Markets are in a fragile spot, and Cardano worth at the moment displays a drained however nonetheless dominant bearish construction urgent in opposition to a key assist stage.

loading=”lazy” />

loading=”lazy” />Cardano worth at the moment: the place ADA stands

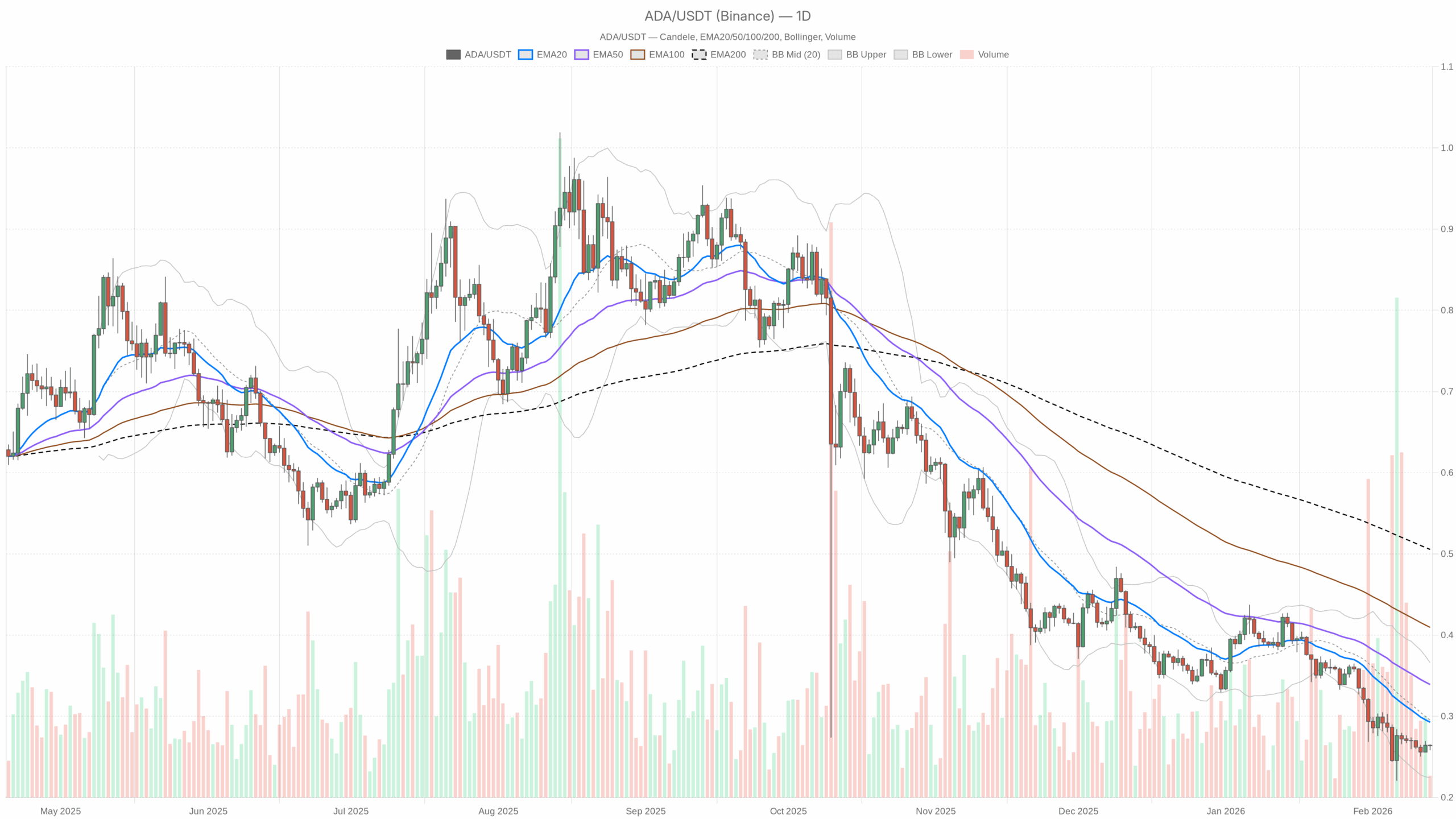

Cardano (ADA) is buying and selling round $0.26 in opposition to USDT at the moment. On the each day chart, ADA is clearly in a broad downtrend, buying and selling effectively under all key shifting averages. Nonetheless, within the quick time period, the market is making an attempt to stabilize round this $0.26 space, with intraday timeframes displaying a pause, not a reversal, in promoting strain.

This second issues as a result of it appears to be like like a traditional late-stage downtrend: sentiment throughout crypto is in Excessive Concern (concern & greed index at 9), complete market cap is slipping (-1.3% in 24h), and BTC dominance is excessive round 56.6%. Danger urge for food is low, and ADA, as a excessive beta alt, is feeling it. The important thing query right here is whether or not $0.26 holds as a base for a bounce, or whether or not the broader bearish regime merely grinds it decrease.

On stability, the fundamental situation from the each day timeframe is bearish. Decrease costs stay the trail of least resistance until patrons can reclaim key ranges above $0.29–0.30.

Day by day timeframe (D1): macro bias continues to be bearish

Development & shifting averages (EMA20 / EMA50 / EMA200)

– Worth: $0.26

– EMA 20: $0.29

– EMA 50: $0.34

– EMA 200: $0.51

ADA is buying and selling under the 20, 50 and 200-day EMAs, with a large hole to the 200-day at $0.51. That may be a textbook bearish construction, with shorter EMAs stacked below longer ones and worth pinned on the backside.

