- Bitcoin’s mounted provide makes it a long-term hedge in opposition to fiat debasement, although not an ideal disaster hedge

- BTC stays the core asset of crypto, with most market cycles nonetheless revolving round its strikes

- ETFs have made Bitcoin simpler to carry in conventional accounts, increasing long-term institutional possession

Bitcoin is a type of property folks like to argue about, however it’s additionally one of many few in crypto that’s earned a everlasting seat on the desk. Even in case you’re not a full-on believer, holding a small quantity could make sense for lots of portfolios. And for some traders, a bigger allocation, even as much as 5%, remains to be justifiable.

Not as a result of Bitcoin is ideal. It isn’t. However as a result of it affords a mixture of shortage, market management, and accessibility that’s truthfully exhausting to duplicate wherever else in crypto.

Bitcoin can hedge inflation, however solely within the long-term sense

Inflation is a type of sluggish issues that quietly eats portfolios over time. And Bitcoin’s attraction right here is easy: the provision can’t be expanded. There’ll solely ever be 21 million BTC, and shut to twenty million have already been mined. No central financial institution can determine to “print extra Bitcoin” as a result of the principles don’t permit it.

That mentioned, calling Bitcoin an inflation hedge with out qualifiers is sloppy. Bitcoin doesn’t behave like gold in each atmosphere. In intervals the place buying energy is being squeezed and inflation is the primary story, Bitcoin typically acts like a hedge. However in outright disaster situations, the place markets panic and liquidity dries up, it will probably commerce like a danger asset and drop exhausting. We noticed that throughout the early pandemic, when Bitcoin didn’t shield portfolios the best way conventional safe-havens usually do.

So the higher framing is that this: Bitcoin is extra like long-term insurance coverage in opposition to fiat foreign money debasement, not a month-to-month defend in opposition to inflation. It’s just too risky to play that position persistently, and pretending in any other case units folks up for disappointment.

Bitcoin remains to be the core asset of your entire crypto market

Inside crypto itself, Bitcoin stays the reference asset. Every little thing else revolves round it, whether or not folks wish to admit it or not. It’s price round $1.4 trillion out of a roughly $2.5 trillion complete crypto market cap, which makes it the anchor of your entire sector.

In most crypto cycles, when Bitcoin rises or falls sharply, the remainder of the market tends to observe with a lag, and often with further drama. That’s why proudly owning some BTC is without doubt one of the easiest methods to realize broad publicity to crypto. You don’t need to gamble on a basket of smaller altcoins, you don’t need to chase narratives, and also you don’t must faux you may predict which ecosystem wins subsequent.

Bitcoin is the bottom layer of the market’s psychology. If you happen to personal BTC, you personal the asset your entire sector reacts to.

Bitcoin is less complicated than ever to carry by way of ETFs and brokerage accounts

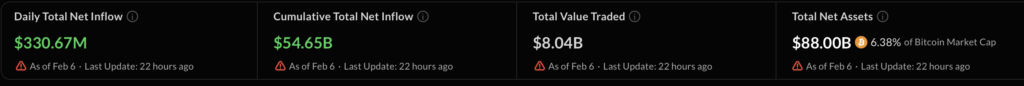

One other main shift is accessibility. Right this moment, it’s simpler than ever to purchase and maintain Bitcoin by way of regulated merchandise like Bitcoin ETFs. Which means you don’t must arrange a pockets, handle personal keys, or fear about custody complications simply to get publicity.

This additionally lowers friction for establishments and corporations. It’s not simply retail anymore. A rising portion of the provision is now held by nations, companies, ETFs, and different conservative entities which might be far much less prone to promote impulsively. In actual fact, greater than 4 million BTC are at the moment held by these giant holders, which modifications the market construction over time.

If you happen to purchase and maintain Bitcoin, you’re not simply betting on retail hype. You’re benefiting from the rising variety of companies and establishments treating BTC like a long-duration scarce asset. And if these entities proceed holding for shortage over time, the long-term value bias tends to tilt upward.

Bitcoin isn’t excellent, however it’s nonetheless exhausting to disregard

Bitcoin doesn’t must be a flawless asset to be price proudly owning. It simply must maintain doing what it already does: stay scarce, stay liquid, stay the market’s reference level, and keep more and more accessible by way of conventional finance.

That mixture is uncommon. And in crypto, it’s principally the closest factor the market has to a “core holding.”

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.