- Bitcoin fell 3.5% to $66,000 as short-term volatility on Binance surged

- Seven-day volatility hit its highest degree since 2022, per CryptoQuant

- Longer-term metrics counsel this can be a burst of stress, not a regime shift

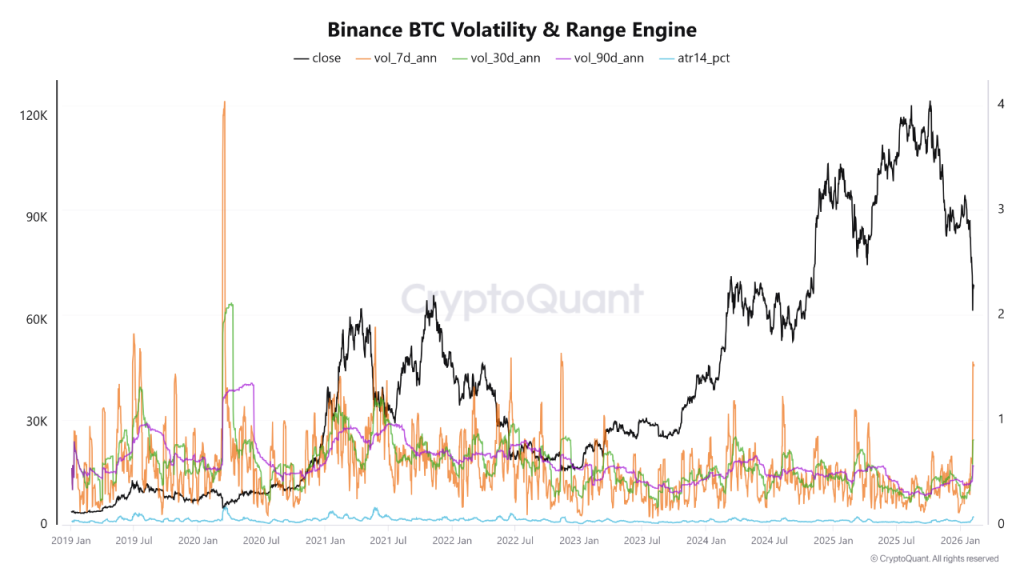

Bitcoin fell to $66,000 on Wednesday, shedding greater than 3.5% in 24 hours as short-term volatility jumped sharply on Binance. In line with CryptoQuant, seven-day annualized volatility climbed to 1.51, its highest studying in almost three years. That sort of spike often grabs consideration quick, particularly when merchants bear in mind what 2022 felt like.

The set off this time wasn’t crypto-specific. Stronger-than-expected US employment knowledge cooled expectations for aggressive Federal Reserve price cuts, which tends to strain speculative belongings. When rate-cut optimism fades, threat belongings wobble, and bitcoin nonetheless sits squarely in that class for a lot of allocators.

Volatility Seems Violent Up Shut

CryptoQuant famous that related short-term volatility ranges had been final seen throughout main market restructurings and broad deleveraging phases. That comparability alone is sufficient to spook merchants. When volatility compresses for months after which instantly snaps increased, positioning often unwinds in waves.

Ether dropped to round $1,925, Solana slid close to $80, and XRP fell to $1.35. Whole crypto market capitalization declined roughly 3.8% in 24 hours, in response to CoinGecko. The transfer felt sharp, even when US fairness indexes just like the Nasdaq remained largely flat.

Zoom Out and the Construction Seems Totally different

Right here’s the place it will get attention-grabbing. Whereas short-term volatility exploded, longer-duration metrics inform a calmer story. The 30-day annualized volatility sits round 0.81, and the 90-day studying is even decrease at 0.56. That declining sample throughout broader timeframes suggests the present turbulence is concentrated in remoted bursts slightly than spreading right into a structural regime shift.

In different phrases, the market is reacting shortly, nevertheless it hasn’t but transitioned into sustained instability. That distinction issues. Brief squeezes and liquidations can spike volatility with out altering the larger pattern.

A Burst or a Breakdown?

The important thing query now could be whether or not that is the start of a deeper deleveraging cycle or just a volatility shock tied to macro repricing. For now, the information leans towards the latter. Remoted bursts of stress usually fade as soon as positioning resets and merchants digest the macro headline.

Bitcoin at $66,000 feels heavy, particularly after current optimism. However till longer-term volatility curves begin rising in tandem, this nonetheless seems to be extra like a quick response than a structural break. In crypto, the distinction between these two states is every part.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.