- Bitcoin falling under $65K has pushed Technique’s BTC holdings beneath price foundation, rising strain

- Technique’s financing mannequin has stalled because the fairness premium fades and no new increase was introduced

- Buyers are actually awaiting capital plans as critics warn of a company crypto “loss of life spiral”

Bitcoin sliding beneath $65,000 is worsening the stress spreading throughout the digital asset market, and few public corporations are as uncovered as Michael Saylor’s Technique Inc. In its earnings launch on Thursday, the corporate reported a staggering $12.4 billion internet loss for the fourth quarter, pushed virtually totally by mark-to-market losses tied to its large Bitcoin holdings. And the scenario obtained worse this week, as contemporary volatility pushed Technique’s BTC stash under its cumulative price foundation for the primary time since 2023, wiping out a lot of Bitcoin’s post-election rally.

That shift issues as a result of Technique’s complete identification has grow to be a monetary experiment constructed round one asset. When Bitcoin is rising, the mannequin appears to be like unstoppable, virtually genius. When Bitcoin is falling, the identical construction begins to appear to be a entice, and markets are actually asking if the unwind has already began.

The premium machine stalls as capital markets tighten

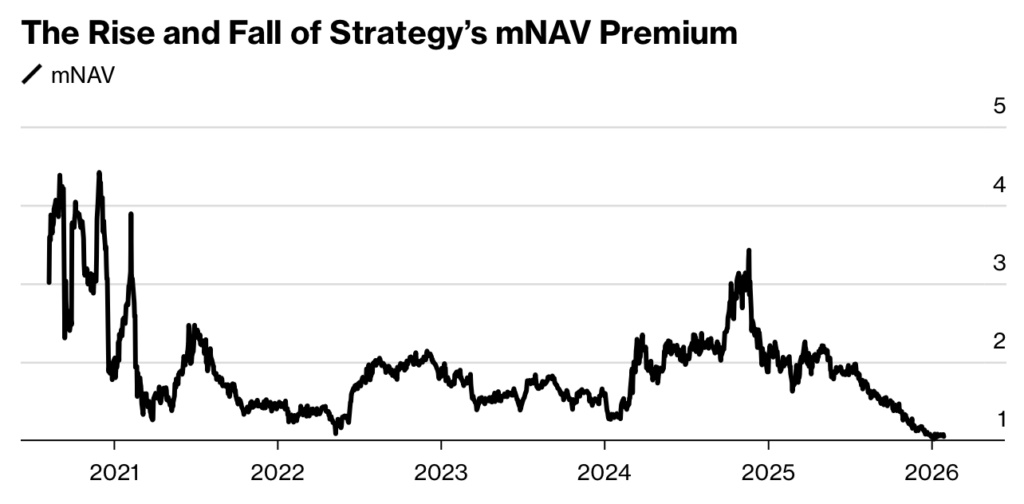

For years, Technique discovered a solution to defy gravity. The corporate’s shares typically traded at an enormous premium to the worth of its Bitcoin holdings, letting it challenge inventory, increase capital, purchase extra Bitcoin, and repeat the cycle. It was a suggestions loop, and it labored, till it didn’t.

That premium has now pale, and the corporate didn’t announce a brand new fairness increase or debt issuance. Extra importantly, Technique didn’t introduce a contemporary financing automobile or new narrative to maintain purchases going, which is a significant departure from the playbook it has adopted since 2020. In previous sell-offs, traders had been used to Saylor responding with extra bravado and extra shopping for. This time, the tone feels defensive, and the silence is loud.

Saylor has stated the corporate faces no margin calls and nonetheless holds $2.25 billion in money, sufficient to cowl curiosity and distributions for greater than two years. However with Bitcoin sitting under Technique’s reported price foundation of $76,052, the strain is constructing anyway. Not as a result of liquidation is imminent, however as a result of the market is beginning to query how sustainable the technique is with out contemporary capital.

Technique admits earnings aren’t coming anytime quickly

Technique additionally reiterated that it doesn’t count on to generate earnings and earnings within the present yr, or within the foreseeable future. That’s not precisely surprising, however saying it out loud adjustments the framing. It additionally signifies that, for now, any distributions paid to holders of the agency’s perpetual most popular shares are anticipated to be tax free, at the very least beneath present circumstances.

Throughout a post-results presentation, CEO Phong Le tried to reassure traders with a blunt message. He stated anybody who purchased Bitcoin or MSTR within the final yr was possible experiencing their first downturn, and his recommendation was to carry on. The remark didn’t land nicely, and the livestream’s remark part reportedly stuffed with offended responses from nameless posters, a reasonably clear signal that investor endurance is sporting skinny.

Analysts are actually centered much less on the Bitcoin thesis itself and extra on Technique’s subsequent transfer. As Benchmark’s Mark Palmer famous, the market needs readability on how Technique plans to lift capital to maintain fueling Bitcoin purchases in a a lot harder surroundings. He advised the agency might now lean on its STRC perpetual most popular inventory as a driver for that effort, however that’s nonetheless extra expectation than certainty.

The dimensions of the guess makes Technique a lightning rod

Technique at present holds greater than 713,000 Bitcoin, valued round $46 billion based mostly on the corporate’s personal figures. In late January, it even added one other $75.3 million price of BTC, signaling that the buildup narrative hasn’t been deserted, at the very least formally. However the margin for error is shrinking, and critics are returning quick.

This week, Michael Burry reignited scrutiny by warning that Bitcoin’s drop may set off a “loss of life spiral” amongst company holders, leaving companies like Technique billions underwater. His remarks revived long-running criticism from high-profile skeptics, together with quick sellers like Jim Chanos, who’ve argued for years that Technique is constructed on speculative leverage tied to a non-earning asset.

For a lot of the final 4 years, Technique functioned as a high-beta Bitcoin proxy, and traders handled it like a leveraged solution to play BTC upside. Between 2020 and 2024, the inventory surged greater than 3,500%, outperforming main indexes and turning into a magnet for each speculators and critics. However the surroundings has modified. Spot Bitcoin ETFs have made BTC publicity cheaper and cleaner, weakening Technique’s area of interest, and as liquidity fades, the identical traders who as soon as chased upside are actually pulling again.

Why this downturn feels totally different for MSTR

Saylor has additionally been managing expectations extra brazenly. Throughout the presentation, he dismissed quantum computing fears as “FUD,” however that wasn’t the actual headline. The actual shift is how Technique is now framing itself. By emphasizing that profitability isn’t coming quickly, Saylor is actually asking traders to cease judging the corporate like a software program enterprise or a buying and selling automobile.

As an alternative, he’s repositioning Technique as one thing nearer to a long-duration Bitcoin belief, the place quarterly earnings matter lower than Bitcoin’s long-term trajectory. The issue is that traders might not need that deal anymore. The inventory is already down almost 80% from its document excessive in November 2024, and in a market like this, narratives don’t shield you the way in which they do in a bull run.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.