Bitcoin’s current rebound has revived the buy-the-dip narrative, however the information tells a extra difficult story. After falling practically 15% and briefly touching the $60,000 zone, the Bitcoin value bounced greater than 11%, drawing merchants again into lengthy positions.

At first look, the bounce appears encouraging. Nonetheless, bearish chart patterns, rising leverage, and fragile spot demand counsel the market will not be out of hazard but. With a possible 25% draw back nonetheless in play, the most recent bounce is now going through critical scrutiny.

Bear Flag, Rising Leverage, and Falling Trade Provide Sign Dangerous Optimism

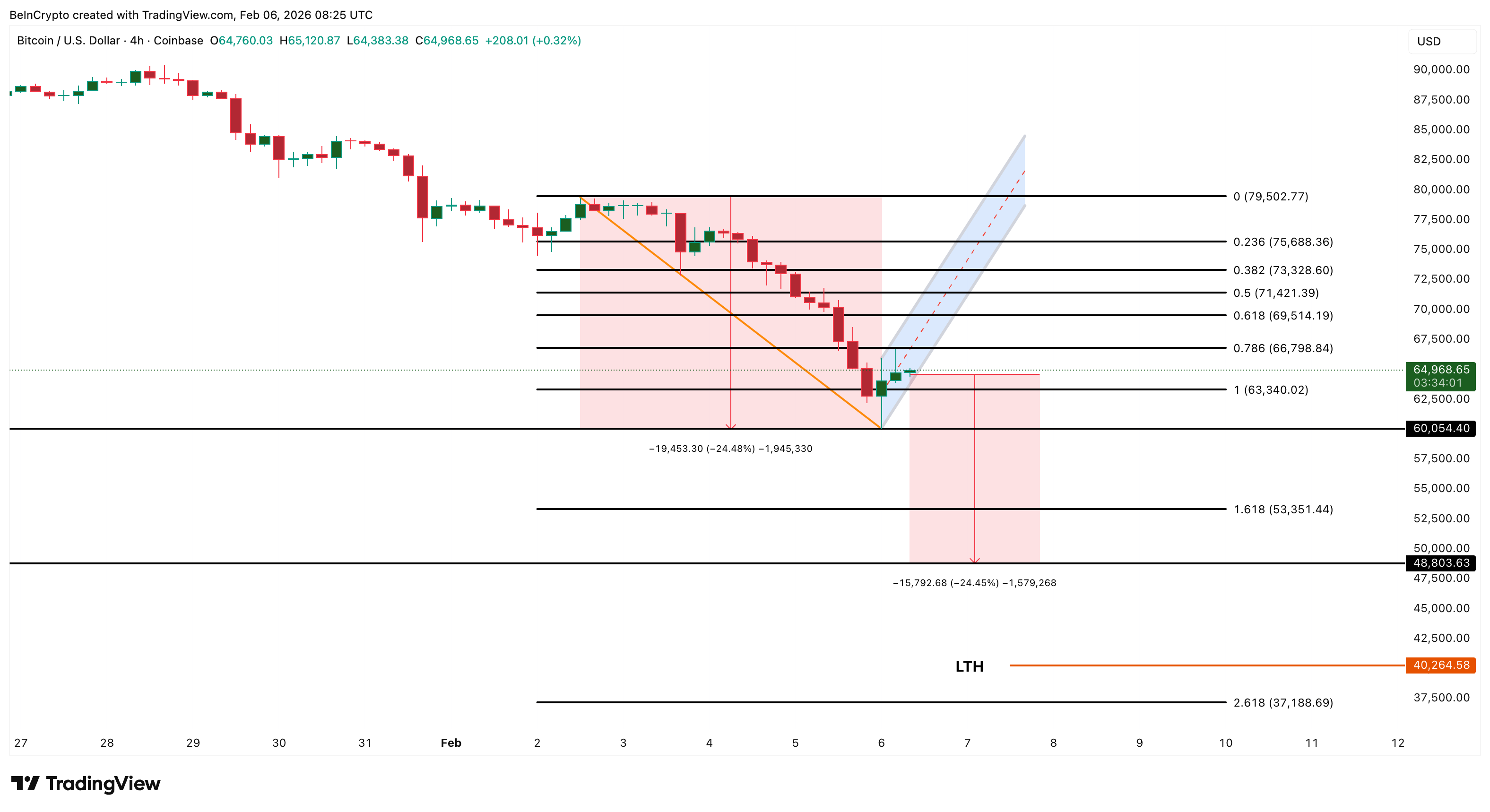

Bitcoin’s short-term threat is already seen on the 4-hour chart.

