Bitcoin’s drop under $70K displays macro stress, ETF outflows, and fading sentiment, with key assist now below shut watch.

Bitcoin continued its southbound motion as cautious sentiment weighed in on international markets. In truth, asset costs have fallen to ranges final seen almost two years in the past. Equities and crypto-focused shares have additionally confronted the present market warmth, which has been linked to macroeconomic components. After Bitcoin’s newest slide, analysts at the moment are watching if the asset can maintain key assist ranges.

Bitcoin Slips Under $70,000 as Promoting Stress Deepens Throughout Crypto Markets

Primarily based on TradingView knowledge, the OG coin fell to a low of $70,894 on Wednesday night time. Alongside the firstborn coin, Ether additionally slid nearer to the $2,000 mark. In keeping with market observers, this drop was BTC’s steepest since October 2024.

Picture Supply: TradingView

Within the present intraday session, promoting stress has pushed BTC under $70k. On the time of writing, Bitcoin is exchanging arms at $69,451 after an over 7% each day drop. On a yearly scale, the OG crypto has declined by about 29%.

Different worth motion indicators additional reinforce Bitcoin’s market struggles:

- Technically, the OG crypto is positioned under the 200-day SMA and 356-day shifting common (MA).

- Typically, such tendencies counsel the potential continuation of its southward motion.

- BTC has posted solely 10 inexperienced classes over the previous 30 days.

- It additionally trailed 96% of the highest 100 crypto belongings on an annual efficiency foundation.

- Bitcoin’s Worry and Greed rating has dropped to a recent low of 12.

Analysts talked about that the present heavy market downturn has exceeded that of the 2022 crypto winter. For now, the firstborn coin sits under the 50-week and 100-week MA after failing to interrupt above the $90,000–$95,000 vary.

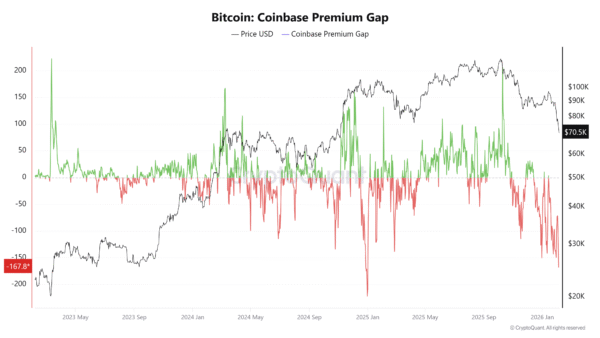

Picture Supply: CryptoQuant

The poor outing on the institutional entrance has additionally added to the cash’ market stress. Yesterday, the Coinbase Premium Hole fell to -167.8, the bottom in over a yr. Apparently, this additionally coincided with $545 million in funding losses posted by U.S. BTC funding funds.

Analysts Flag ETF Flows and Market Sentiment as Key to BTC Subsequent Transfer

“BTC prolonged losses after a failed aid bounce misplaced key assist,” stated Vincent Liu, chief funding officer at Kronos Analysis. He cited lengthy liquidations and spillover from a pointy U.S. tech sell-off as causes for the present market wrestle. Liu additionally pointed to continued ETF outflows as one other driver of the accelerated decline.

Nonetheless, market commentators defined that the present worth motion displays wider market stress somewhat than inside crypto shocks.

Peter Chung, head of analysis at Presto Analysis, famous investor sentiment has fallen to its weakest level because the final bear cycle.

Regardless of the unfavourable tone, Chung urged longer-term views could differ as soon as short-term stress fades. Liu added that indicators of liquidation exhaustion, steadier ETF flows, and bettering sentiment would sign easing draw back momentum.