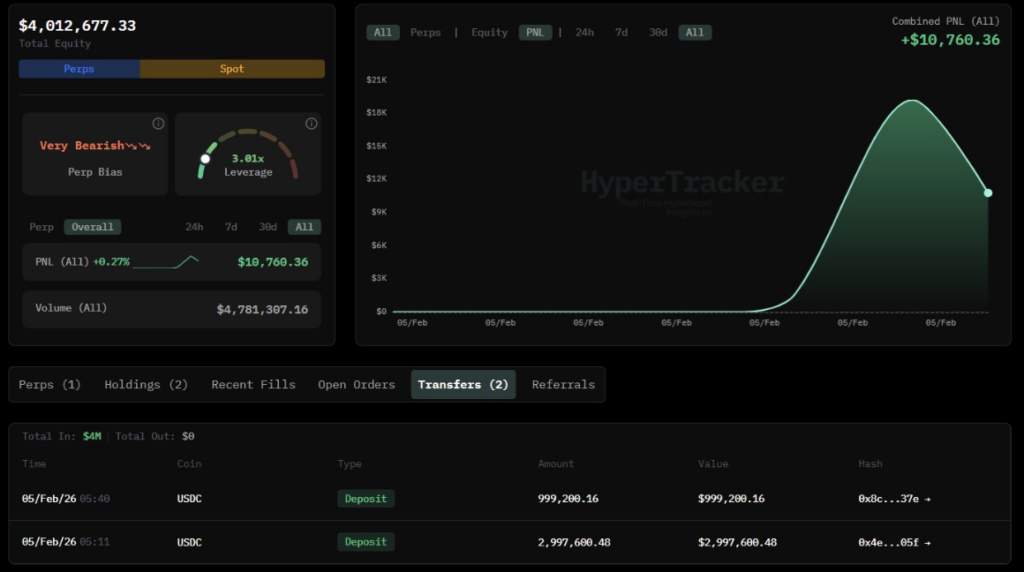

- A brand new pockets deposited $4M into Hyperliquid and opened a 3x SOL brief, signaling draw back conviction

- SOL stays in a descending channel with weak RSI, and $90 is the important thing stage bulls should defend

- High merchants stay closely lengthy, growing the chance of pressured liquidations if value breaks decrease

A newly created pockets simply deposited $4 million in USDC into Hyperliquid, then instantly opened a 3x leveraged brief on Solana. That type of transfer often isn’t informal, and it doesn’t seem like a hedge both. It reads like recent capital coming in with a transparent bearish view, particularly for the reason that dealer selected reasonable leverage, sufficient to matter, however not so excessive that liquidation threat turns into reckless.

The timing provides one other layer. This brief was opened whereas SOL was already buying and selling under key structural ranges, which strengthens the draw back narrative. New wallets can typically sign new info, or no less than a robust macro bias, and this one confirmed up with conviction. What makes it extra attention-grabbing is that this brief isn’t taking place in a vacuum, it’s immediately clashing with broader market positioning.

Solana construction stays weak as sellers defend the pattern

Solana remained trapped inside a well-defined descending channel on the each day chart at press time. Decrease highs, decrease lows, similar story, and value has continued to respect that construction. The rejection close to $120 ended up being a giant deal, as a result of it lined up with horizontal resistance and the channel midpoint, principally an ideal place for sellers to step in and defend.

As soon as SOL failed there, draw back stress accelerated and value slid under the $100 stage, reinforcing bearish management. Overhead, $147.85 stays the main invalidation zone, and repeated failures to reclaim it have regarded extra like distribution than wholesome consolidation. In the meantime, value is now hovering close to the decrease boundary of the channel round $90, a zone that beforehand provided solely temporary pauses earlier than continuation decrease.

Momentum helps the bearish case too. The each day RSI has slipped towards 23, which displays sustained promoting stress slightly than a clear capitulation bounce. Extra importantly, RSI hasn’t printed a bullish divergence, and prior rebounds struggled to even push above 40. That’s weak. If $90 fails decisively, SOL might prolong towards the $80 assist space, the place historic demand and psychological curiosity could lastly present up once more.

High merchants stay closely lengthy regardless of the downtrend

Right here’s the place issues get messy. Binance prime dealer knowledge exhibits lengthy accounts sitting close to 82%, with shorts round 18%, pushing the long-to-short ratio above 4.5. That’s a reasonably excessive skew, and it tells you one factor: the group nonetheless expects a rebound, even whereas the chart retains bleeding.

However heavy lengthy focus can turn into an issue, not a bullish sign. When value fails to get better, pressured unwinds usually comply with, and that’s how downtrends abruptly velocity up. This positioning additionally contrasts sharply with the Hyperliquid whale brief, creating a transparent divergence between concentrated capital and aggregated dealer publicity. That imbalance is the place volatility often comes from.

Open Curiosity drops as leverage resets, however threat stays

Open Curiosity has declined by about 4.37%, falling to roughly $6.19 billion. That implies leverage is being lowered throughout the derivatives market, with merchants closing positions slightly than including aggressively. In a falling market, declining OI usually displays lengthy exits, and given the long-heavy positioning, that interpretation matches.

Nonetheless, lowered leverage doesn’t take away directional threat. It simply resets it. The market can now rebuild leverage in both path, and if value continues to stall or grind decrease, new brief publicity might are available in, extending volatility as an alternative of calming it down. So this isn’t “aid” but, it’s extra like cleanup.

Lengthy liquidations dominate as SOL trades close to assist

Liquidation knowledge exhibits longs taking many of the harm lately. Whole lengthy liquidations reached round $3.59 million, whereas shorts noticed roughly $733,000. That imbalance confirms draw back stress on bullish positioning, and it wasn’t remoted to 1 venue both. Binance, Bybit, and OKX all recorded heavier lengthy liquidations, and Hyperliquid additionally confirmed extra lengthy stress than shorts.

These liquidations occurred whereas SOL hovered close to $90, which means value weak spot is already forcing leveraged bulls out. On the similar time, liquidation clusters stay comparatively modest to date, which is vital. It suggests there’s nonetheless room for a bigger draw back flush if SOL fails to carry assist and the market begins to unwind extra aggressively.

Solana sits at a harmful junction

Solana is now sitting at some extent the place construction, momentum, and positioning are colliding. The chart stays bearish, RSI is weak, and value continues to be trapped in a descending channel. On the similar time, the broader dealer crowd stays closely lengthy, whereas a well-capitalized Hyperliquid brief alerts that no less than one massive participant is leaning the opposite approach.

Open Curiosity is falling, however that appears extra like leverage resetting than actual aid. If SOL stalls close to assist or slips additional, lengthy liquidation stress might speed up shortly. And in that type of atmosphere, Solana could must undergo a pressured deleveraging part earlier than any sturdy restoration can lastly stick.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.