Sponsored

Sponsored

After the sharp sell-off towards $60,000, the Bitcoin value fashioned a rebound construction that now resembles a bear flag sample. This setup sometimes seems when the worth pauses after a powerful drop earlier than persevering with decrease. If the decrease trendline breaks, the sample factors to a draw back transfer of practically 25%, concentrating on the $48,000–$49,000 zone.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

Regardless of this technical warning, leverage is rising once more.

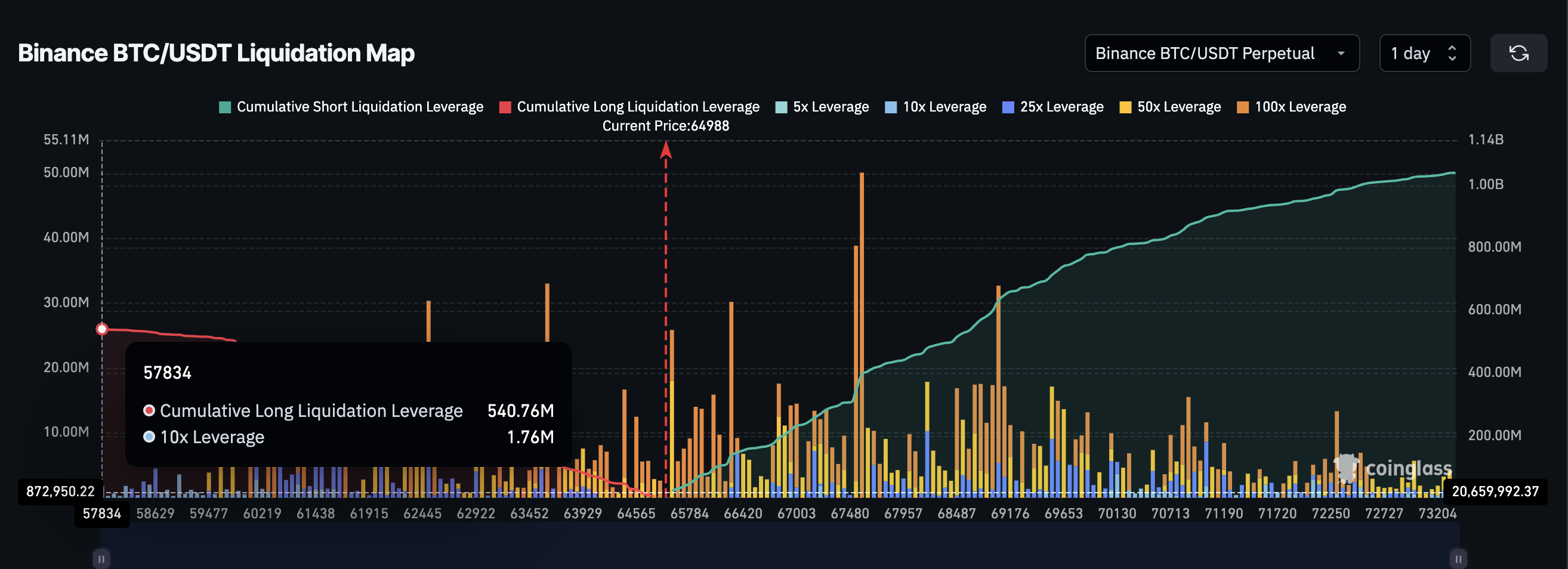

Following the 11.18% rebound, greater than $540 million in new lengthy positions had been constructed on Binance alone. This reveals that merchants are as soon as once more utilizing heavy leverage, betting that the underside is already in. Related conduct has preceded main liquidations in previous downturns.

On the similar time, spot market conduct displays a rising buy-the-dip mindset.

