- Saylor says Bitcoin will double or triple S&P returns over the following 4–8 years

- Technique retains shopping for BTC regardless of sitting on giant unrealized losses

- The corporate treats Bitcoin as its stability sheet id, not a commerce

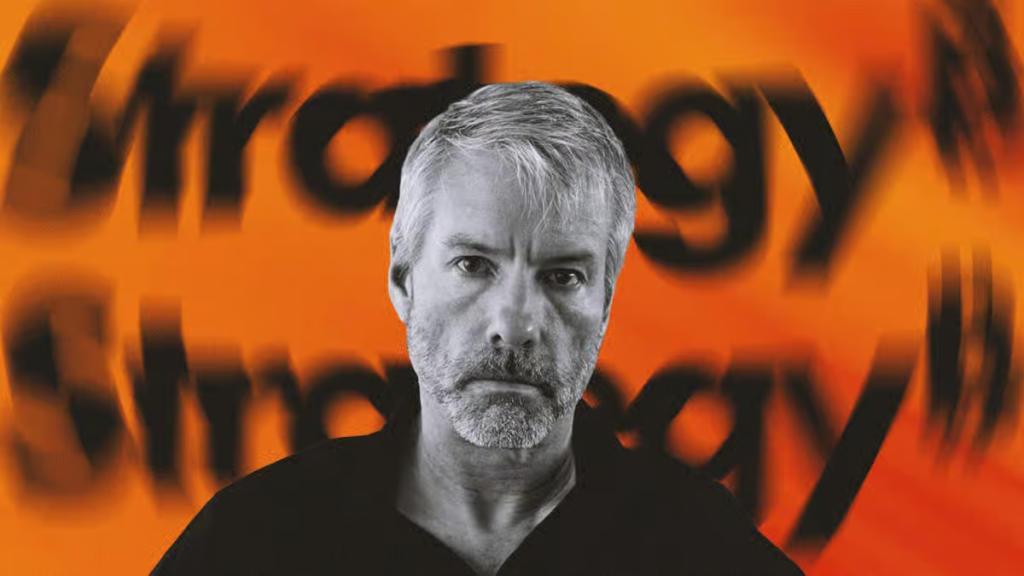

Michael Saylor isn’t quietly optimistic about Bitcoin. He’s express. Talking on CNBC, he stated Bitcoin is positioned to outperform the S&P by multiples over the following 4 to eight years. Not marginally, however decisively. Whereas most executives would hedge that type of declare, Saylor leans into it, framing Bitcoin as the bottom layer of capital slightly than a speculative asset that wants defending throughout drawdowns.

That framing issues as a result of it explains all the pieces Technique does. This isn’t a tactical allocation or a macro hedge. It’s a perception that Bitcoin’s shortage and community results basically outperform diversified fairness publicity over very long time horizons.

Technique’s Shopping for Doesn’t Cease When It Hurts

Technique now holds greater than 700,000 BTC, and after the current market pullback, the place is underwater on paper. As a substitute of slowing down, the corporate purchased extra. That’s the half critics are inclined to gloss over. Anybody can sound assured when costs are rising. Shopping for aggressively whereas sitting on unrealized losses is a unique type of conviction.

Administration has been clear that promoting shouldn’t be a part of the plan. Not this quarter, not subsequent 12 months, not subsequent cycle. Technique isn’t attempting to time Bitcoin. It’s attempting to personal as a lot of it as attainable and let time do the work.

Volatility Is Handled as a Price, Not a Threat

Critics preserve pointing to Technique’s inventory decline and its debt construction as proof the technique is fragile. Saylor sees it otherwise. In his view, the stability sheet solely breaks underneath an excessive state of affairs the place Bitcoin collapses and stays depressed for years. That’s the sting of the stress check, not the bottom case.

Inside that vary, volatility isn’t a menace. It’s the toll you pay for uneven upside. If Bitcoin behaves the best way Saylor expects, the swings alongside the best way are irrelevant in comparison with the vacation spot.

This Is a Rejection of Index Considering

What Technique is doing isn’t actually about beating the S&P. It’s about rejecting index logic fully. Saylor is betting that shortage beats diversification over time, and that focus beats fixed rebalancing if the underlying asset is robust sufficient.

Most companies deal with Bitcoin like a facet pocket, one thing to experiment with however by no means totally decide to. Technique treats Bitcoin like gravity. All the things else on the stability sheet orbits round it.

Conviction Over Timing

If Saylor is improper, this can be remembered as one of many boldest miscalculations in company historical past. If he’s proper, it’s going to look much less like bravado and extra just like the cleanest expression of perception fashionable markets have seen.

Both manner, this isn’t a commerce. It’s an id. And markets not often see conviction expressed this clearly.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.