- BlackRock transferred massive quantities of BTC and ETH to Coinbase Prime

- The transfer comes as Bitcoin and Ethereum lengthen sharp 2026 losses

- ETF outflows and liquidations spotlight ongoing market stress

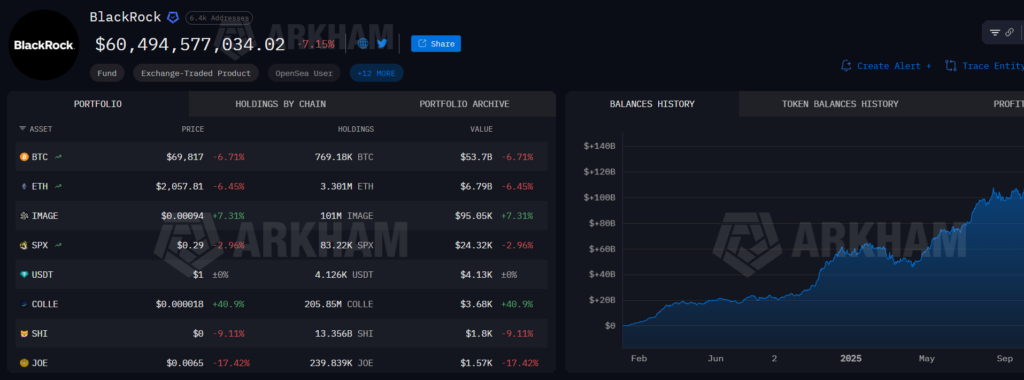

BlackRock, the world’s largest asset supervisor, deposited roughly 5,080 Bitcoin, value about $358 million, together with 27,196 Ethereum valued close to $57 million, into Coinbase Prime earlier as we speak. The information, flagged by on-chain monitoring, instantly caught market consideration given the timing. These transfers arrived simply as crypto markets had been already underneath stress and sentiment was fragile.

Bitcoin had damaged under the $71,000 stage the day earlier than and slid additional to round $69,200 on the time of reporting. That places BTC down roughly 22% over the previous seven days, a pointy transfer that has rattled each spot and derivatives markets.

Massive Transfers Don’t At all times Imply Promoting

Actions of this measurement usually set off hypothesis, however they don’t routinely sign liquidations. Coinbase Prime is often used for custody, execution, and inside fund operations, particularly by massive establishments. Related switch patterns earlier this week had been adopted by sizable inflows and outflows with out clear directional intent.

Nonetheless, in unstable situations, each massive transfer will get scrutinized. When costs are already falling, even routine operational transfers can amplify concern and short-term reactions throughout the market.

ETF Outflows Add to the Strain

The timing additionally coincides with notable ETF exercise. IBIT, BlackRock’s spot Bitcoin ETF launched in January 2024, recorded roughly $373 million in internet outflows on Wednesday. Throughout the broader US market, spot Bitcoin ETFs noticed about $545 million depart in a single day.

These outflows mirror traders decreasing publicity as costs slide, not essentially a collapse in long-term conviction, however the velocity of withdrawals has added to draw back momentum. The stress has spilled into derivatives as nicely.

Liquidations and 12 months-to-Date Losses Mount

Crypto markets noticed greater than $1 billion in leveraged liquidations over the previous 24 hours, with lengthy positions accounting for roughly $897 million of that complete. The unwind highlights how rapidly leverage builds throughout rebounds, and the way violently it could reverse when costs break key ranges.

Bitcoin is now down greater than 20% year-to-date in 2026, whereas Ethereum has suffered even deeper losses, falling roughly 30% since January. In that context, institutional strikes, even impartial ones, are being interpreted by a way more cautious lens.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.