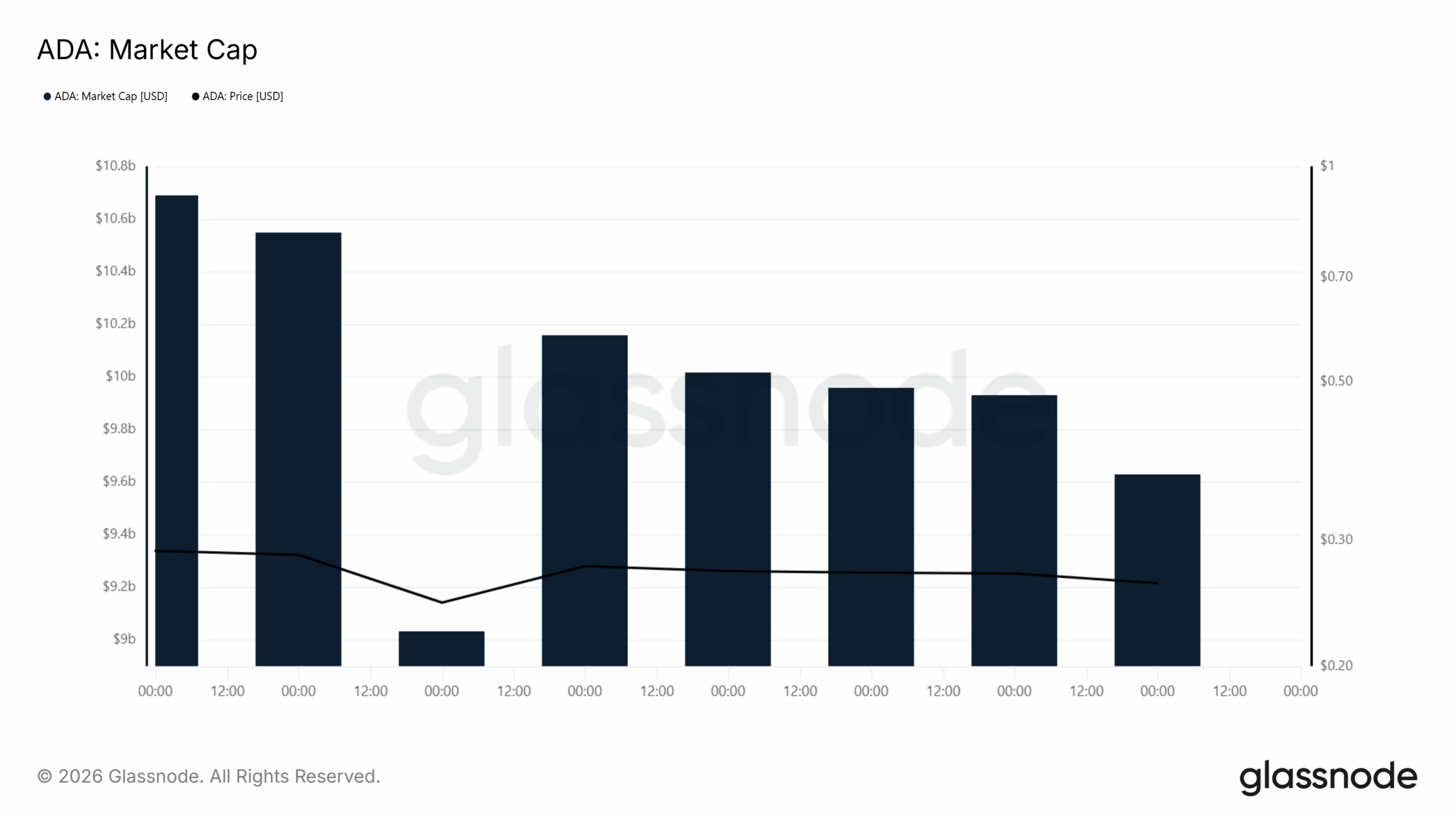

Cardano value prediction tendencies have turn out to be the main target of consideration based mostly on recent information from Glassnode revealing that the ADA market capitalization diminished over the previous few days from greater than $10.6 billion to the $9.6 billion mark. On the similar time, the ADA costs have been shifting away from the $0.30 mark and in direction of the $0.25 value vary.

Market contributors at the moment are specializing in whether or not ADA manages to stabilize above this level or if the downtrend extends from this degree. All technical indicators, together with these on greater and decrease timeframes, are displaying weakening momentum with the worth compressing round a requirement space.

