- BitMine purchased round 20,000 ETH for $41.98M as Ethereum continued to slip.

- The agency now holds roughly 4.29M ETH, already previous 70% of its purpose to regulate 5% of provide.

- BitMine can also be pivoting into staking and higher-risk acquisitions to outperform the cycle.

BitMine, now extensively seen as the most important company holder of Ethereum, has been treating the market’s chaos like a reduction window. Whereas quite a lot of buyers have been spooked by ETH’s current volatility, the agency has leaned into it and expanded its treasury holdings as an alternative. It’s an aggressive stance, and it makes it fairly clear BitMine is enjoying a protracted recreation right here.

BitMine Buys 20,000 ETH as Costs Slide

On February 7, blockchain tracker Lookonchain flagged BitMine’s newest buy, citing Arkham Intelligence information. The corporate acquired round 20,000 ETH for roughly $41.98 million, which is a critical allocation contemplating how fragile the market seems. This transfer additionally pushes BitMine nearer to its longer-term purpose of controlling 5% of Ethereum’s circulating provide, a goal that will put them in a league of their very own.

The Firm Is Quietly Closing In on Its 5% Provide Purpose

Strategic ETH Reserve information reveals BitMine at present holds about 4.29 million ETH, which means it has already reached greater than 70% of that goal. That’s the half that actually separates this story from the same old company dip-buy headlines. This isn’t a one-time treasury play, it’s a sustained accumulation marketing campaign, and BitMine appears comfy being one of many greatest whales within the ecosystem.

Ethereum’s Crash Hasn’t Shaken BitMine’s Conviction

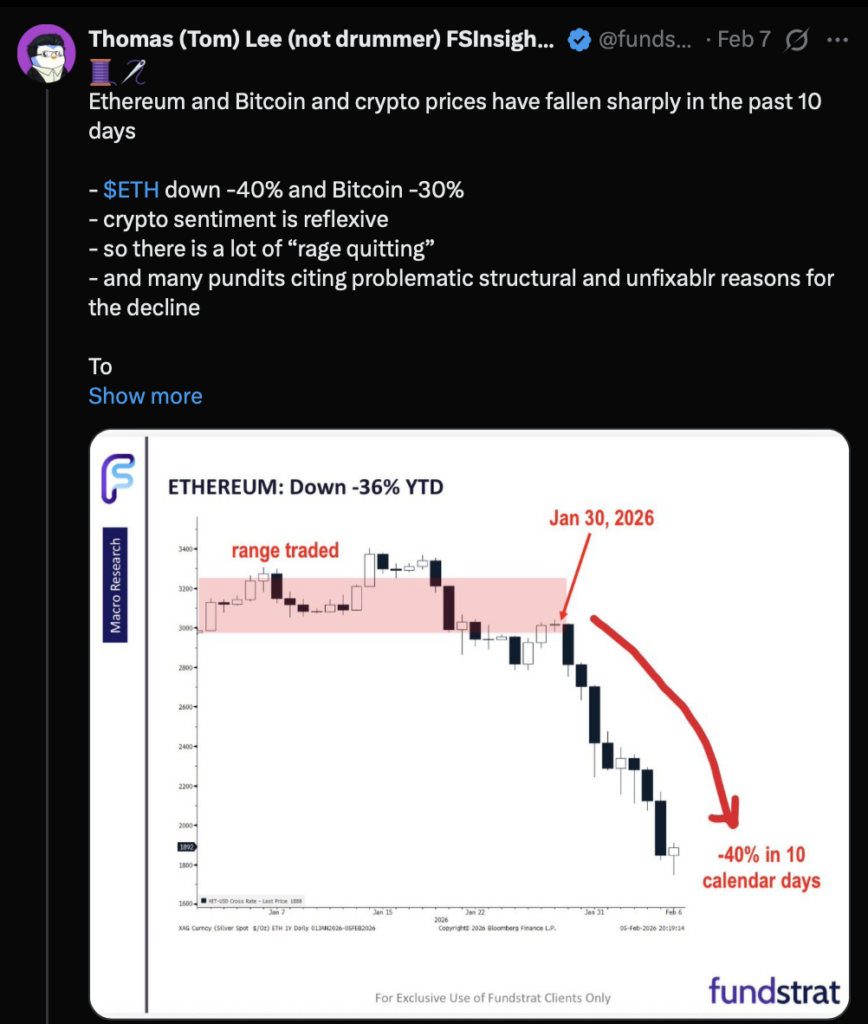

The timing is daring as a result of Ethereum has been beneath heavy strain. ETH is down roughly 31% during the last 30 days and was buying and selling round $2,117 at press time, with the previous week seeing lows close to $1,824. That’s the weakest stage since Might 2025, and it’s precisely the type of drawdown that usually forces large holders to rethink their publicity.

Tom Lee Calls Volatility “A Function, Not a Bug”

Even so, BitMine chairman Tom Lee has stayed agency, saying Ethereum is “the way forward for finance.” He’s additionally dismissed considerations round deepening unrealized losses, arguing that the volatility is a part of what makes the asset distinctive. Lee backed up his stance by stating that Ethereum has survived drawdowns of 60% or worse seven occasions since 2018, framing this downturn as painful however traditionally regular.

BitMine Is Shifting Past a Easy Purchase-and-Maintain Technique

One other key element is that BitMine is evolving previous the usual company treasury mannequin. The agency says it’s shifting towards “accretive acquisitions” and extra aggressive capital deployment, aiming to outperform the cycle as an alternative of simply holding by way of it. That features high-risk “moonshot” allocations into smaller-cap tokens like Orbs, plus unconventional investments comparable to media publicity by way of Mr Beast.

Staking Almost 3 Million ETH for Yield in a Threat-Off Market

Alongside these strikes, BitMine continues to generate yield by staking almost 3 million ETH. The thought is to scale back the drag of falling spot costs whereas the macro surroundings stays sharply risk-off. In easy phrases, BitMine is making an attempt to maintain the machine working even whereas the market feels frozen, and so they’re betting Ethereum’s long-term fundamentals will outlast the present concern cycle.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.