- Binance accomplished its full $1B SAFU conversion from stablecoins into Bitcoin

- The fund purchased 4,545 BTC for over $305M, reaching roughly 15,000 BTC whole

- The conversion completed in underneath 13 days, far forward of the 30-day goal

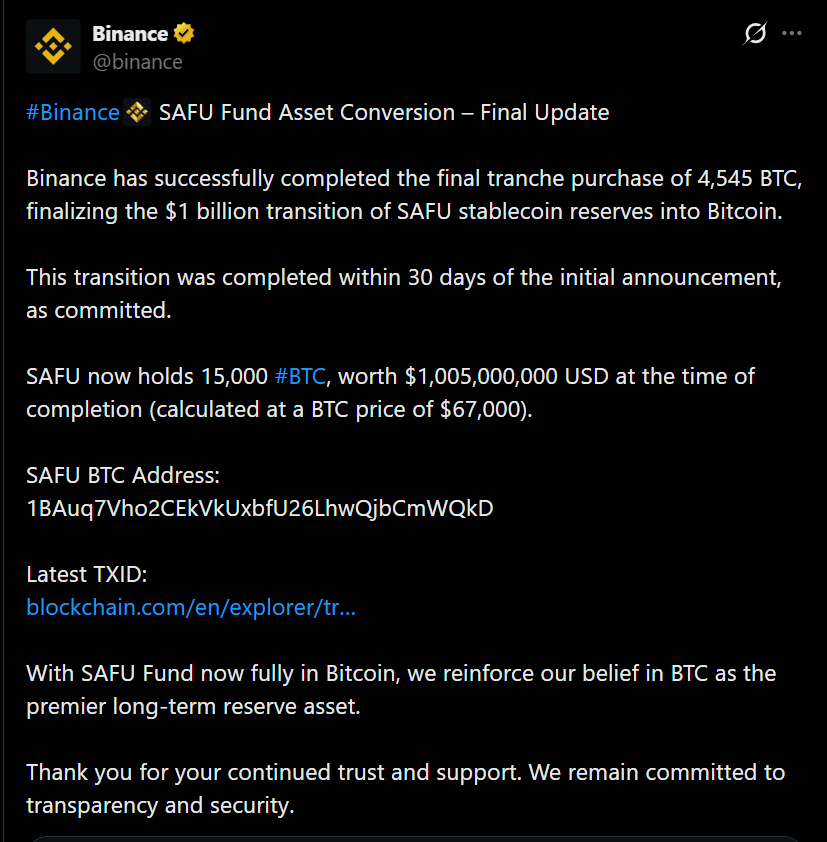

Binance has accomplished the conversion of its $1 billion Safe Asset Fund for Customers (SAFU) from stablecoins into Bitcoin. The ultimate push occurred Thursday, when the fund spent greater than $305 million to accumulate 4,545 BTC, bringing whole holdings to roughly 15,000 BTC price over $1 billion, in keeping with Arkham Intelligence information.

This wasn’t a sluggish roll. Binance initially mentioned the conversion may take as much as 30 days beginning January 30, however it completed the method in underneath 13 days. That velocity issues as a result of it exhibits intent. When a agency this huge strikes that shortly, it’s normally as a result of they need the market to see it.

Why Pace Issues Extra Than the Precise Quantity

A $1 billion reserve shifting into Bitcoin is already a robust sign. However doing it in underneath two weeks is what makes it stand out. Binance may have unfold this out quietly, diminished consideration, and averted the “headline threat” of shopping for into weak spot. As an alternative, it accelerated.

That tells you Binance isn’t treating this like a commerce. It’s treating it like a structural allocation. And for an emergency reserve fund, that’s a significant shift. SAFU is meant to be a confidence backstop, so the asset chosen for that position isn’t only a informal choice.

The $800M Flooring Is the Hidden Mechanic

Binance has mentioned it would monitor SAFU and rebalance the fund if its market worth falls beneath $800 million. That clause is essential as a result of it provides a self-discipline mechanism. It implies SAFU isn’t meant to drift freely as a pure Bitcoin publicity car. It’s meant to stay a dependable reserve, even throughout drawdowns.

In observe, this creates a framework the place Binance has dedicated to defending the fund’s minimal worth, not simply holding BTC passively. That makes SAFU really feel much less like a advertising line and extra like a structured reserve coverage.

This Comes as Company BTC Hype Cools

Institutional curiosity in Bitcoin continues to be rising underneath the present regulatory atmosphere, however the frenzied accumulation from late 2024 by mid-2025 has clearly cooled. Latest market turbulence has shaken threat urge for food, and plenty of public-company treasury performs have slowed down or gone quiet.

That’s why Binance’s transfer lands in another way. It’s occurring in a extra cautious tape, not a euphoric one. Bitcoin is hovering round $67,000 at press time, down roughly 5% over the previous seven days, per CoinGecko. In different phrases, this wasn’t Binance shopping for right into a breakout. It was Binance shopping for into stress.

Conclusion

Binance finishing a full $1 billion SAFU conversion into Bitcoin is a serious sign, particularly as a result of it occurred so shortly. In a market the place company and institutional accumulation has cooled, Binance simply made a really loud assertion: Bitcoin continues to be the reserve asset they belief most when volatility is excessive. And that’s precisely why this transfer issues.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.