Ethereum creator Vitalik Buterin declares he’s “capitulating” — to not crypto, however to lastly calling Twitter “X” simply days after promoting $6.6 million price of ETH throughout peak crypto panic.

In the meantime, Bitcoin faces renewed nervousness over quantum vulnerability as CoinShares highlights 20,000 BTC doubtlessly uncovered to future decryption. Bitcoin Money surges 25%, reclaiming a high 10 spot and pushing Cardano out in a uncommon reversal of fortunes.

Because the crypto market tries to stabilize this Sunday close to $69,000 after a $1.46 billion liquidation wipeout, its contributors brace for subsequent week’s volatility, with majors caught under key resistance and macro dangers from Fed coverage nonetheless unresolved.

Morning Crypto Report: ‘I Am Capitulating’: What’s Vitalik Buterin Speaking About? Bitcoin Quantum Risk Drama Will get 20,000 BTC Twist, Cardano out of High 10 as Bitcoin Money Wins Again 25% of BCH Worth

XRP Defies Market Bearishness with $45M in Weekly ETF Inflows

TL;DR

- Vitalik Buterin publicly capitulates to calling Twitter “X” days after promoting $6.6 million in ETH.

- Bitcoin’s quantum risk danger resurfaces: 20,000 legacy BTC in theoretical hazard.

- Bitcoin Money explodes 25%, reclaims high 10: Cardano dethroned.

Ethereum creator Vitalik Buterin confirms he’s capitulating

Vitalik Buterin’s newest publish is designed to be misinterpret on goal because the Ethereum visionary wrote “I’m capitulating” however then instantly clarified the goal: naming. The message is that he’ll name Twitter “X” going ahead, and that “tweet” has turn into a generic time period for short-form posts on platforms with X-like UX, explicitly mentioning Farcaster and Lens in his examples. He even added a utilization information.

In fact, Buterin’s use of the time period “capitulate” — simply days after promoting 2,961.5 ETH for $6.6 million at a mean worth $2,228 — set off one other spherical of uncertainty and worry.

I’m capitulating, I’ll name Twitter “X” any more. “Tweet” turns into a generic time period for messages on any platform that prioritizes short-form textual content content material with X-like UX, comparable linguistically to “kleenex”. – Vitalik Buterin on X

As was later confirmed by on-chain knowledge, the ETH sale went to a number of addresses linked to open-source biotech tasks and the Ethereum Basis, together with Kanro, Buterin’s nonprofit centered on pandemic prevention.

The timing aligned with Ethereum’s plunge to new native lows below $1,950 — down 22% from the height — throughout one of many worst liquidation cascades since “Black Friday” on Oct. 10, 2025. Whereas Buterin didn’t touch upon the ETH worth immediately, the twin sign of “capitulating” and exiting ETH positions fueled dialogue as as to if Ethereum’s creator is signaling about one thing deeper than simply the identify of X.

As much as 20,000 Bitcoin (BTC) weak to quantum risk

A recent report from CoinShares’ Christopher Bendiksen touches on the long-circulating “quantum computing kills Bitcoin” speak — however this time with arduous numbers and particular assault surfaces.

The punchline is that round 1.7 million BTC, which is 8% of the overall provide, previous P2PK addresses might be weak to theoretical Shor’s algorithm assaults many years down the road.

However within the quick to medium time period? Solely about 20,000 BTC, or 0.1% of the Bitcoin provide, are doubtlessly uncovered in any means, and even that may require optimistic advances in qubit scale and stability far past at this time’s tech.

The important thing distinction, as outlined by Bendiksen, is that fashionable Bitcoin codecs (P2PKH, P2SH, Taproot) don’t expose public keys till cash are moved. Outdated-school P2PK cash have uncovered keys from inception, making them a future vulnerability goal.

CoinShares argues towards aggressive interventions like burning dormant cash or compelled migrations, citing decentralization, immutability and property rights dangers. As a substitute, they counsel monitoring and non-compulsory QR-format forks as a long-term buffer.

No panic has emerged available on the market — but. However the concept of 20,000 BTC doubtlessly changing into liquid by way of quantum unlocks certainly provides a surreal undertone to an already chaotic week on the crypto market.

Bitcoin Money units 25% comeback into high 10: Cardano out

In every week dominated by sell-offs, Bitcoin Money (BCH) pulled off a 25% rebound and muscled its means again into crypto’s high 10 membership — knocking out Cardano (ADA) within the course of.

