- XRP fell to $1.22, a degree final seen in November 2024

- The token is down over 40% in a month as crypto liquidity tightens

- Bulls argue a sub-$1 dip might reset the cycle and arrange a future $5 run

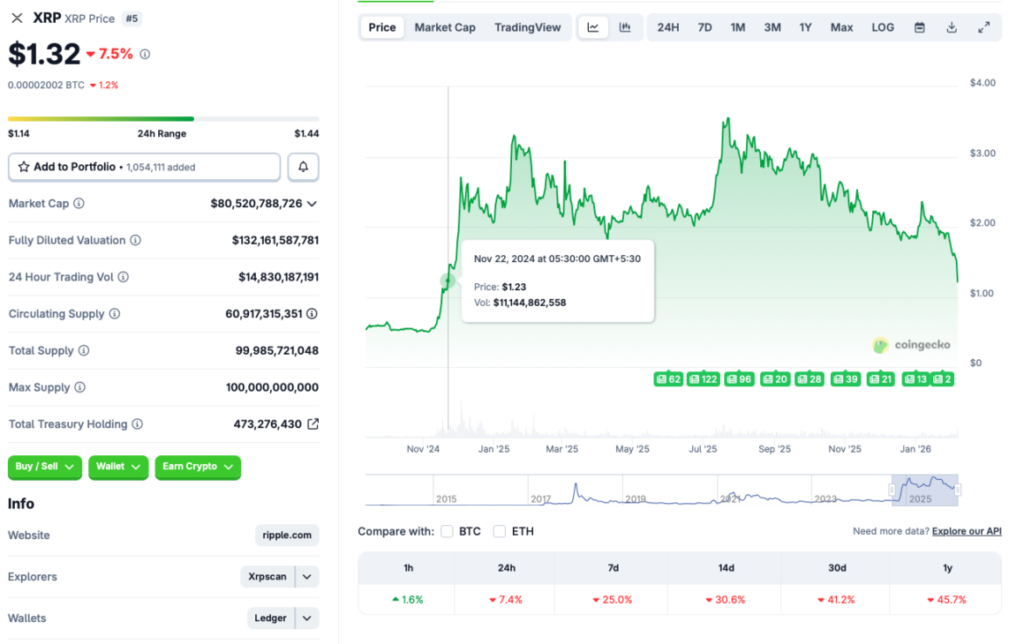

Ripple’s XRP dropped to round $1.22 earlier at this time, Feb. 6, 2026, revisiting worth ranges final seen in November 2024. Again then, XRP was simply beginning to regain momentum. The distinction is sharp, as a result of 2025 was a robust yr for the asset, with XRP reaching a peak of $3.65 in July earlier than the development flipped arduous.

Since that peak, XRP has been grinding decrease, and the decline accelerated after the October market crash. In keeping with CoinGecko information, XRP is down about 7.4% within the final 24 hours, 25% on the week, 30.6% over 14 days, and roughly 41.2% throughout the previous month. That form of compression doesn’t simply harm worth. It hurts confidence.

The Market Is Now Whispering About Sub-$1 Once more

With XRP sliding this shortly, the concern is apparent. Traders are beginning to ask whether or not the token might dip under $1 once more, a degree that tends to really feel like a line within the sand even when it’s largely psychological. In a weak market, these strains matter, as a result of they form how merchants handle danger and the place stop-losses cluster.

The larger difficulty is that XRP is unlikely to decouple from Bitcoin in an actual liquidity crunch. If BTC continues falling and breaks deeper into the low $60,000s or under, XRP will probably stay dragged alongside. Even sturdy narratives battle when the complete market is in survival mode.

The Bull Thesis Nonetheless Depends on the “Reset Then Run” Sample

Regardless of the bearish setup, some merchants argue {that a} deeper dip might really develop into a part of the long-term bullish case. The concept is that Bitcoin traditionally pulls again arduous earlier than launching into new peaks. BTC fell to round $15,000 in 2022, solely to push previous $100,000 roughly two years later. XRP bulls imagine the token might observe an analogous sample, particularly as soon as sentiment resets and liquidity returns.

That’s the place the $5 goal comes from. Not as a result of XRP is exhibiting power at this time, however as a result of merchants are projecting what a future bull cycle might seem like after a painful washout. It’s much less a forecast and extra a story: break down, clear the weak fingers, then rebuild greater.

ETF Narratives Nonetheless Sit within the Background

One other issue supporting the long-range optimism is the presence of spot XRP ETFs launched in 2025. Though ETF inflows aren’t serving to proper now, supporters argue they may matter later as soon as the bear part ends. Within the 2025 cycle, ETF flows performed a significant function in pushing Bitcoin and Ethereum towards new highs, and XRP bulls imagine an analogous sample might emerge when danger urge for food returns.

Telegaon analysts have additionally projected XRP might breach the $5 mark, reinforcing the concept the market remains to be considering in cycles, not weeks. However the actuality is easy. Till the broader market stabilizes, ETF optimism is simply background noise.

XRP’s Close to-Time period Story Is Ache, Not Potential

Proper now, XRP is buying and selling like a high-beta asset in a weak macro atmosphere. The market is risk-off, liquidity is skinny, and volatility is punishing every little thing directly. That doesn’t kill the long-term thesis, but it surely does make the near-term outlook brutally depending on Bitcoin’s subsequent transfer.

A future $5 run remains to be a story folks will maintain repeating. However first, XRP has to outlive this part with out breaking investor perception utterly. And in crypto, that’s typically the toughest half.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.