- Ethereum noticed $466M in liquidations as longs absorbed a lot of the harm throughout a 15% drop

- ETH broke under key demand zones close to $2,500 and $2,100, confirming bearish momentum

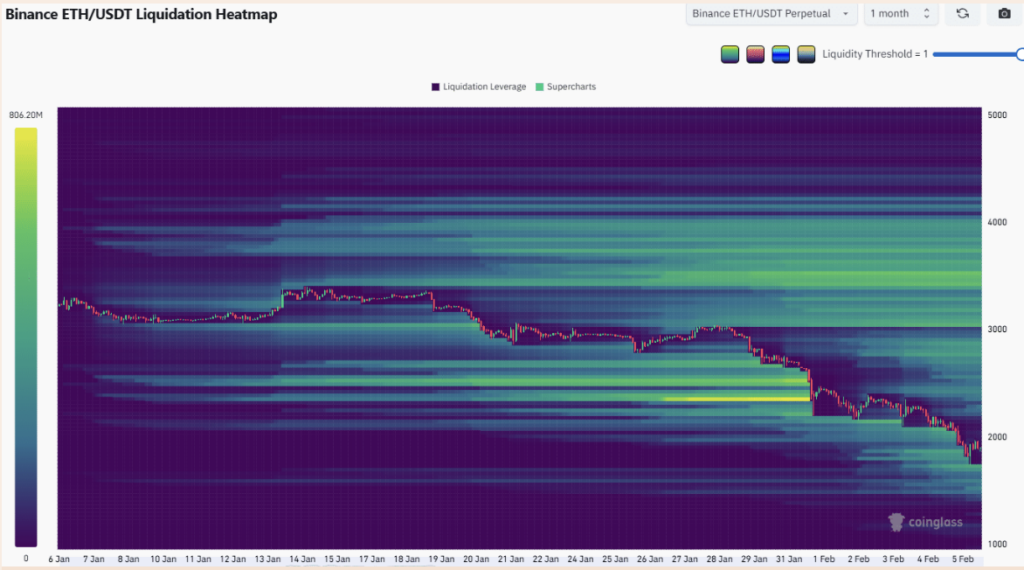

- Liquidation heatmaps recommend $2,100–$2,400 could act as promote zones, whereas $1,500 stays a draw back goal

On February 5, Ethereum noticed a brutal liquidation occasion, with roughly $466.4 million worn out in a single day. Most of that ache landed on the lengthy facet, with round $382 million in lengthy liquidations, which tells you precisely who was leaning the mistaken manner. ETH value dropped practically 15% in the course of the session, sliding from about $2,148 right down to $1,826, and the transfer wasn’t mild.

This type of flush doesn’t occur in a peaceful market. Crypto sentiment was already deep in panic mode, with the Worry and Greed Index falling to 11, a stage not seen since 2023. Traditionally, sub-20 readings sign heightened stress, pressured promoting, and broad de-risking throughout the board. When that form of worry takes over, technical ranges don’t all the time maintain the best way they’re “supposed” to.

On the identical time, ETH/BTC hit a three-year low, reflecting Ethereum’s extreme underperformance towards Bitcoin. The $2,000 stage was already flagged as a key psychological zone in danger, and Ethereum has now slipped under it, turning what was as soon as assist into a brand new drawback overhead.

ETH breaks main demand zones as bears keep in management

On the every day chart, the energy of the bears has been apparent. Again in Could and June final yr, Ethereum spent weeks consolidating round $2,500 earlier than exploding increased in July. That very same zone was examined once more in November, held as assist, and produced a bounce, giving bulls a purpose to remain assured.

This time, there was no such response. The newest retest over the previous week noticed ETH bulls barely present up. Value pushed straight by means of the $2,500 demand zone and continued decrease, slicing by means of the weekly swing level round $2,100 as nicely. When a market bulldozes by means of ranges that beforehand mattered, it often means one factor: the pattern has shifted, and consumers are stepping again.

Momentum indicators confirmed the harm. RSI was deep in oversold territory, with the every day RSI printing round 18.68 on February 5, the bottom studying since August 2024. OBV additionally dropped to a contemporary low, reflecting heavy promote quantity fairly than a managed pullback. This wasn’t a sluggish correction, it was an unwind.

Liquidation heatmap exhibits draw back liquidity has been cleared

Liquidation information provides one other layer to what’s occurring. The one-month liquidation heatmap exhibits that liquidity to the draw back has been largely worn out, that means an enormous chunk of pressured promoting has already performed out. Zooming out to the one-year heatmap exhibits the identical factor, with a large liquidation pocket round $2,000 getting cleared in the course of the latest drop.

That issues as a result of liquidation zones usually act like magnets. As soon as a serious cluster will get taken out, value steadily searches for the following massive pool. In response to the heatmap, the following main magnetic zones sit additional south, round $1,500 and under, which isn’t precisely what bulls need to hear.

On the upside, there are nonetheless notable liquidation zones round $2,400 and the $2,700 to $2,900 vary. These areas may appeal to value if ETH manages a restoration bounce, however the market would wish to stabilize first. Proper now, it’s nonetheless in damage-control mode.

Why merchants could need to promote the bounce

The dearth of response on the $2,400 demand zone is a transparent signal of bearish dominance. When a market fails to defend a stage that beforehand mattered, it usually turns into resistance on the best way again up. That’s why swing merchants seeking to catch an ETH bounce must be cautious. A bounce can occur, certain, however that doesn’t imply the pattern has flipped.

An extra drop towards $1,500 stays doable, particularly if broader market circumstances keep risk-off. Within the coming weeks, the $2,100 and $2,400 zones are more likely to be revisited, and merchants must be ready for bearish reactions round these ranges. In a market like this, promoting rallies tends to be the higher-probability play till value proves in any other case.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.