- XMR crashed almost 64% in 22 days after topping close to $798 as Bitcoin momentum pale

- Indicators affirm heavy promote stress, with bearish transferring common crossover and weak A/D readings

- If BTC bounces, XMR may retest $390–$420 and even $500, however these zones could act as promote traps

Monero (XMR) had a kind of traditional “too scorching, too quick” rallies in January. The sort the place worth goes vertical, social feeds get loud, and all of a sudden everyone seems to be a privateness coin maxi once more. It even pushed to a contemporary all-time excessive close to $798. However proper round that peak, Bitcoin (BTC) began shedding momentum, and as soon as BTC rolled over, the entire market temper flipped.

XMR didn’t simply pull again. It received slammed. Over the following 22 days, Monero corrected roughly 63.7%, turning what regarded like a clear breakout right into a full-blown unwind. The irony is, the warning indicators have been already there. Social engagement round XMR exploded, and AMBCrypto had already flagged the transfer as apparent crowd FOMO. The spot quantity bubble map additionally confirmed overheating indicators, mainly flashing “that is getting stretched” earlier than the drop even began.

And positive sufficient, the correction hit simply days later.

The Trendline Break Was the Actual Pink Flag

As soon as Monero did not defend its long-term trendline help, the draw back targets began opening up shortly. Analysts had highlighted the $266 space as the following main stage, and by Friday, February 6, XMR printed a low round $276. Not fairly $266 but, however shut sufficient to make the purpose: the market is not in “dip shopping for mode.” It’s in damage-control mode.

Promoting Strain Has Been Heavy, and It Reveals within the Indicators

On the day by day chart, the promote stress hasn’t been refined. The A/D (Accumulation/Distribution) indicator dropped to contemporary multi-month lows, confirming that this wasn’t only a gentle correction. Actual quantity got here in on the promote facet, and it’s the form of exercise that tends to depart a scar on the chart for some time.

On the identical time, the 20-day and 50-day transferring averages printed a bearish crossover, snapping a four-month bullish development and reinforcing the concept that momentum has shifted. The DMI additionally pointed to a powerful downtrend, which actually matches what your eyes already see: decrease highs, heavy candles, and weak rebounds.

$352 Was the Bulls’ Final Hope, and It Failed

If there was one stage that would’ve saved the construction, it was round $352. That was the 78.6% Fibonacci retracement stage of the rally from roughly $230 to $799, and it was mainly the final significant “bounce zone” earlier than the market began trying actually bearish.

However the retest didn’t maintain. It didn’t even get a powerful response. That’s what makes this setup really feel heavy. Ranges that acted like help only a few weeks in the past have now flipped into provide zones, which means sellers are utilizing rebounds as exits, not patrons stepping in with conviction.

And when $352 failed, it despatched a reasonably clear message: the run is over, a minimum of for now.

What Merchants Ought to Count on Subsequent

The downtrend continues to be the bottom case. That doesn’t imply XMR can’t bounce, as a result of it completely can. Actually, it would even pause and vary at sure ranges if Bitcoin and main altcoins catch a aid rally inside their very own longer-term downtrends.

However any bounce, a minimum of within the close to time period, appears to be like extra like a retest alternative than the beginning of a brand new uptrend. That’s simply how these post-parabolic charts are likely to behave. They don’t go straight again up. They often grind, entice late patrons, and bleed.

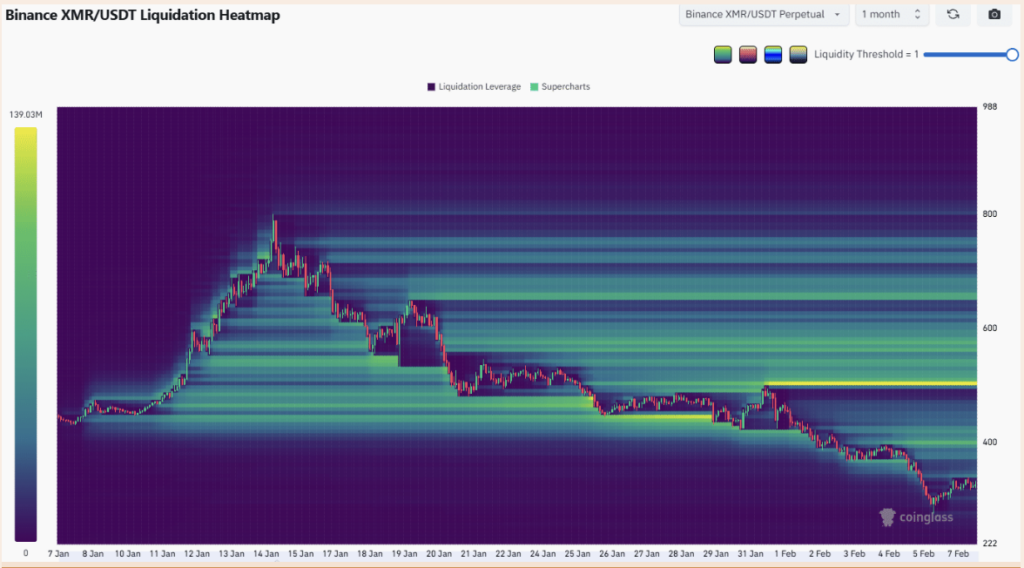

Liquidation Heatmap Reveals The place a Bounce Might Get Rejected

Taking a look at liquidation heatmaps, the following main “magnetic zones” sit larger up the chart. The important thing areas to look at are round $390–$420, after which the $500 area after that. These zones usually act like worth magnets throughout rebounds, particularly when the market is looking for liquidity.

If Bitcoin bounces, XMR may simply get pulled towards these ranges. But when it does, merchants also needs to be ready for an additional bearish response as soon as these zones are tapped. That’s the place liquidations and trapped positioning usually reset.

In brief, Monero’s parabolic rally already performed out. Now it’s within the a part of the cycle the place the chart is looking for a brand new base, and that course of is never clear.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.