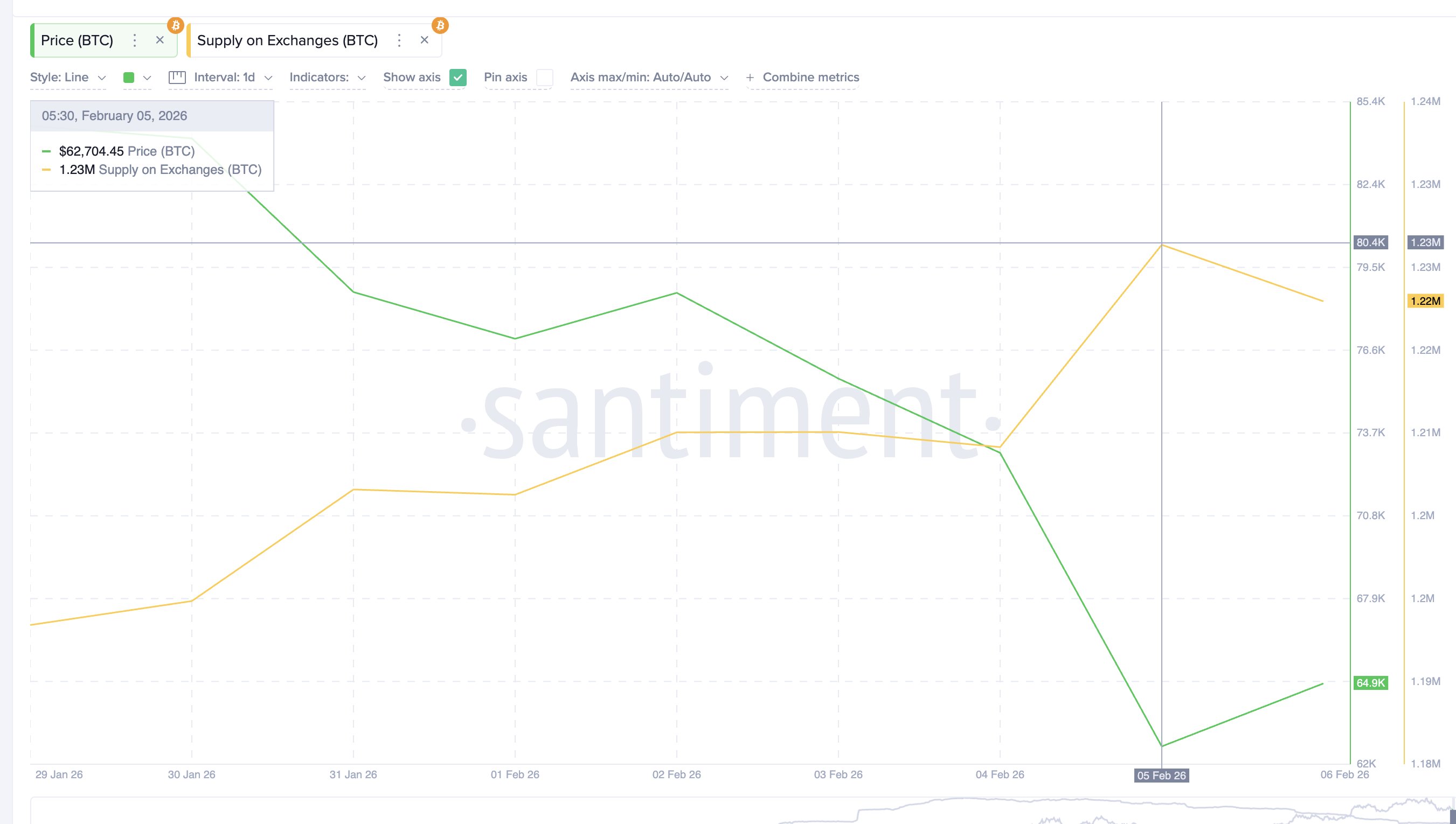

Bitcoin provide on exchanges fell from round 1.23 million BTC to 1.22 million BTC between February 5 and February 6. This decline means that merchants are withdrawing cash, presumably for short-term holding, anticipating greater costs.

Public figures and social media sentiment have additionally turned extra optimistic, reinforcing the ‘Purchase-the-Dip’ narrative.

Sponsored

Sponsored

Collectively, these alerts presumably present misplaced confidence.

A fragile chart sample, rising leverage, and early dip shopping for are forming on the similar time. When optimism builds earlier than structural weak spot is resolved, draw back threat typically will increase relatively than fades.

Lengthy-Time period Holders Hold Promoting as Realized Worth Help Comes Into Focus

Whereas short-term merchants are turning bullish, long-term holders, essentially the most secure of us, are shifting in the other way.

