin Worth

For the bullish camp, the core thought is imply reversion after capitulation. The present Bitcoin value construction is stretched, however that alone doesn’t affirm a sturdy backside.

1. Maintain and construct above $68k (day by day S1): So long as BTC defends the $68,000 area on day by day closes, the market can argue the worst of the liquidation is completed. A collection of upper lows on intraday charts above this zone would reinforce that view.

2. Reclaim the $70.8k pivot and $72k space: On the day by day, getting again above the pivot ($70,795) after which holding above $72k (R1 and up to date breakdown space) would sign that sellers are operating out of ammunition. Hourly RSI would probably drift again towards impartial, and the MACD histogram would possibly flip constructive on that push.

3. Drive again inside or towards the day by day decrease Bollinger Band: A day by day shut again inside the decrease band (above roughly $71.2k) would mark the top of the Bollinger overshoot and ensure a short-term reversal try.

4. Goal zone: In that case, an affordable upside magnet can be the $75k–78k area, close to the underside of short-term resistance zones and nearer to the 20-day EMA, the place the bigger-picture sellers are ready.

What invalidates the bullish state of affairs?

A clear day by day shut beneath $68k with increasing quantity and a still-negative MACD histogram would let you know the market shouldn’t be completed flushing. That will counsel the bounce was a bull entice and that the trail of least resistance stays down towards the mid-60s or decrease.

Bearish State of affairs for Bitcoin Worth

The bearish camp has the structural argument proper now: development is down, momentum is down, and rallies are for promoting.

1. Fail to reclaim $72k–73k: So long as BTC stays pinned beneath the day by day pivot zone and particularly beneath $72k–73k, each push increased is simply aid inside a broader downtrend. Hourly and 15-minute EMAs overhead create a ceiling the place brief sellers can lean in.

2. Break $68k and “stroll” the decrease Bollinger Band down: A decisive transfer by means of $68k adopted by value hugging the decrease day by day band would point out ongoing distribution somewhat than capitulation. With RSI already at 20, this might be a “grind decrease in ache” state of affairs somewhat than a waterfall, however it may well nonetheless bleed out a number of thousand {dollars}.

3. Momentum stays detrimental: If the day by day MACD line retains diving away from the sign and the histogram stays strongly detrimental, you’re looking at a persistent bearish impulse. Quick-term bounces that fail to flip hourly MACD constructive can be handled as reload factors.

4. Goal zone: Under $68k, the subsequent logical zone is the mid-60ks, the place prior consolidation befell. In additional pressured situations, a spike towards the low-60k space can’t be dominated out given present volatility.

What invalidates the bearish state of affairs?

The bear case weakens if BTC can reclaim and maintain above the 20-day EMA (at the moment round $82.9k) on a closing foundation, with day by day RSI pushing again into the 40s and MACD flattening or crossing up. That will flip the latest transfer right into a deep however profitable retest somewhat than the beginning of a bigger downtrend. Extra tactically, a collection of upper highs and better lows on the day by day chart, closing again above $75k–78k, would already be a warning that the simple sell-the-rip playbook is failing.

Assume About Positioning Right here

The large image is straightforward however uncomfortable: the day by day development is bearish, however the market is deeply oversold and extremely emotional. That blend is the place each side repeatedly get punished, shorts by violent squeezes and dip-buyers by continuation selloffs.

Key factors to bear in mind:

- Development vs. imply reversion: The dominant construction (EMAs and MACD) says trend-followers nonetheless have the higher hand. Imply reversion alerts (RSI, Bollinger overshoot, concern and greed) argue a counter-trend bounce is more and more probably. Any bullish positioning right here is inherently combating the upper timeframe development and may respect that danger.

- Timeframe alignment: All three timeframes, day by day, hourly, and 15-minute, are technically bearish, however the shorter ones present slowing draw back momentum. That helps short-term tactical trades in each instructions, nevertheless it doesn’t but justify a assured long-term bullish stance.

- Volatility and danger: With day by day ATR close to $4k and hourly round $1k, place sizing and leverage are important. Ranges like $68k and $72k could also be “close to” in share phrases, however they are often breached and reclaimed a number of occasions in a day. Planning round that noise is extra vital than attempting to guess the precise backside.

In abstract, the Bitcoin value sits in a bearish regime with oversold situations. The subsequent few periods will determine whether or not this was an exhaustive capitulation that units up a bigger bounce, or simply the primary significant leg of a deeper correction. Both means, that is an setting the place self-discipline and volatility consciousness matter greater than conviction.