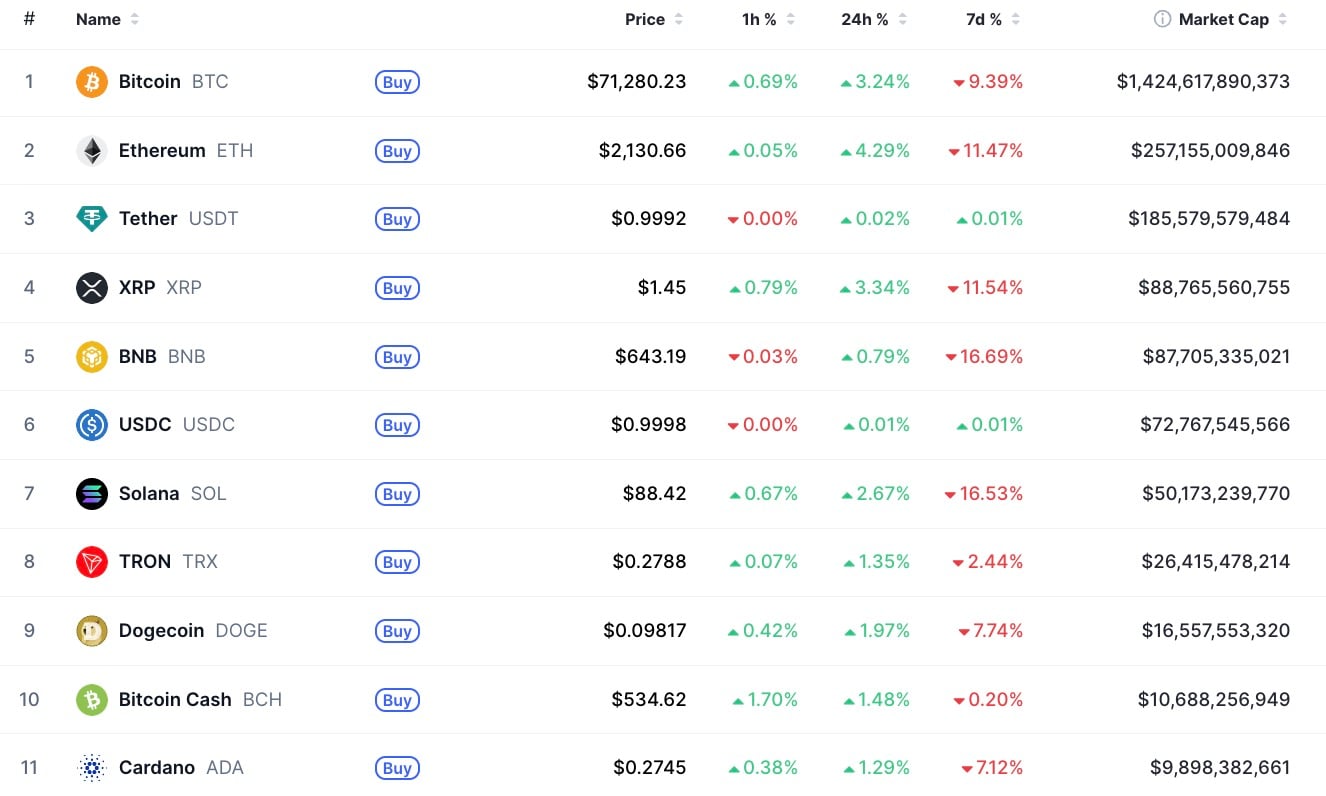

In keeping with CoinMarketCap, the BCH market cap surged to $10.5 billion, overtaking ADA’s $9.86 billion. Whereas each cash rallied after Feb. 6’s crash, BCH’s bounce was barely stronger — +25% vs. +24% for ADA — and this 1% delta was sufficient to make it into the crypto market’s elite.

This marks one of many few instances since 2021 that Bitcoin Money has reclaimed the next place than Cardano. It comes amid renewed chatter round BCH as a possible Bitcoin different in cost use instances, with small transaction charges and easy UTXO construction interesting to some retail buyers amid excessive L2 charges elsewhere.

For Cardano, the loss stings. Whereas founder Charles Hoskinson teased new AI-native governance instruments final week, ADA’s worth motion continues to disappoint — from a peak above $0.70 in mid-January to sub-$0.25 simply days in the past. Even with the 24% restoration, the community has struggled to retain retail curiosity.

Crypto market outlook: BTC, ETH, ADA, BCH worth replace

Regardless of Buterin’s “capitulation,” Ethereum’s structural fundamentals are right here to remain, although the shift in tone alerts mounting fatigue and looks like an absence of concepts.

-

Ethereum (ETH): Watching $2,000-$2,150 as essential resistance is essential. Failure there, and ETH might revisit $1,750-$1,800 shortly.

-

Bitcoin (BTC): $70,000 zone has turn into a magnet. Bulls must reclaim and maintain $73,000 to substantiate a pattern reversal. Under $66,000, one other flush towards $60,000 and even $55,000 stays probably.

-

Cardano (ADA): Dangers slipping additional except it could regain the psychological $0.30 degree and reclaim high 10 confidence. BCH would possibly fade, however its short-term return speaks volumes about capital desperation and rotation video games.

Amongst upcoming catalysts is Consensus Hong Kong on February 10-12, and Fed commentary round Warsh affirmation will set the tone for subsequent week. For now, the crypto market stays fragile, fragmented and basically suspicious.