- Binance’s SAFU added 3,600 BTC, bringing whole holdings to about 6,230 BTC

- The trade has already handed 40% of its $1B Bitcoin conversion objective

- SAFU is designed as an emergency reserve and have to be restored if it drops too low

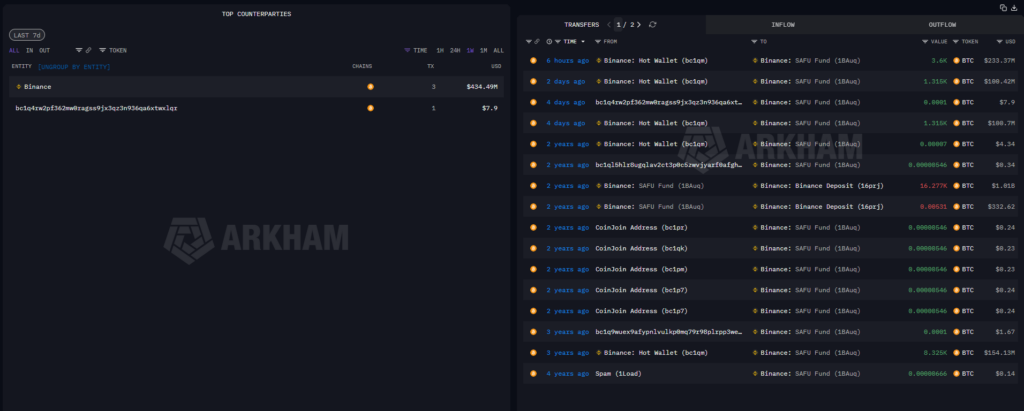

Binance’s Safe Asset Fund for Customers has bought an extra 3,600 Bitcoin for roughly $233 million, in accordance with on-chain knowledge. The brand new acquisition brings SAFU’s whole Bitcoin holdings to about 6,230 BTC, valued close to $410 million at present market costs. The timing is notable, coming as crypto markets stay risky and sentiment remains to be shaky.

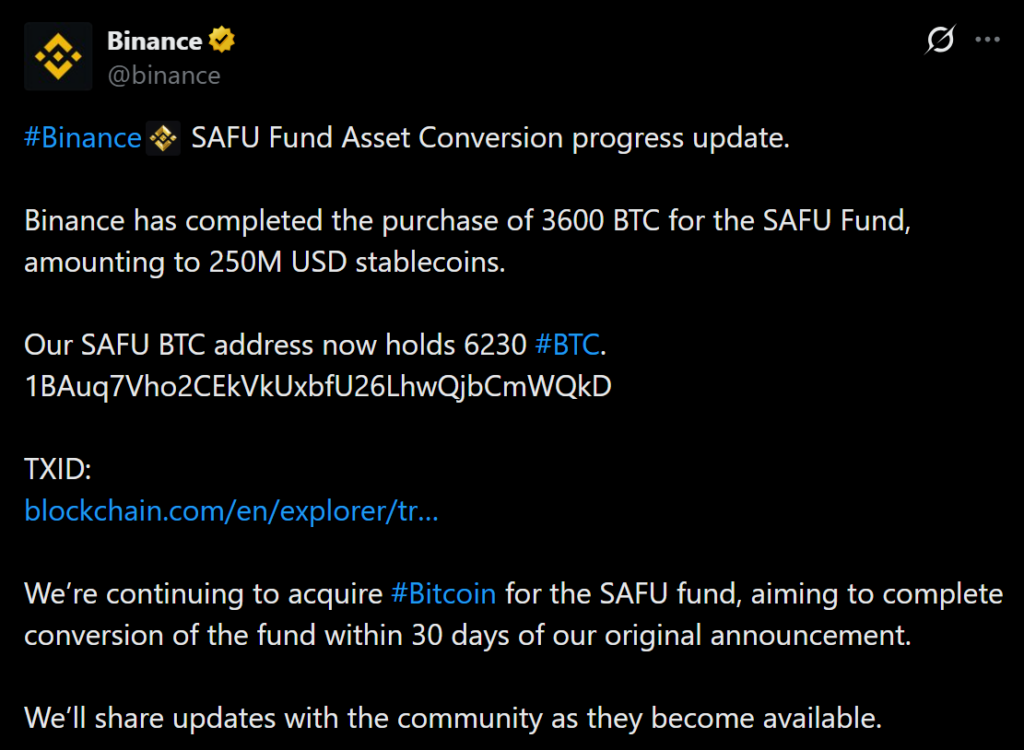

Binance has said it intends to transform the total $1 billion SAFU reserve from stablecoins into Bitcoin inside 30 days. With this newest buy, the trade has already surpassed 40% of that objective in simply 4 days. That tempo suggests this isn’t a gradual experiment, it’s an aggressive reserve technique shift.

SAFU Was Constructed for Disaster Eventualities

SAFU was established in July 2018 after a safety breach, and it features as Binance’s emergency reserve designed to guard customers if hacks or operational failures happen. The fund is financed by means of allocations from buying and selling charges and grew into some of the seen security mechanisms within the trade business.

By January 2022, SAFU reached a $1 billion valuation, and Binance has continued positioning it as a core belief layer for its platform. The fund reportedly safeguards belongings for greater than 300 million customers, which makes any structural change to SAFU significant, not simply beauty.

Why Binance Desires SAFU in Bitcoin

Binance introduced the transfer towards Bitcoin-based SAFU holdings on January 30, framing it round transparency, auditability, and inflation hedging. Bitcoin is less complicated to confirm on-chain, less complicated to trace publicly, and tougher to misrepresent in comparison with a mixture of stablecoins and off-chain devices.

The conversion course of started on February 2 with an preliminary buy of roughly 1,315 BTC for greater than $100 million. This second main batch reinforces that Binance is sticking carefully to its timeline and is prepared to execute by means of risky situations.

The $800M Flooring Provides a Threat-Management Mechanism

Binance has additionally dedicated to restoring SAFU again to $1 billion if its worth drops under $800 million. That rebalancing promise is vital as a result of holding the fund in Bitcoin introduces volatility, even when it improves transparency. In observe, it creates a built-in flooring that forces Binance to prime up the reserve throughout drawdowns.

That is what makes the technique greater than a headline. Binance isn’t simply swapping belongings. It’s redefining how a large trade approaches person safety in a world the place stablecoin danger, inflation danger, and transparency danger are all being taken extra severely.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.