- Binance has opened deposits for Ripple’s RLUSD stablecoin on XRPL

- Withdrawals will comply with as soon as ample liquidity is established

- RLUSD now competes extra straight with USDT and USDC at scale

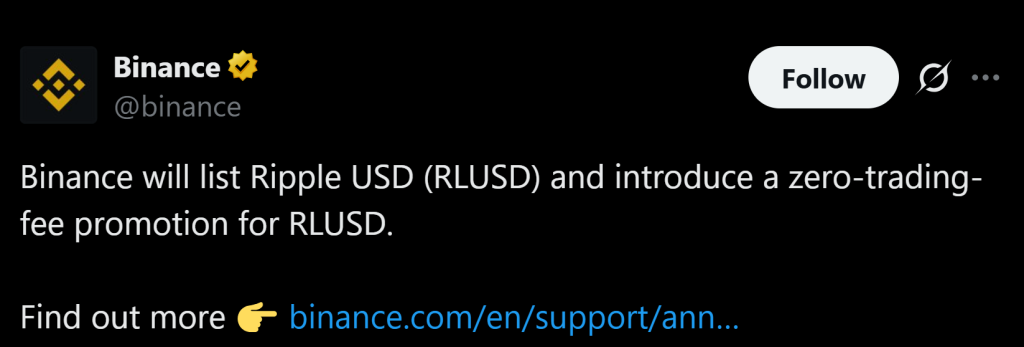

Binance has accomplished its integration of Ripple USD (RLUSD) on the XRP Ledger, formally opening deposits for the dollar-pegged stablecoin. In keeping with the announcement, customers can now generate deposit addresses by means of their Binance wallets, with withdrawals set to go dwell as soon as liquidity circumstances are sturdy sufficient.

Which may sound procedural, however trade integrations are not often trivial. For a stablecoin, distribution is every thing. Entry by means of Binance instantly expands RLUSD’s attain to one of many largest world buying and selling platforms, which adjustments how simply the asset can transfer throughout markets.

What RLUSD Is Making an attempt to Be

RLUSD is Ripple Labs’ dollar-backed stablecoin, designed to take care of a one-to-one peg with the US greenback. It operates natively on each the XRP Ledger and Ethereum, positioning itself as a regulated, multi-chain answer geared toward institutional funds and DeFi use circumstances.

Ripple entered the stablecoin market in late 2024, which suggests RLUSD continues to be comparatively younger in comparison with established gamers. However it has already grown shortly. In keeping with CoinGecko, RLUSD’s market capitalization has surpassed $1.5 billion since launch, signaling significant early adoption.

Competing in a Crowded Stablecoin Area

The stablecoin market is dominated by Tether’s USDT and Circle’s USDC, which collectively account for over $250 billion in market capitalization. That’s the benchmark RLUSD is up towards. Competing right here isn’t nearly tech. It’s about belief, liquidity depth, trade help, and regulatory readability.

By securing Binance integration, RLUSD features one of the essential distribution channels in crypto. Liquidity on a high trade typically determines whether or not a stablecoin turns into extensively used or stays area of interest. The truth that withdrawals can be enabled as soon as ample liquidity builds suggests Binance is taking a measured strategy reasonably than speeding the rollout.

Why This Issues for XRP Ledger

RLUSD working natively on XRPL additionally strengthens the XRP ecosystem narrative. A regulated stablecoin built-in into main exchanges provides the community a extra sensible monetary layer, particularly for funds, settlement, and DeFi-style functions constructed round greenback liquidity.

Stablecoins are the lifeblood of onchain finance. If RLUSD continues scaling, it might deepen XRPL liquidity and make it extra engaging for builders and establishments searching for regulated digital greenback infrastructure.

Conclusion

Binance integrating RLUSD is greater than an inventory replace. It’s a distribution milestone for Ripple’s stablecoin ambitions. With over $1.5 billion already in circulation and multi-chain performance throughout XRPL and Ethereum, RLUSD is positioning itself as a critical contender within the stablecoin area.

Whether or not it could actually chip away at USDT and USDC dominance will rely on liquidity development and institutional uptake. However entry by means of Binance is a transparent step towards making RLUSD greater than only a Ripple facet undertaking.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.