The market is but to witness a correct restoration, however we’re at the least reaching ranges the place most belongings are thought of “oversold,” which creates a window of alternative for almost all of buyers.

XRP has to get out

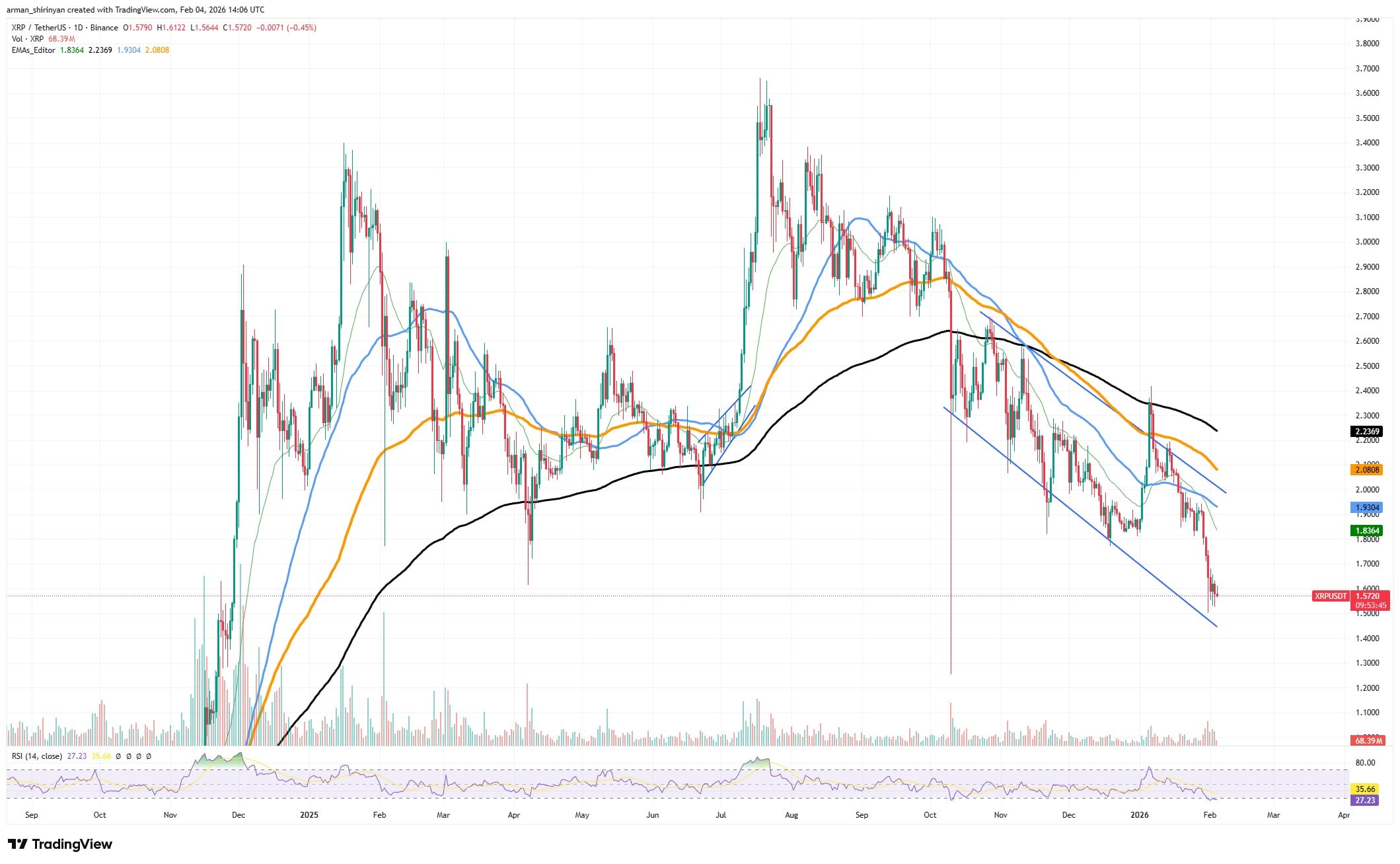

XRP is presently caught in what more and more appears like a bearish lure, with worth motion struggling to reclaim momentum after repeated failed restoration makes an attempt. The asset continues to be caught beneath the vital $1.60 threshold regardless of sporadic makes an attempt at a bounce. For merchants watching the market develop, this stage has develop into a technical and psychological barrier.

