Veteran dealer Peter Brandt, who beforehand tipped that Bitcoin might fall as little as $60,000 in 2026, says the market possible hasn’t bottomed but.

“Actual backside won’t happen till October 2026,” Brandt tells Journal.

In December, Brandt advised Cointelegraph that, with Bitcoin buying and selling close to $88,000, he was concentrating on a third-quarter 2026 backside round $60,000. Simply over a month into 2026, on Feb. 6, Bitcoin slid to roughly $62,700. Now, Brandt says the market might flush even decrease this 12 months.

“It’s really spooky to me that Bitcoin has been really easy to forecast,” he says.

“The cyclic and parabolic habits of Bitcoin absolutely can not proceed to be so predictable. I simply assume there should be a shock to the repeating nature of value discovery,” he provides.

Brandt says within the close to time period, the value might chop “upwards,” however Bitcoin can also fall into the excessive $50,000s.

Crypto analyst Anup Dhungana lately warned in an X submit that it’ll take “a very long time” for Bitcoin to get well to its all-time excessive of $126,000, which it reached in October 2025.

Ether might chop round $2,000 for a short while: Arthur Hayes

BitMEX co-founder Arthur Hayes is bracing for extra sideways chop in Ether over the close to time period.

“ETH, similar to Bitcoin, will chop round these ranges till USD liquidity will increase,” Hayes tells Journal.

Ether is buying and selling at $1,941 as of publication, down 41.65% over the previous 30 days, in line with CoinMarketCap.

Nevertheless, the founding father of MN Buying and selling Capital, Michaël van de Poppe, believes Ether presents a robust shopping for alternative.

Van de Poppe stated in a current X submit, “I don’t know a greater alternative to be Ethereum.” He pointed to stablecoin transactions rising 200% over the previous 18 months.

“Worth follows narrative,” he stated, pointing to the same occasion unfolding in 2019.

Ether has attracted noticeably fewer daring value predictions from crypto analysts on social media currently.

Clearly, that hasn’t stopped the everyday bulls from worshipping the asset. BitMine chair Tom Lee doubled down in an X submit on Thursday, calling Ethereum “the way forward for finance.”

Crypto market members are “fiercely bearish,” says Santiment

Crypto market members usually are not feeling nice concerning the market’s prospects as the brand new 12 months kicks off, in line with crypto sentiment platform Santiment.

“Crowd sentiment is fiercely bearish,” Santiment stated in a current report.

Santiment, utilizing its social media monitoring information on bullish and bearish feedback from a variety of vetted crypto accounts, stated the ratio of bullish to bearish feedback has “collapsed.”

Learn additionally

Options

Assault of the zkEVMs! Crypto’s 10x second

Options

Soulbound Tokens: Social credit score system or spark for world adoption?

“Traditionally, markets are inclined to backside and bounce precisely when the group turns into satisfied costs will fall additional, just like the mid-November crash,” Santiment stated.

Whereas it might seem like everybody available in the market is freaking out, Santiment, historical past, says it might be extra of a constructive signal.

“Excessive negativity is usually a bullish sign,” Santiment says. “When the group is satisfied costs will go decrease, it’s usually the time to start out on the lookout for lengthy entries,” Santiment provides.

In that case, we’re set for a large bull market, as sentiment is dire.

