- Solana has damaged key macro constructions throughout a number of timeframes and is now struggling to carry the $69–$70 zone

- ETF outflows have remained constant, signaling a sluggish however regular lack of confidence amongst market individuals

- Regardless of the sell-off, Solana’s RWA market cap surpassing $1B reveals the ecosystem continues to be rising underneath the floor

Not way back, the market was filled with optimism and SOL was one of many loudest winners of the cycle. Now, it’s caught in the identical brutal risk-off wave hitting the whole crypto complicated, and it’s exhibiting actual indicators of stress. At press time, Solana was down greater than 20% for the reason that begin of February, dragged decrease by the broader correction and a breakdown in its personal construction.

And this wasn’t only a small crack both. SOL has now breached a macro head-and-shoulders setup throughout a number of timeframes, together with the day by day, weekly, and even the month-to-month chart. When breakdowns begin aligning like that, it often means the market isn’t simply “pulling again.” It’s resetting.

Solana Misplaced Key Assist, and the Chart Appears to be like Heavy

The worth motion has been tough. After shedding its key help zones, SOL slid underneath $70 in early February, which is the type of degree that tends to flip sentiment from “purchase the dip” to “perhaps this isn’t the dip anymore.”

Extra importantly, the $79–$81 area failed too, and that zone had been performing like a dependable flooring. As soon as it broke, the drop accelerated shortly and Solana fell towards $69. And sure, it bounced just a little, but it surely was the type of bounce that appears extra like survival than energy.

Now the danger is fairly clear. If SOL can’t maintain this area, the subsequent actual demand pocket sits a lot decrease, between $49 and $53. That’s a nasty vary to even speak about, however markets don’t care about what feels snug. They care about liquidity.

ETF Outflows Add One other Layer of Stress

Solana’s weak spot hasn’t simply been on the chart. It’s additionally been exhibiting up within the movement information, which is arguably much more uncomfortable.

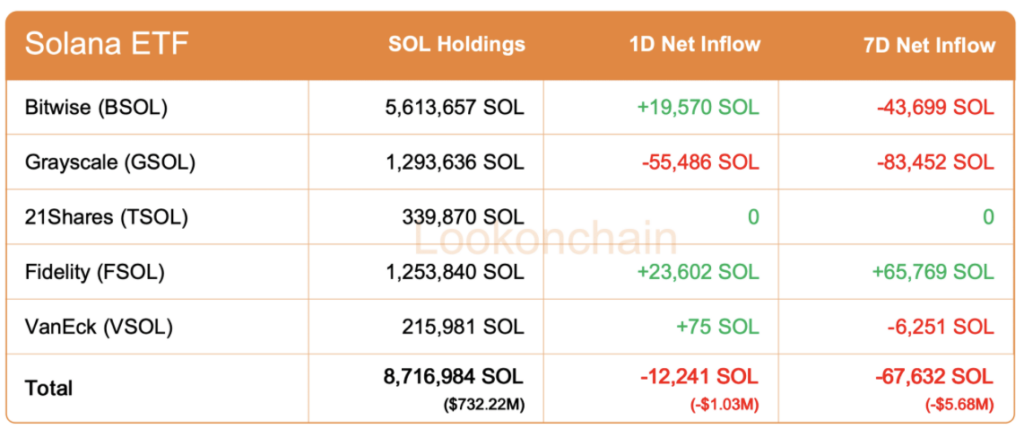

Over the previous week, Solana-focused ETFs reportedly noticed internet outflows totaling round -67,632 SOL, roughly $5.68 million. And on February 6 alone, greater than $1 million price of SOL exited these merchandise, marking the seventh occasion of constant outflow stress.

That type of sample doesn’t scream “non permanent concern.” It appears like traders slowly backing away, day after day, which is how confidence erosion really occurs. It’s not often one huge dramatic exit. It’s often loss of life by a thousand small cuts.

Solana’s RWA Progress Is Actual, Even If Worth Isn’t Displaying It But

Right here’s the place it will get attention-grabbing although, as a result of Solana isn’t precisely “lifeless” underneath the floor. In accordance with Token Terminal, Solana’s Actual-World Asset (RWA) market cap surpassed $1 billion on February 7, 2026. That’s an actual milestone, and it suggests the ecosystem continues to be pushing ahead even whereas the market is bleeding.

Tokenized belongings don’t develop in a vacuum. They require partnerships, infrastructure, and precise demand. So that is a kind of awkward moments the place fundamentals and worth are shifting in reverse instructions. It occurs so much in crypto, actually.

And it creates pressure.

As a result of if Solana can hold constructing out its RWA base whereas the market stabilizes, that might finally turn into a powerful narrative tailwind. However narratives don’t cease sell-offs in actual time. Not often.

Can SOL Stabilize Right here, or Is This Simply the Begin?

Proper now, the massive query isn’t whether or not Solana can “recuperate quickly.” The query is whether or not the market may even soak up the present outflows with out breaking additional.

SOL has already slipped into new lows, and ETF cash continues to be leaving. Except Solana can reclaim key zones between $118 and $145, the chances of a clear restoration stay low. These ranges are mainly the road between “aid bounce” and “development reversal,” and for the time being, SOL is nowhere close to them.

To flip the script, Solana possible wants contemporary institutional inflows, stronger absorption, and a return of danger urge for food throughout crypto. If that doesn’t present up, draw back danger stays very actual, and the market might drift towards a deeper capitulation section earlier than an actual backside varieties.

For now, Solana isn’t exhibiting robust energy. It’s exhibiting hesitation, and the chart continues to be leaning bearish.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.