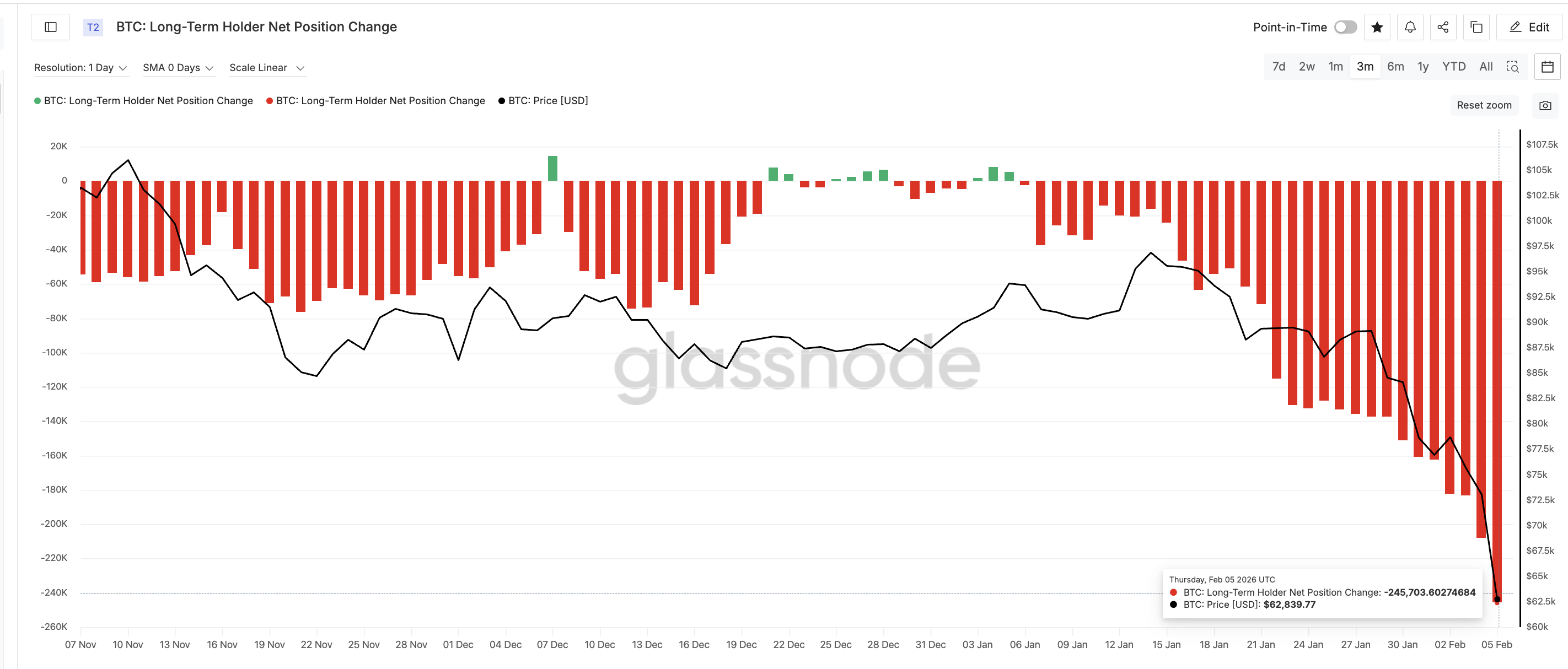

The Lengthy-Time period Holder Web Place Change, which tracks the 30-day provide shift amongst traders holding for multiple yr, has remained deeply unfavorable since early January. On January 6, this metric confirmed internet promoting of round 2,300 BTC. By February 5, that determine had worsened to roughly 246,000 BTC.

This represents a virtually 10,500% improve in long-term distribution in only one month. In easy phrases, essentially the most conviction-driven traders are nonetheless lowering publicity.

Sponsored

Sponsored

This conduct turns into extra regarding when mixed with the long-term holder realized value.