Knowledge Reveals Declining Market Capitalization

A chart supplied by Glassnode, displays the ADA market capitalization in addition to the ADA value in USD phrases. In keeping with this chart, the ADA valuation has been declining steadily, decreasing over time, although not abruptly.

There’s a noticeable dip within the chart earlier than the market cap approached the $9 billion mark. A minor value hike is seen following the dip earlier than the slope continued on the identical path. Because the circulating provide stays secure, the noticed modifications must be attributed to the worth motion.

The worth line on the identical chart affirms this. Value went down from the $0.29 to $0.30 vary to the $0.25 to $0.26 vary. It’s a sequence of decrease highs and decrease lows. That is in step with the downtrend in market capitalization.

Cardano Value Prediction as Assist Faces Stress

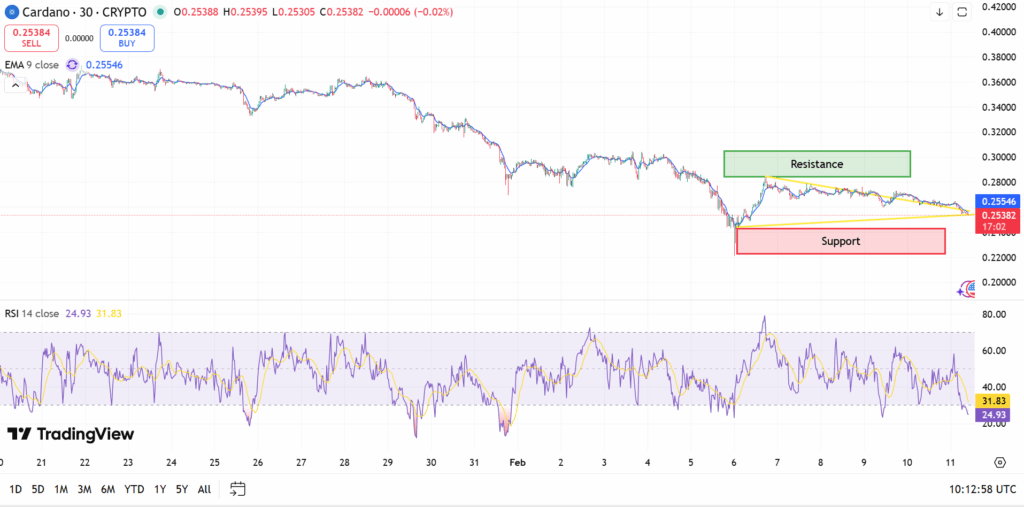

The present Cardano value is concentrated across the assist zone of $0.24–$0.25. In keeping with previous information, the world has represented earlier intervals of shopping for motion. The present value is buying and selling immediately over this level.

On a optimistic observe, resistance is discovered near $0.27 to $0.29. ADA’s current short-term makes an attempt to go up met resistance round that vary. The general development stays down so long as ADA doesn’t commerce above that vary.

Momentum indicators present context. Relative Power Index, analyzed on the Day by day chart, has been monitoring the decrease development line close to the 30s, which is indicative of weakening momentum. Typically, such oversold alerts don’t represent affirmation of upcoming modifications with out accompanying quantity enlargement or shifts.

Technical Construction Displays Managed Promoting

Decrease-timeframe charts seem like displaying a compression sample growing round assist. Value motion has been consolidating inside decreasing boundaries, which suggests decrease volatility. Compression actions don’t are typically directional by themselves.

The nine-period exponential shifting common slopes downwards on greater timeframes. Alignment signifies that there’s total prevailing promote stress. The development stays in place till it goes previous that common.

That is fortified by market capitalization actions as properly. If the market capitalization have been to drop constantly under $9 billion, it’s anticipated to replicate the additional contraction. Furthermore, consolidation could happen round these elevated ranges.

Broader Outlook for Cardano Value Prediction

The broader Cardano value prediction depends upon the ADA response at current ranges. In case patrons can defend $0.24 area and value closes above short-term resistance, a bounce could arrange towards $0.30 zone. A breach of assist on sturdy quantity would see the downtrend proceed.

If information from Glassnode gives valuation context, value charts present construction and momentum. Together, the latter suggests ADA trades at a technical inflection level.

Through the time being, ADA trades close to assist, with declining market capitalization and subdued momentum. The next transfer will greater than seemingly point out the short-term course on this Cardano value prediction.

Disclaimer: This evaluation is predicated on market tendencies and doesn’t assure future outcomes. It shouldn’t be handled as monetary recommendation. Cryptocurrency investments contain threat, so at all times do your individual analysis (DYOR) earlier than investing.