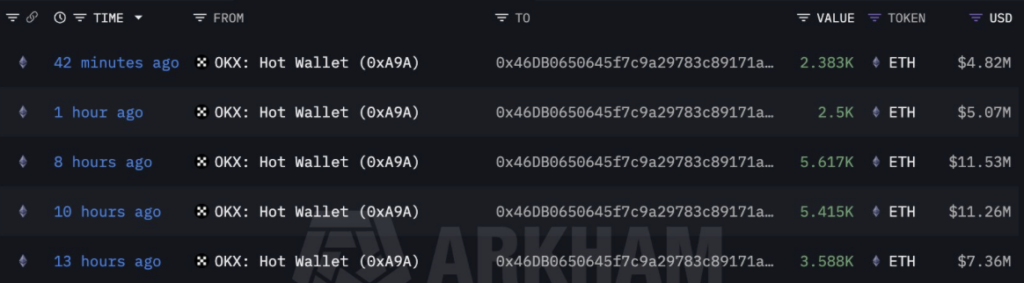

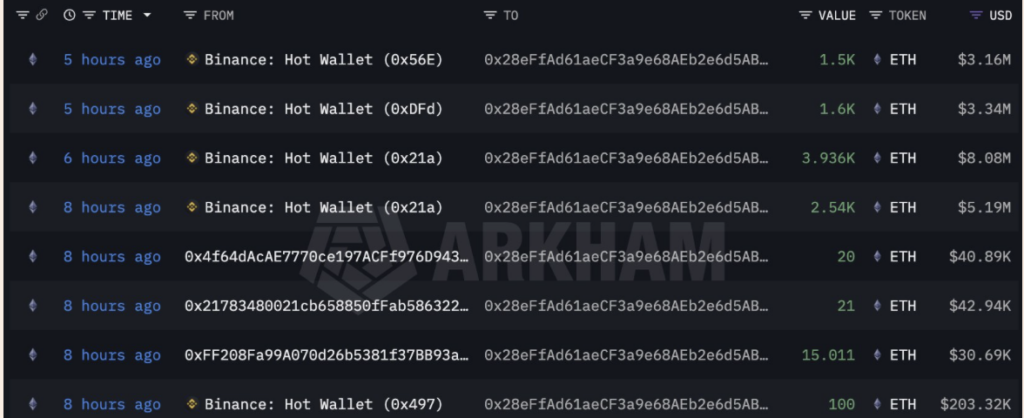

- Ethereum whales pulled massive quantities of ETH off OKX and Binance throughout the dip close to $2,050, hinting at accumulation as panic cooled.

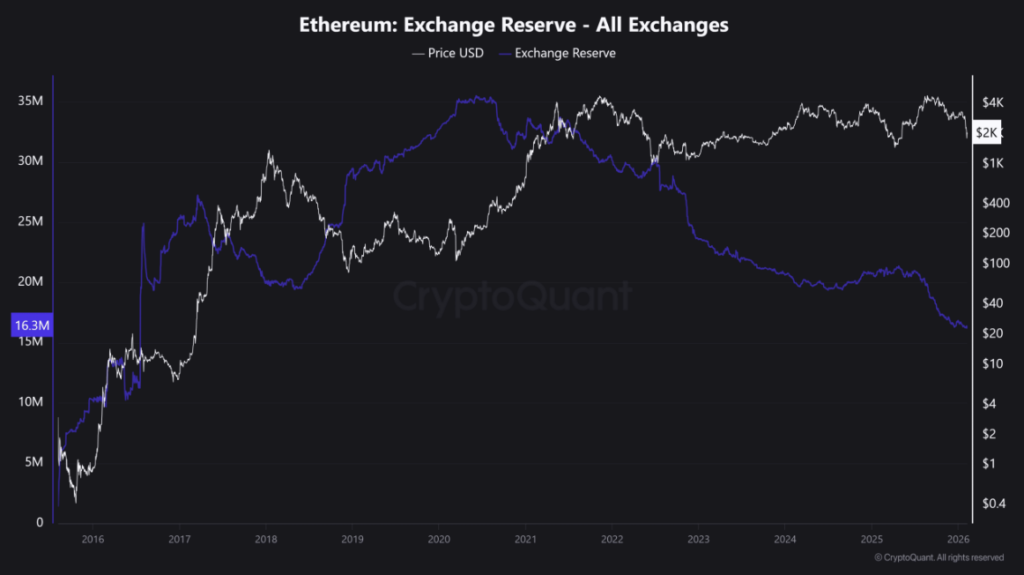

- Trade reserves have dropped to round 16.3M ETH, a multi-year low final seen in 2016, tightening liquid provide throughout the market.

