- XRP remained the fifth-largest crypto asset in This fall 2025, however market cap fell 34.5% quarter-over-quarter

- Community charge exercise dropped sharply, reflecting weaker demand and decreased burn

- Spot XRP ETFs launched within the U.S. and reached $1B AUM shortly, reshaping institutional entry

XRP closed This fall 2025 nonetheless holding its place among the many greatest names in crypto, ending the quarter because the fifth-largest asset by market cap. That’s the headline. However the particulars beneath it are lots much less snug.

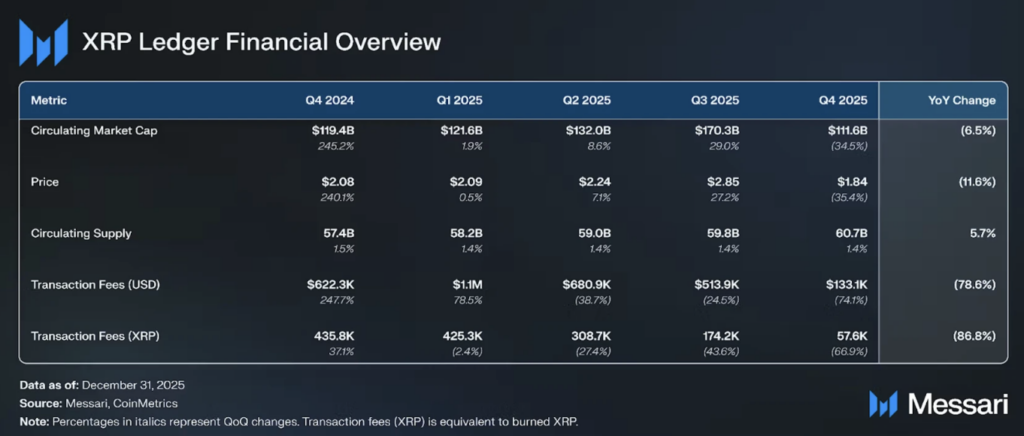

In keeping with Messari’s February 6 report, XRP’s circulating market cap ended the quarter at $111.6 billion, down 34.5% from Q3. That decline was sharper than the mixed drop throughout Bitcoin, Ethereum, and Solana, which collectively fell 24.4% over the identical interval. So sure, the entire market pulled again, however XRP received hit tougher than the majors.

Value additionally weakened, with XRP dropping 35.4% quarter-over-quarter to round $1.84. The market cap decline was barely smaller than the worth drop as a result of circulating provide grew by about 1.4%. In comparison with the identical quarter a 12 months earlier, XRP’s market cap was additionally down 6.5% from the $119.4 billion stage recorded on the finish of This fall 2024.

Community charge exercise collapsed, and it’s not a small dip

One of many clearest weak spots within the report was charge exercise. Transaction charges measured in {dollars} dropped from roughly $513,900 in Q3 to about $133,100 in This fall, a 74.1% decline. Native charge totals additionally fell sharply, with charges dropping from 174,200 XRP to 57,600 XRP over the identical interval.

XRPL is completely different from many chains in a single key method. These charges are burned moderately than distributed to validators or stakers, which implies decrease charge exercise doesn’t simply mirror decreased demand, it additionally reduces the already small quantity of XRP being faraway from provide. And since XRPL charges are tiny to start with, it highlights how quiet issues have been in the course of the quarter.

Spot XRP ETFs modified U.S. market entry quick

Regardless of the weaker quarter in value and charges, one main growth got here from Wall Avenue. This fall 2025 marked the launch of huge U.S. spot XRP ETFs after SEC approval, a second that will have sounded unattainable a couple of years in the past. These ETFs reached $1 billion in property beneath administration in beneath 4 weeks, making them the fastest-growing crypto ETF phase since Ethereum.

The primary itemizing was Canary Capital’s XRPC on November 13. It was adopted by Franklin Templeton’s XRPZ, Grayscale’s GXRP, 21Shares’ TOXR, and Bitwise’s XRP product. By January 28, 2026, spot ETFs held 789.8 million XRP, round 1.3% of circulating provide, which is a significant chunk for such a brief timeframe.

Canary led holdings with 182.6 million XRP, adopted by Bitwise at 160.2 million, Franklin Templeton at 142.8 million, 21Shares at 118.5 million, and Grayscale at 112.3 million. The tempo of adoption was quick, even when the market itself was trending down.

This ETF surge solely grew to become potential after the Ripple vs. SEC case formally closed in August 2025, resolving XRP’s authorized standing for secondary market buying and selling within the U.S. CME additionally expanded entry by way of XRP futures choices in October and spot futures in December, giving establishments extra regulated methods to commerce and hedge.

XRPL provide mechanics stay a long-term issue

XRPL’s provide construction continues to form the asset’s long-term dynamics. Since inception, solely about 14.3 million XRP has been burned, valued round $26.3 million at This fall costs. The reason being easy: transaction charges are extraordinarily low, usually beneath $0.0008 per transaction, so burn stays minimal even throughout lively durations.

Ripple additionally continues releasing one billion XRP from escrow every month. Any unused XRP is recycled again into new escrow contracts till the remaining 34.2 billion XRP is ultimately in circulation. This predictable month-to-month movement is a continuing issue merchants consider, even when it doesn’t dominate short-term value motion day-after-day.

Community exercise stayed principally flat, with small shifts in conduct

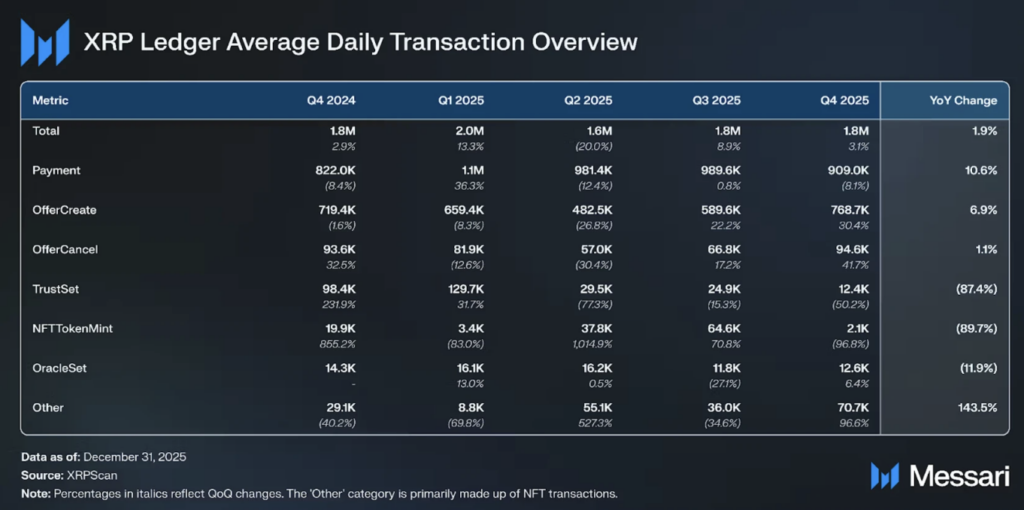

Community exercise total remained comparatively regular. Every day lively addresses fell 8.2% to about 49,000, whereas whole addresses grew 5.7% to 7.3 million. Transactions per day averaged 1.83 million, up 3.1%, displaying that utilization didn’t collapse at the same time as charges dropped sharply.

Funds remained the commonest exercise on XRPL, however OfferCreate rose as effectively, suggesting extra utilization of the built-in change performance. That shift issues as a result of it hints at rising engagement with XRPL’s buying and selling options, even when the broader market was cooling off.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.