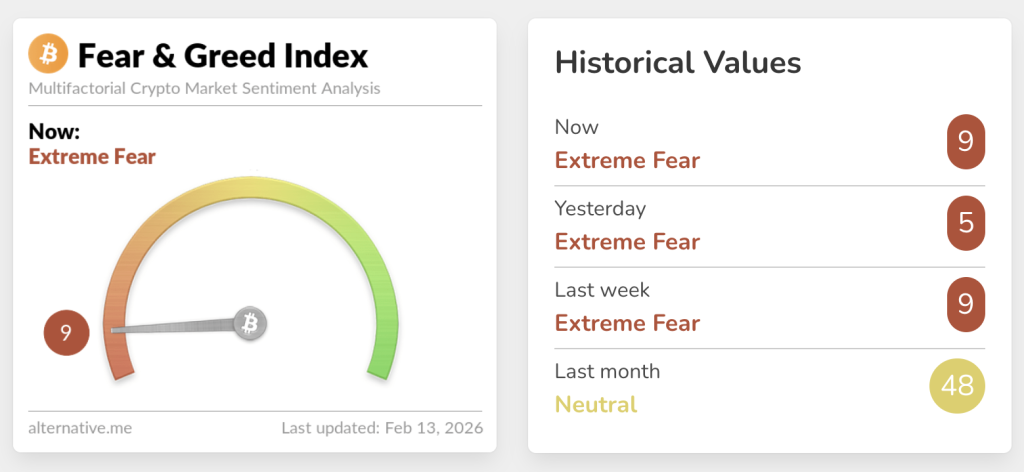

The Crypto Worry & Greed Index, which measures total crypto market sentiment, has spent many of the 12 months caught in “concern” and “excessive concern” territory.

On Friday, it printed an “excessive concern” studying of 9, signalling that market members stay extremely cautious about deploying capital into crypto.

In the meantime, CoinMarketCap’s Altcoin Season Index is flashing a “Bitcoin Season” studying of 28 out of 100. The indicator flips between “Altcoin Season” and “Bitcoin Season” relying on how the highest 100 altcoins have carried out in opposition to Bitcoin over the previous 90 days.

What are the prediction markets saying?

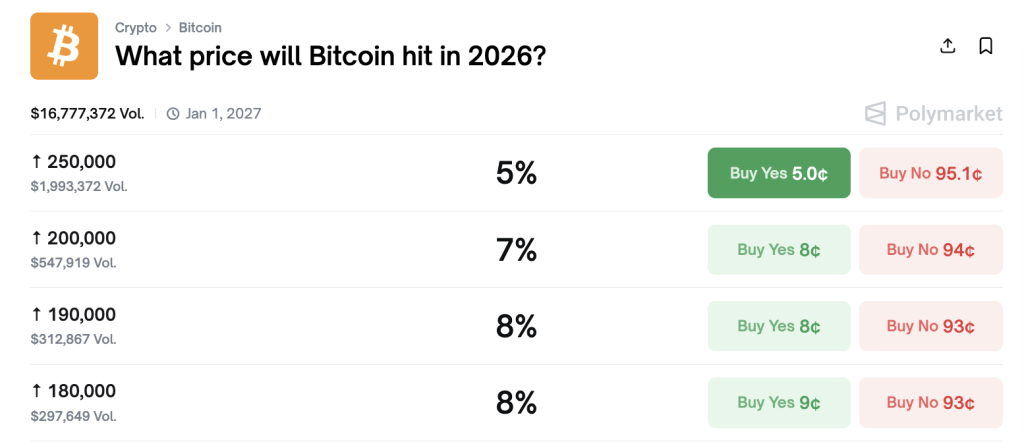

Prediction market members are majority bearish within the quick time period, with small hopes that the market will see robust upward development by the tip of this 12 months.

Learn additionally

Options

Older traders are risking every little thing for a crypto-funded retirement

Options

The rise of Mert Mumtaz: ‘I in all probability FUD Solana essentially the most out of anyone’

The percentages of Bitcoin ending February beneath $60,000 are at 41% on Polymarket, however the second-highest odds are that Bitcoin will reclaim $75,000 by the tip of February at 29%. So, there’s nonetheless hope amongst a big minority.

Long term, Bitcoin has a 23% likelihood of reclaiming the $120,000 stage in 2026, with only a 10% likelihood of the asset reaching above $150,000.

Pundits predict the most effective month for Bitcoin shall be December, with 21% odds, and that the worst month has already handed in January. This goes in opposition to Bitcoin’s historic common efficiency over its best-performing months since 2013, with September the worst-performing month and November the best-performing month, in line with CoinGlass.

In the meantime, prediction merchants are assigning a 23% likelihood of ETH falling to $1,600, and even larger odds at 76% that it’ll fall to $1,500 in some unspecified time in the future in 2026. Ether’s lowest print of the 12 months up to now was $1,821 on Feb. 6.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is a Cointelegraph employees author masking cryptocurrency markets and conducting interviews inside the digital asset trade. He has a background in mainstream media and has beforehand labored in Australian broadcast journalism, together with roles in nationwide radio and tv. Previous to becoming a member of Cointelegraph, Lyons was concerned in media initiatives throughout information, documentary, and leisure codecs. He holds Solana, Ski Masks Canine, and AI Rig Advanced above Cointelegraph’s disclosure threshold of $1,000.