XRP is presently buying and selling beneath vital shifting averages, forming decrease highs and decrease lows, because it slides inside a persistent downward channel. Each try to maneuver increased has been swiftly adopted by recent promoting stress, indicating that the market as a complete continues to be not very bullish. Sellers proceed to regulate short-term momentum, as evidenced by quantity spikes throughout sell-offs.

Crypto Market Prediction: Will XRP Break Bullish Entice? Shiba Inu’s (SHIB) 3 Bullish Targets, Ethereum’s (ETH) 300-Day Report Damaged

Stifel: Bitcoin Might Collapse Under $40K

Short-term bullish indicators, resembling transient comebacks and oversold technical readings, proceed to entice merchants to anticipate a reversal, which creates the lure. Nevertheless, these actions fall in need of making a long-lasting development shift within the absence of serious shopping for follow-through. The bearish construction is strengthened because of the worth being repeatedly pushed again beneath resistance zones. A breakout just isn’t utterly out of the query, although.

Momentum indicators present that XRP continues to be near oversold territory, and as soon as promoting stress has subsided, markets incessantly see dramatic reduction rallies. Consumers might provoke quick masking and clear the way in which for increased resistance ranges, if they’re able to maintain the present help zone and push the worth again above $1.60 with convincing quantity.

The issue is that important capital inflows and wider stabilization of the cryptocurrency market will probably be needed for such a breakout. XRP would possibly proceed to undergo beneath promoting stress if sentiment towards Bitcoin and different main altcoins doesn’t enhance.

Shiba Inu builds path

Although the asset nonetheless lacks the power needed for a transparent breakout, Shiba Inu is beginning to define a potential restoration construction following a chronic interval of promoting stress. Consumers are steadily stepping in as SHIB stabilizes after a steep decline, in line with latest worth motion, however momentum continues to be too weak to substantiate an entire development reversal at this level. Though execution has not but adopted, technically the trail towards restoration is changing into extra obvious.

Bulls haven’t regained management, as SHIB continues to be struggling beneath its short-term shifting averages. The asset has not been in a position to develop sustained upward momentum as a result of every try at a rebound has stalled earlier than regaining important resistance zones. Earlier than a major restoration can begin, plenty of technical obstacles must be overcome.

Regaining the 26 EMA, which is presently serving as quick dynamic resistance, is an important first step. If this stage is efficiently crossed, it could point out that the short-term promoting stress is abating.

Subsequently, SHIB should surpass the 50 EMA, which has constantly capped upward makes an attempt within the earlier weeks. Regaining this common may draw short-term merchants again to the asset and point out a structural enchancment in worth conduct. The final breakdown zone that precipitated the latest leg decrease, $0.0000078, is the ultimate and most vital barrier. The true restoration affirmation level is now this stage.

The present bearish construction would solely be invalidated by a sustained transfer above it, enabling SHIB to pursue increased resistance ranges. Because of this, buyers ought to pay shut consideration to those milestones. Regardless that SHIB just isn’t but prepared for a major breakout, the trail to restoration is evident.

Ethereum’s likelihood to bounce

With the asset reaching its most oversold state on the day by day RSI within the final 300 days, Ethereum is presently experiencing considered one of its most technically difficult circumstances in virtually a yr. Previous to a major reduction rebound that occurred all through the market in April 2025, Ethereum final skilled comparable oversold ranges.

The worth motion of ETH in the mean time exhibits persistent promoting stress because the asset repeatedly breaks beneath vital help zones and shifting averages. Latest candles point out that enormous market contributors have been actively lowering their publicity or that liquidations have accelerated through the decline, as evidenced by their aggressive draw back momentum and excessive buying and selling quantity.

As a substitute of confirming further declines, the RSI’s decline to those excessive ranges signifies that promoting momentum has run its course. Prior to now, when the market absorbs extra provide, such deep oversold readings incessantly preceded both a reduction rally or a protracted consolidation part.

Traders ought to nonetheless train warning although. Particularly, if general market sentiment continues to be destructive, oversold situations by themselves don’t guarantee an immediate reversal. Ethereum continues to be buying and selling beneath main shifting averages, and your complete cryptocurrency market might want to stabilize with the intention to regain these ranges. Trying forward, if consumers transfer in near current help zones, Ethereum would possibly attempt a technical rebound as sellers lose steam.

It’s possible for ETH to get well towards damaged resistance areas close to earlier consolidation ranges, however long-term features will rely on its means to regain quantity participation and confidence. As of proper now, Ethereum is at a pivotal juncture: both the market begins to construct a basis for a comeback or the asset retains falling till stronger demand finally seems.