itcoin is vulnerable to deeper losses as threat urge for food fades and macro strain builds, in keeping with Normal Chartered’s head of digital property analysis Geoff Kendrick.

In a observe reported on by Bloomberg, Kendrick mentioned weaker U.S. financial momentum and decreased expectations for Federal Reserve price cuts have weighed on crypto markets. He added that falling digital-asset ETF holdings have eliminated a key supply of demand.

Kendrick warned bitcoin might drop to $50,000 and Ethereum might fall towards $1,400 earlier than stabilizing later within the 12 months. BTC trades close to $67,869 after reaching a 16-month low of $60,008 final week.

Normal Chartered reduce its year-end bitcoin forecast by a 3rd, reducing its 2026 goal to $100,000 from $150,000. The financial institution cited deteriorating macro situations and the danger of additional investor capitulation.

Bitcoin has already suffered a serious correction, falling as a lot as 50% from its October 2025 document excessive at its worst shut on Feb. 5. Normal Chartered estimates solely half of BTC provide stays in revenue, a pointy decline although much less extreme than in prior bear cycles.

The financial institution pointed to an unsupportive interest-rate backdrop as a key headwind.

Markets have pushed again expectations for Fed easing, with traders now searching for the primary reduce later within the 12 months. Kendrick mentioned uncertainty round future Fed management has added to warning.

ETF flows additionally stay a priority. Normal Chartered estimated bitcoin ETF holdings have dropped by nearly 100,000 BTC from their October 2025 peak. With a median buy value close to $90,000, many ETF traders now maintain unrealized losses, elevating the prospect of extra promoting strain.

Regardless of the near-term downgrade, the financial institution maintained a constructive longer-term outlook. Kendrick famous that on-chain utilization information continues to enhance and the present downturn has not triggered main platform failures, in contrast to the 2022 cycle that noticed collapses comparable to Terra/Luna and FTX.

Normal Chartered continues downgrading Bitcoin

Again in December of final 12 months, Normal Chartered halved its forecasts, seeing Bitcoin at $100,000 by end-2025 and $150,000 by end-2026, whereas holding a $500,000 goal pushed out to 2030. Bitcoin didn’t hit $100,000 by the top of 2025.

The financial institution cited fading company treasury demand and slowing ETF flows on the time. Geoffrey Kendrick mentioned company accumulation has “run its course,” leaving ETF inflows as the principle driver.

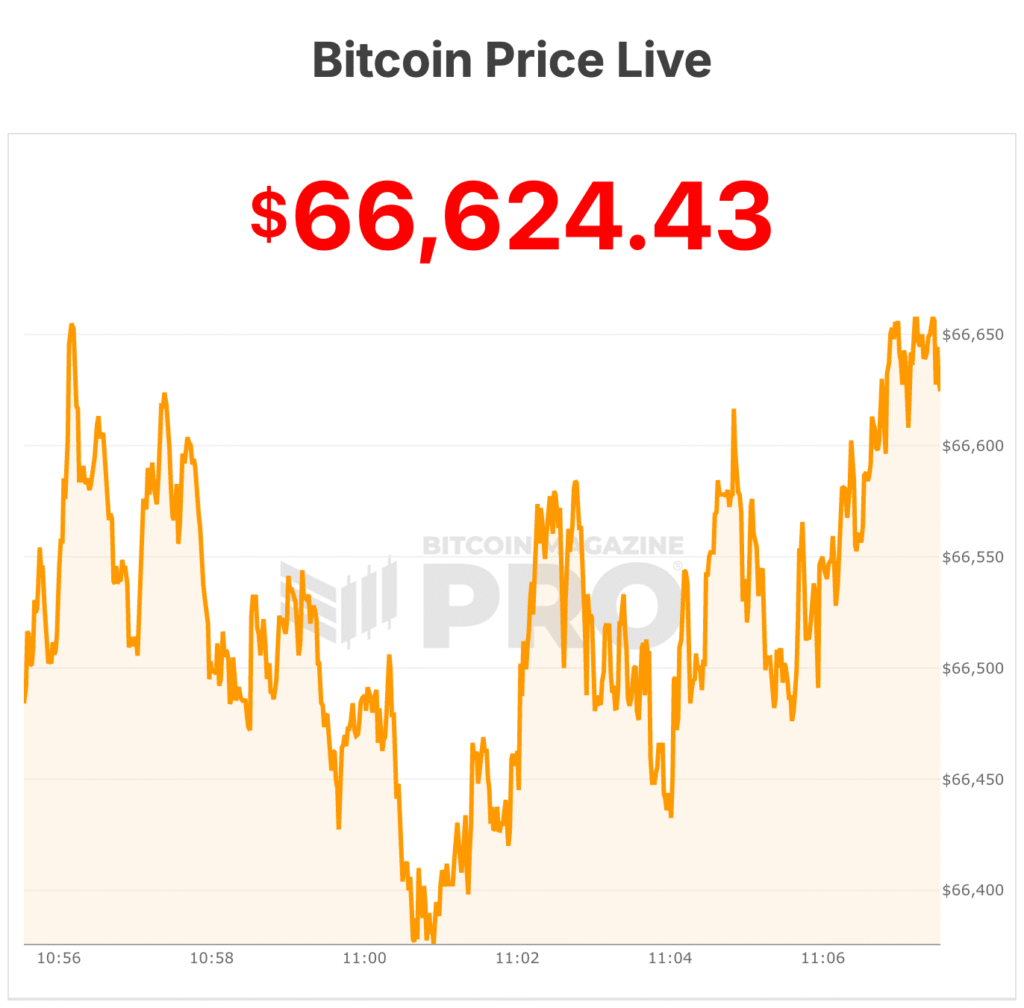

Bitcoin is at present buying and selling close to $67,000, per Bitcoin Journal Professional information.