- Bitcoin’s MVRV ratio has dropped to 1.2, approaching the undervalued zone

- Traditionally, MVRV beneath 1 indicators the typical holder is underwater

- A backside is feasible, however macro stress may nonetheless push BTC decrease

In keeping with CryptoQuant knowledge, Bitcoin is nearing what many analysts think about undervalued territory. BTC’s MVRV (Market Worth to Realized Worth) ratio is at present sitting round 1.2. In easy phrases, MVRV compares Bitcoin’s present market worth to the typical worth at which cash final moved onchain. When it drops beneath 1, it sometimes means the typical holder is holding at a loss, and traditionally that has lined up with deep bear-market zones.

We aren’t there but, however we’re shut sufficient that the market is beginning to ask the plain query once more: is that this the underside, or simply one other cease on the best way down?

Worth Motion Nonetheless Seems to be Fragile

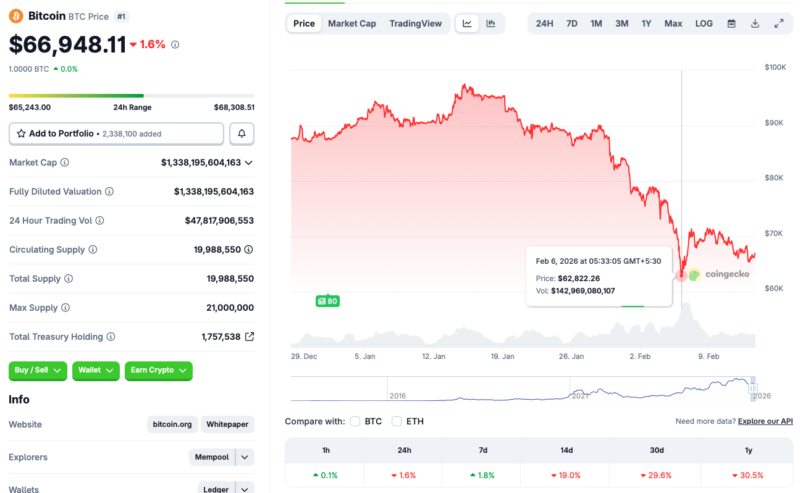

Bitcoin just lately dipped to the $62,000 stage earlier this month earlier than bouncing again and reclaiming $71,000. However that restoration didn’t maintain. BTC confronted a rejection and slipped once more, displaying the market continues to be struggling to regain momentum. In keeping with CoinGecko, Bitcoin is down roughly 19% during the last 14 days and practically 30% over the previous month, although it has managed a small acquire during the last week.

That’s the messy half about bottoms. They hardly ever really feel clear. They really feel like exhaustion blended with uncertainty, and proper now that’s precisely what the chart appears to be like like.

Undervaluation Doesn’t Imply “Up Solely”

Quite a lot of merchants misunderstand MVRV. It’s not a magic purchase sign, it’s extra like a temperature test. When MVRV approaches 1, it suggests capitulation could also be nearer than it was earlier than. But it surely doesn’t assure the market reverses instantly. Bitcoin can sit in undervalued zones for some time, particularly if macro circumstances keep hostile.

And macro continues to be the elephant within the room. Liquidity is tight, danger urge for food is weak, and even conventional markets have been shaky. If broader markets slip once more, BTC can completely overshoot to the draw back, even when onchain metrics look “low cost.”

The Bear Case Nonetheless Exists

Some forecasts stay brazenly bearish. There are rising requires Bitcoin to revisit the $50,000 vary, and Stifel has floated a good harsher situation, suggesting BTC may fall as little as $38,000. Which will sound excessive, however the market has already proven it’s keen to punish danger property quick when liquidity disappears.

The important thing level is that this: approaching undervaluation shouldn’t be the identical factor as being immune to a different flush.

The Bull Case: A Backside Might Be Forming

On the opposite aspect, CoinCodex analysts nonetheless anticipate Bitcoin to rally from right here. Their mannequin initiatives BTC reaching $88,047 by Might 11, 2026, which might characterize roughly a 31% upside transfer from present ranges. That sort of rebound would match the basic sample the place Bitcoin bottoms when sentiment is ugly, positioning is washed out, and most buyers cease believing in upside.

That’s why MVRV is getting consideration proper now. It’s not about calling an ideal backside, it’s about recognizing when risk-reward begins shifting.

Conclusion

Bitcoin nearing undervalued MVRV ranges is an actual sign, nevertheless it’s not a assure that the market has already bottomed. It suggests the selloff is getting mature, and that the typical holder is nearer to ache ranges that traditionally result in long-term accumulation. Nonetheless, macro uncertainty and liquidity stress can push BTC decrease earlier than any actual restoration begins.

In different phrases, a backside could also be forming, however the market nonetheless hasn’t confirmed it but.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.