- VeChain (VET) rose 7.2% in 24 hours regardless of broader market weak point

- Enterprise transaction progress and digital passport updates boosted sentiment

- Macro stress and Bitcoin’s softness may restrict upside momentum

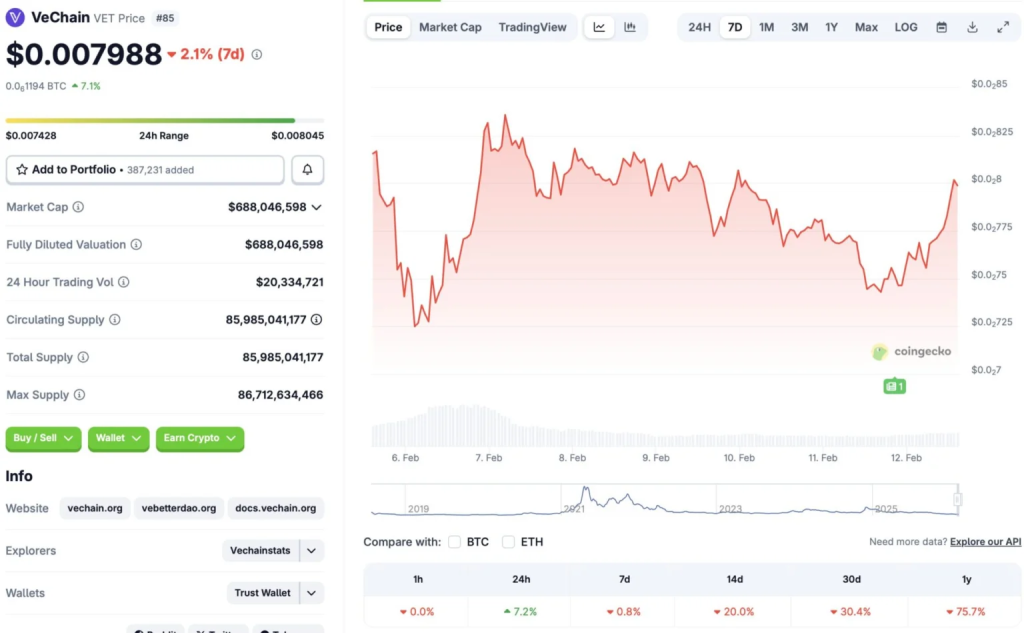

VeChain (VET) is presently one of many better-performing belongings within the prime 100 cryptocurrencies, posting a 7.2% acquire within the final 24 hours, in response to CoinGecko. On the floor, that form of transfer stands out, particularly in a market that has been largely risk-off. However zoom out and the broader image seems to be much less spectacular.

VET stays down roughly 20% over the previous 14 days, greater than 30% within the final month, and over 75% since February 2025. So whereas the each day candle seems to be robust, the upper time frames are nonetheless deeply unfavourable. That context issues when discussing whether or not it is a reversal or only a reduction bounce.

Enterprise Exercise Is Driving the Narrative

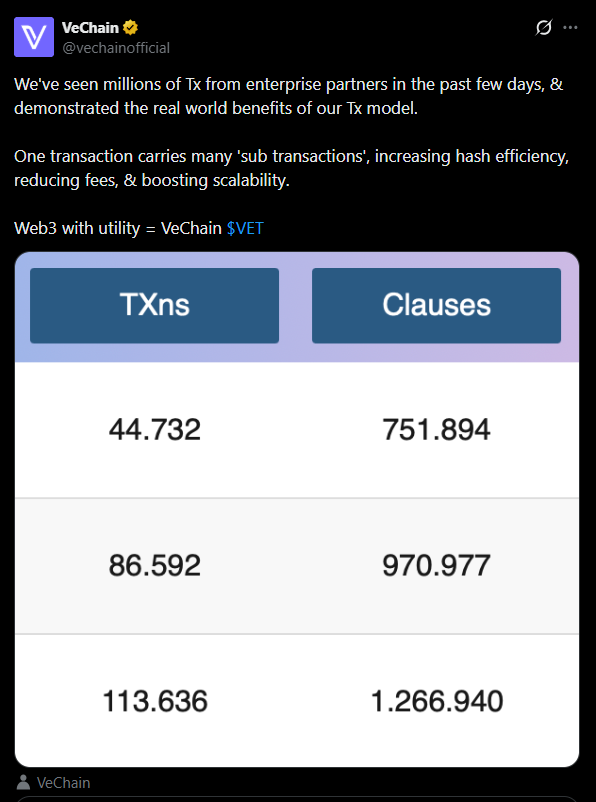

One of many doubtless catalysts behind VeChain’s rally is renewed deal with its enterprise transaction mannequin. An official replace highlighted that the community processed thousands and thousands of transactions from enterprise companions in current days. VeChain’s construction permits one major transaction to incorporate a number of sub-transactions, which improves hash effectivity whereas preserving charges low.

That’s the kind of real-world utilization narrative VET holders have leaned on for years. Scalability, enterprise partnerships, and measurable community exercise differentiate VeChain from purely speculative tokens. When that information resurfaces throughout market weak point, it may possibly reignite curiosity, a minimum of briefly.

Digital Passport Momentum Provides Gas

One other driver seems to be VeChain’s development in digital passport infrastructure. The challenge is working alongside Rekord and the College of Sheffield’s Superior Manufacturing Analysis Centre (AMRC) to help industrial-grade digital product passport (DPP) programs. The European Union’s Ecodesign for Sustainable Merchandise Regulation (ESPR) is now in movement, and VeChain is positioning itself as a technical layer inside that framework.

For buyers, regulatory-aligned use circumstances have a tendency to hold extra weight than summary guarantees. If VeChain can anchor itself to compliance-driven provide chain monitoring and sustainability reporting, it positive factors relevance past crypto-native hype cycles. That shift in notion doubtless boosted short-term sentiment.

Macro Actuality Nonetheless Looms Giant

Regardless of these developments, the broader crypto market stays fragile. Bitcoin is hovering close to $67,000, and general sentiment continues to lean defensive. Traders have been rotating into gold, silver, and different conventional safe-haven belongings amid macroeconomic uncertainty.

In that form of surroundings, altcoin rallies usually battle to maintain momentum. Quick-term merchants might take earnings rapidly, particularly after a sudden spike. With out broader liquidity returning to the market, remoted power in a single asset can fade simply as quick because it appeared.

Conclusion

VeChain’s 7% each day rally displays renewed consideration on enterprise transactions and digital passport adoption. These fundamentals strengthen the long-term case for VET. Nevertheless, given the bigger bearish surroundings and Bitcoin’s continued weak point, this transfer might signify a short-term bounce relatively than a confirmed pattern reversal.

For a sustained restoration, VET will doubtless want each continued real-world traction and a extra supportive macro backdrop. Till then, volatility stays the default setting.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.