- Ripple’s XRP Neighborhood Day 2026 takes place tomorrow as a world digital occasion

- Periods will concentrate on real-world XRPL adoption, DeFi, wrapped XRP, and infrastructure

- US-listed XRP funds have pulled in $1.2B in internet inflows, signaling rising confidence

Ripple will host XRP Neighborhood Day 2026 tomorrow, bringing collectively XRP holders, builders, monetary establishments, and Ripple management for a world digital occasion centered on real-world adoption and the way forward for the XRP Ledger ecosystem. Returning for its second yr, the occasion is positioning itself as greater than a group gathering. It’s being framed as a progress replace on how XRP is used right now, and what Ripple believes the following stage of XRPL growth seems like.

Ripple says the agenda will cowl regulated merchandise, DeFi functions, wrapped XRP, and next-generation XRPL infrastructure. The tone is clearly aimed toward displaying maturity, not hype, particularly after years the place XRP’s narrative was dominated by authorized uncertainty as a substitute of expertise.

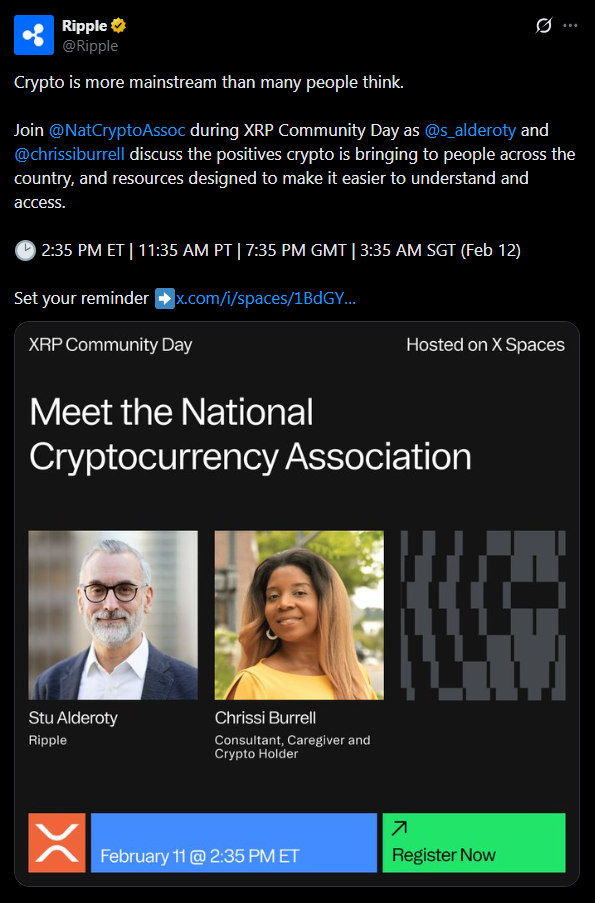

Management and Establishments Are Each Exhibiting Up

Ripple CEO Brad Garlinghouse and President Monica Lengthy are anticipated to talk alongside ecosystem companions and institutional individuals. Names listed embrace Grayscale, Gemini, and a variety of XRPL-native tasks, which provides the occasion a mixture of retail-facing and institutional-facing vitality.

That mix is vital. XRP has at all times sat in an uncommon center floor, retail-driven consideration on one facet, and institutional fee and settlement narratives on the opposite. Neighborhood Day seems like Ripple making an attempt to maintain each audiences engaged on the similar time, which isn’t simple on this market.

The Periods Are Constructed Round World Use Circumstances

Ripple’s lineup is organized round areas, which alerts the way it desires XRPL adoption to be understood. Key classes embrace capital markets and tokenized finance in EMEA, function updates and nationwide crypto initiatives within the Americas, and cross-chain innovation, stablecoins, and DeFi in APAC.

Audio system embrace individuals from Uphold, the Solana Basis, EasyA, and Flare Community, amongst others. That issues as a result of it exhibits Ripple isn’t making an attempt to current XRPL as a closed ecosystem. It’s leaning into interoperability and cross-chain growth, which is the place the broader market is heading anyway.

XRP ETFs Are the Headline Subject for Establishments

A serious focus this yr will likely be XRP ETFs, which proceed to draw institutional curiosity. Based on SoSoValue information, 5 US-listed XRP funds have collectively pulled in $1.2 billion in internet inflows, with complete internet property now surpassing $1 billion.

That’s nonetheless small in comparison with Bitcoin and Ethereum merchandise, however the consistency is the purpose. These inflows counsel there’s a gradual purchaser base constructing, even in a uneven market. For XRP, that sort of sluggish institutional adoption is arguably extra vital than a single explosive headline.

The SEC Cloud Lifting Modified Every part

Momentum accelerated after Ripple resolved its extended authorized dispute with the SEC final yr, eradicating the regulatory shadow that had weighed on XRP for years. That decision didn’t routinely push worth larger without end, but it surely modified the framework. It made it simpler for establishments to interact with out feeling like they had been stepping right into a authorized minefield.

XRP Neighborhood Day 2026 is arriving at a second the place Ripple can lastly speak about development with out continuously circling again to litigation. Whether or not the market rewards that’s one other query. However strategically, that is the cleanest setup XRP has had in years.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.