In short

- Dalio mentioned CBDCs may give governments unprecedented means to observe transactions and implement coverage by means of the monetary system.

- He performed down their long-term attraction as a retailer of worth, arguing they might battle to compete with money-market funds or bonds.

- The feedback come as dozens of nations advance CBDC pilots, reviving debate over privateness, management and the longer term position of decentralized options like Bitcoin.

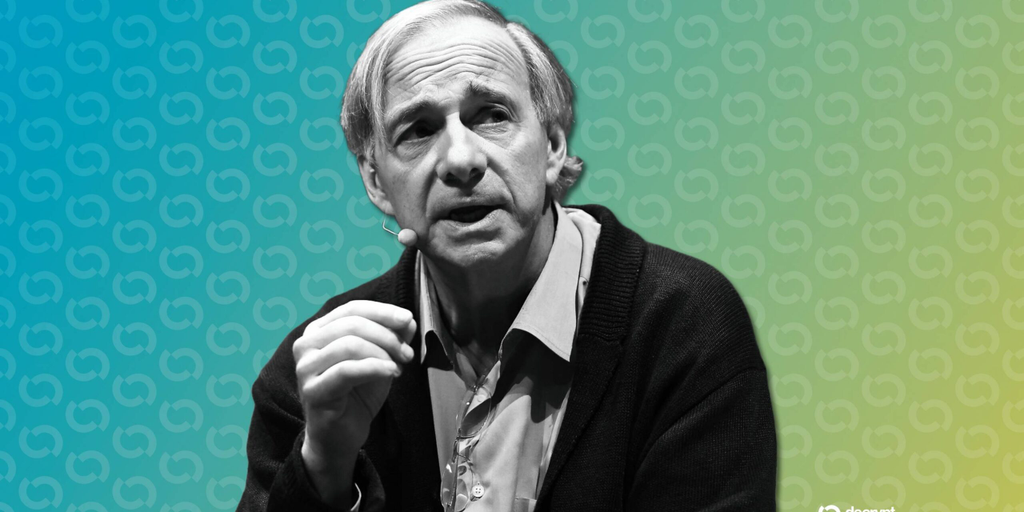

Bridgewater Associates founder Ray Dalio warned Monday that central financial institution digital currencies would give governments far larger visibility into monetary exercise, whilst he performed down their doubtless scale.

Talking in an interview with Tucker Carlson, Dalio mentioned CBDCs “might be achieved” within the foreseeable future however are unlikely to turn into “that massive of a deal,” including they might perform like money-market funds whereas providing governments tighter management over transactions.

“There might be a debate; in all probability they gained’t be [offering interest], then they’re not an efficient car to carry since you’ll have depreciation,” he mentioned. “You’d quite maintain in a cash market fund or a bond.”

Whereas acknowledging that “there’s a substantial amount of attraction” in CBDCs as a result of they’re “straightforward” and handy, Dalio mentioned they’re a “very efficient controlling mechanism by the federal government.”

Full transparency might be good for monitoring and decreasing unlawful actions, however would additionally imply “the federal government has a substantial amount of management,” he mentioned. “What I imply is all of the transactions might be identified.”

Such management will prolong into different areas, with CBDCs doubtlessly being utilized by governments to mechanically levy taxes and apply international change controls, he mentioned.

He added that CBDCs may enable governments to mechanically implement sanctions, limit entry for politically disfavoured teams, levy taxes and impose foreign-exchange controls.

Dalio’s feedback come as greater than 130 international locations or foreign money unions are at numerous phases of exploration, with 72 presently in superior phases of improvement, in response to the Atlantic Council.

The figures embrace three international locations, the Bahamas, Jamaica, and Nigeria, which have formally launched CBDCs, in addition to 49 jurisdictions, together with China, which might be operating pilot packages.

Dalio’s issues echo views lengthy held by components of the blockchain trade, although critics body the problem much less as surveillance and extra as a structural design difficulty.

Harry Halpin, chief government of decentralized mix-network supplier Nym Applied sciences, mentioned the core infrastructure required for CBDCs already exists inside the banking system.

“Digital expertise is already utilized by central banks just like the Fed to observe relationships with industrial banks,” Halpin instructed Decrypt. “It’s a really small step to increase that visibility to particular person accounts by means of a CBDC.”

Halpin mentioned privacy-focused cryptocurrencies had been designed to handle these issues, although such instruments stay controversial with regulators.

Halpin contrasted the mannequin with Bitcoin, whose decentralized structure limits the flexibility of any single authority to observe or limit transactions, saying CBDCs symbolize “the alternative” of the system envisioned by Bitcoin’s creator.

Dalio has, in recent times, softened towards Bitcoin as a portfolio diversifier, whilst he continues to emphasize its limitations.

He has mentioned he holds a small allocation within the asset and that buyers ought to take note of it in its place type of cash, and at instances has expressed a desire for Bitcoin and gold over conventional debt devices like bonds.

Every day Debrief E-newsletter

Begin every single day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.