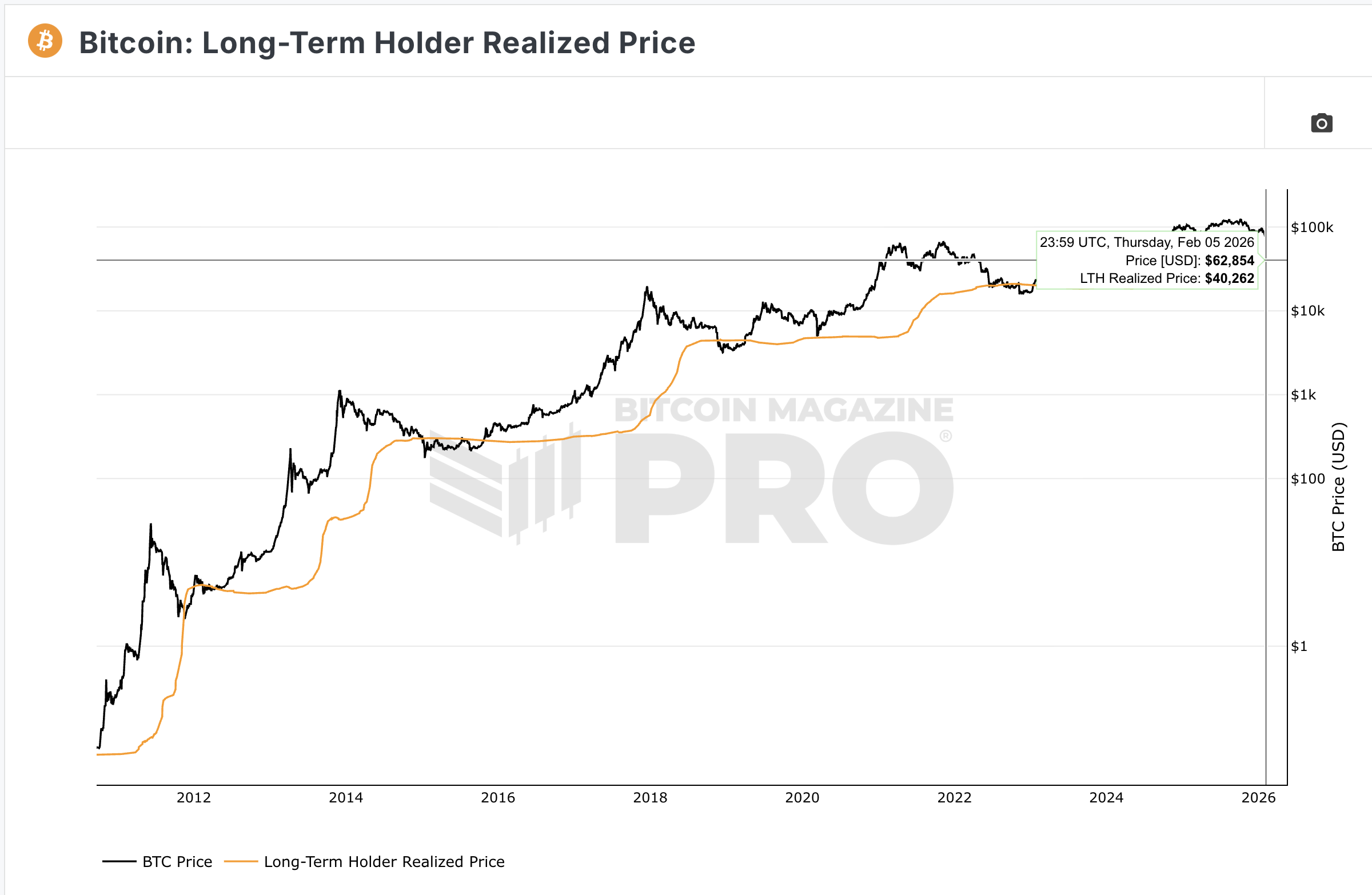

The realized value represents the typical acquisition price of cash held by long-term traders. Traditionally, when Bitcoin approaches or falls beneath this degree, it alerts deep market stress. In previous cycles, main rallies solely started after the worth stabilized round this zone; nevertheless, not instantly.

At present, the long-term holder realized value sits close to $40,260.

As Bitcoin strikes nearer to this degree, extra long-term traders method breakeven. If the worth drops beneath it, many enter losses, typically accelerating capitulation. This dynamic performed out in late 2022 earlier than the ultimate bear market backside fashioned.

Up to now, that reset has not occurred.

Lengthy-term holders are nonetheless promoting, not accumulating. Their realized value is turning into a key draw back magnet. This means the market has not accomplished its full deleveraging and redistribution part.

Sponsored

Sponsored

Key Bitcoin Worth Ranges Present Why $48,000 and $40,000 Matter Subsequent

All technical and on-chain alerts now converge round a number of crucial value zones.

On the draw back, the primary main help sits close to $53,350. A failure right here would expose the $48,800 area, which aligns with the bear flag goal and prior consolidation zones.

If $48,800 breaks, consideration shifts to the long-term holder realized value close to $40,260.

This zone represents the deepest structural help within the present cycle. A transfer into this area would point out broad capitulation amongst long-term traders and ensure a deeper bear part.

In a worst-case situation, prolonged weak spot might even open the door towards $37,180, based mostly on longer-term projections and historic help clusters.

On the upside, Bitcoin should reclaim $69,510 on a sustained 4-hour closing foundation to regain short-term credibility. A transfer above $73,320 can be required to invalidate the bearish sample.

Till that occurs, rallies stay weak.

With leverage rebuilding, long-term holders nonetheless promoting, and demanding help ranges approaching, the present rebound lacks structural affirmation. Beneath these situations, buy-the-dip methods stay uncovered to sharp reversals relatively than sustained upside.