- Derivatives present deleveraging, not contemporary bullish positioning, with falling open curiosity, over $1B in lengthy liquidations, and destructive funding charges.

Because the panic begins to fade out, one thing else is quietly taking its place: strategic accumulation. Over the past stretch of buying and selling, whale exercise confirmed up in a reasonably clear approach, beginning with massive Ethereum (ETH) withdrawals from OKX scorching wallets. A number of tranches moved inside just some hours, and never lengthy after that, Binance started exhibiting related outflows. That type of timing issues. It appears much less like random pockets shuffling and extra like coordinated off-exchange migration, the sort you usually see when greater gamers need to maintain, not flip.

Why ETH Leaving Exchanges Can Matter Extra Than Worth

ETH dipped close to the $2,050 area proper when sentiment was cracking and concern was dominating the tape. That’s the precise atmosphere whales have a tendency to like. As a substitute of chasing power, they purchase weak spot, they usually do it when liquidity is thick as a result of retail is promoting into them. As soon as ETH begins leaving exchanges, the accessible sell-side stock naturally shrinks, which might ease stress on worth, even when the market nonetheless feels ugly for some time.

Reserve compression doesn’t assure a rally, nevertheless it typically units the stage for volatility growth… and typically, a pointy rebound. And in a post-ETF world in 2026, these withdrawals can also be positioning for staking, DeFi deployment, or longer-term institutional custody. Both approach, it’s the identical finish outcome: much less liquid ETH floating round when demand ultimately returns.

ETH Trade Reserves Simply Hit Multi-Yr Lows

Zooming out, the change reserve pattern tells a reasonably dramatic story. ETH reserves expanded closely between 2016 and 2017, climbing from round 5–10 million ETH as adoption accelerated and exchanges grew to become the default hub for liquidity. That rise continued into the 2020–2021 cycle, when reserves peaked close to 35 million ETH throughout the DeFi and NFT explosion. Again then, all the pieces was traded continually, and maintaining cash on exchanges was simply regular.

However then the construction shifted. A sluggish drawdown started, and by 2024–2025 it had changed into one thing extra persistent as staking, self-custody, and off-exchange storage grew to become the dominant habits. By early February 2026, reserves dropped to roughly 16.3 million ETH, ranges that haven’t been seen since 2016. ETH was buying and selling across the $2,000 area throughout this tightening section, which strains up with the volatility and stress the market has been feeling these days.

Provide Tightness Doesn’t Assure a Rally, However It Modifications the Sport

When staking absorbs provide and institutional autos take away liquidity, tradable stock tightens, and that modifications how worth reacts to demand. These contractions scale back speedy promote stress and, when sustained, have traditionally preceded stronger recoveries as soon as demand circumstances enhance. It’s not a promise, nevertheless it’s a shift within the underlying market construction, and merchants have a tendency to note it later than they need to.

Derivatives Present Deleveraging, Not Contemporary Bullish Positioning

On the similar time, Ethereum’s derivatives market is telling a distinct however associated story: that is threat discount, not new risk-taking. In the course of the February 2026 sell-off, Open Curiosity slid decrease, dropping into the $24 billion to $36 billion vary after being a lot larger earlier within the cycle. That type of decline often means merchants are closing positions, not opening contemporary ones.

And it wasn’t a clear exit both. Lengthy liquidations ripped by means of the market, with greater than $1 billion in lengthy publicity worn out throughout the crash section, which is principally compelled deleveraging in actual time. Funding charges flipped destructive and stayed suppressed, hovering round –0.003% and even deeper throughout capitulation home windows. That’s a reasonably basic signal that shorts are in management and longs are paying simply to remain within the commerce.

What This Setup Might Imply Subsequent for ETH

Put collectively, the setup is somewhat tense but additionally type of explosive. Spot provide is tightening as ETH leaves exchanges, whereas derivatives are cleansing out extra leverage. That mixture can create the circumstances for a squeeze afterward, particularly if demand returns abruptly. However within the quick time period, volatility remains to be the tax you pay for being concerned.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.