BitMine Immersion Applied sciences saved shopping for as costs fell, scooping up 40,613 ETH throughout final week’s sell-off. Reviews say the acquisition totaled roughly $83–$84 million, made when Ether traded close to $2,020 per token.

BitMine’s Rising Stake And The Man At The Helm

In keeping with latest protection, the transfer pushed BitMine’s complete Ethereum holdings to round 4.32–4.33 million ETH, a stash value billions at present costs. Govt chairman Tom Lee has framed the dip as a lovely entry level and has voiced confidence in a bounce again.

Paper Losses Widen As Costs Slide

Reviews observe that the agency’s giant price foundation for its amassed ETH has left its treasury sitting on multibillion-dollar unrealized losses.

Estimates within the newest items place these paper losses between about $7.5 billion and $8 billion, relying on which worth is used to mark the holdings. That hole widened as Ether fell from greater ranges into the low-$2Ks.

BitMine faces an estimated $7.7 billion paper loss on its ETH holdings. Supply: DropsTab

Market And Shareholder Response

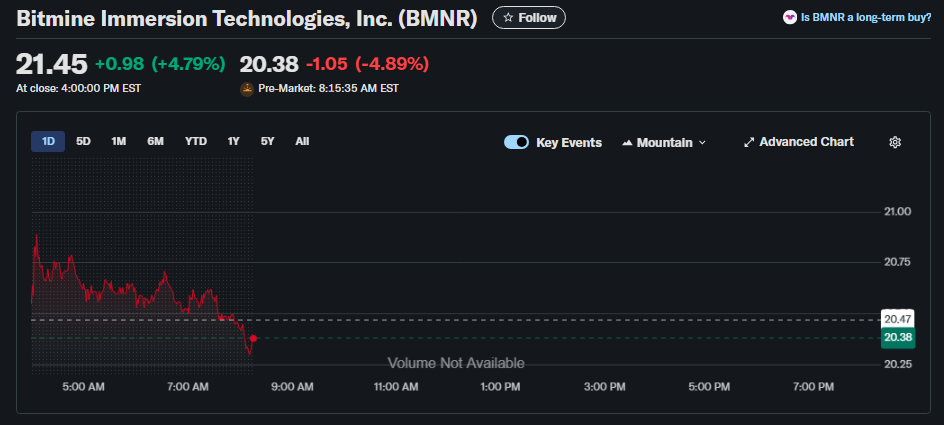

BitMine’s aggressive shopping for didn’t calm all buyers. Information retailers tracked a drop within the firm’s inventory (BMNR), which was reported down roughly 5% in pre-market buying and selling across the identical time the ETH purchase was disclosed.

Merchants look like weighing the long-term thesis in opposition to the fast hit to the corporate’s web asset worth.

Six‑month efficiency of BitMine (BMNR) inventory. Supply: Yahoo Finance

Why The Firm Is Nonetheless Including

Reviews say BitMine sees this as a part of an intentional treasury play. A number of the agency’s ETH is staked, which generates yield and may help offset paper losses over time.

Tom Lee has forecast a robust rebound, calling for a V-shaped restoration in ether. That type of outlook explains why purchases got here even whereas the market was weak.

ETHUSD buying and selling at $2,012 on the 24-hour chart: TradingView

What To Watch Subsequent

Brief time period, worth strikes in ether and shifts in investor sentiment would be the clearest indicators. If ETH phases a gentle climb, the unrealized losses will shrink shortly.

If the token continues to commerce decrease, the corporate’s paper loss metrics will stay a headline for shareholders and analysts.

Reviews say particulars akin to financing, staking returns, and any additional disclosed buys will form how buyers view the agency’s threat profile.

BitMine’s option to preserve shopping for at decrease ranges is a transparent guess on future worth restoration. Whether or not that guess pays off for shareholders relies upon available on the market’s subsequent strikes, and on whether or not persistence and staking earnings can outweigh a big short-term drawdown.

Featured picture from Thomas Fuller/SOPA Pictures/LightRocket through Getty Pictures, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.