In plain phrases: the development is down, and any rally towards $0.29–0.34 is, for now, extra possible a bounce inside a downtrend than the beginning of a brand new bull leg.

RSI (14-day): 34.9

RSI is sitting just below 35, under the midpoint however not deeply oversold.

That tells you bears are in management, however the market just isn’t totally washed out but. There’s room for one more leg decrease earlier than you get the type of capitulation-style studying that always precedes an even bigger bounce.

MACD

– MACD line: -0.03

– Sign line: -0.03

– Histogram: 0

MACD is flat and overlapping the sign line across the similar damaging worth, with basically no histogram.

That is what development exhaustion appears to be like like: momentum continues to be on the bearish facet, however the push decrease is dropping power. It’s extra of a sluggish bleed than an aggressive selloff proper now.

Bollinger Bands (20-day)

– Center band: $0.30

– Higher band: $0.37

– Decrease band: $0.22

– Worth: $0.26 (under the center, above the decrease band)

ADA is buying and selling within the decrease half of the band vary, however not hugging the decrease band.

That matches the image of a managed downtrend fairly than panic promoting. Sellers are dominant, however they don’t seem to be dumping at any worth. Strain is constant, not climactic.

ATR (14-day): $0.02

Common each day vary is round two cents at this worth stage.

Volatility is modest. We aren’t in a high-volatility capitulation section. As an alternative, worth is sliding in a comparatively orderly trend. That makes sudden multi-day development adjustments much less possible with out a clear catalyst.

Day by day pivot ranges

– Pivot level (PP): $0.26

– Resistance 1 (R1): $0.27

– Assist 1 (S1): $0.26 (very tight cluster round present worth)

With worth sitting proper on the each day pivot, the market is balanced intraday round this stage.

Consider $0.26 as the present battlefield. A sustained break above pushes the very short-term tone barely constructive. A break and maintain under would verify sellers successful this native struggle.

Total, the each day chart says the dominant development is down, momentum is weak however not reversing, and $0.26 is a fragile assist space inside a bigger bearish regime.

Hourly timeframe (H1): stabilization, not a development change

Development & shifting averages (H1)

– Worth: $0.26

– EMA 20: $0.26

– EMA 50: $0.26

– EMA 200: $0.27

– Regime: impartial

On the hourly chart, worth, EMA20 and EMA50 are all glued round $0.26, with EMA200 simply above at $0.27.

This can be a traditional consolidation after a transfer down. Sellers are now not in full management intraday, however bulls haven’t seized the initiative both. It’s a pause contained in the bigger downtrend.

RSI (H1): 54.3

RSI is barely above 50.

Intraday, the strain is marginally skewed towards patrons, however there isn’t a robust momentum. It’s extra of a dead-cat or range-trading atmosphere than a transparent development reversal.

MACD (H1)

– MACD line: 0

– Sign line: 0

– Histogram: 0

MACD is totally flat on the hourly chart.

The market is in wait-and-see mode. Neither facet is committing actual dimension right here, which inserts with low conviction and low volatility.

Bollinger Bands (H1)

– Center band: $0.26

– Higher band: $0.27

– Decrease band: $0.26

Bands have tightened considerably.

Band compression like this typically precedes a volatility enlargement. In different phrases, the subsequent transfer is more likely to be sharper than the current chop, however course continues to be up for grabs.

ATR (H1): ~0

ATR on the hourly is successfully at zero within the information, reflecting extraordinarily tight current ranges.

Worth is coiling. When hourly ATR begins to tick up from these ranges, that’s normally your trace {that a} directional transfer is underway.

15-minute timeframe (M15): short-term bullish bias, however just for execution

Development & shifting averages (M15)

– Worth: $0.26

– EMA 20 / 50 / 200: throughout $0.26

– Regime: bullish

The 15-minute regime is flagged as bullish, however in actuality all EMAs are clustered, much like the hourly chart.

Microstructure is a little more supportive of patrons. You possible have a slight upward tilt inside a decent vary, however that is noise relative to the bearish each day image. It issues primarily for timing entries and exits, not for outlining the primary bias.

RSI (M15): 57.2

RSI leans to the upside however is way from prolonged.

Brief-term scalpers are getting higher entries on the lengthy facet for now, however this may flip rapidly if $0.26 provides method.

MACD (M15): flat

MACD line, sign and histogram are all principally zero.

There isn’t any robust intraday follow-through in both course. This can be a holding sample.

Bollinger Bands & ATR (M15)

– Bands tight round $0.26–0.27

– ATR close to zero

The very short-term tape is extraordinarily compressed, which creates good circumstances for sudden cease runs in both course when liquidity thins.

Bullish and bearish situations for ADA from right here

Dominant bias: Bearish (from the each day chart)

The each day downtrend and positioning under all main EMAs maintain the higher-timeframe bias bearish, regardless of the short-term consolidation.

Bullish situation for Cardano

For bulls, the sport is about turning this consolidation right into a base.

- Maintain $0.26 assist on the each day shut.

- Push again towards $0.29 (EMA20 / Bollinger mid) and reclaim it decisively.

- See RSI elevate again above 40–45 on the each day and MACD begin to curl larger from damaging territory.

If patrons handle that, the subsequent upside magnets are:

- First, the $0.29–0.30 zone, which is imply reversion to short-term truthful worth.

- Subsequent, a possible extension towards $0.34 (EMA50) if broader market danger urge for food improves and crypto strikes out of Excessive Concern.

What invalidates the bullish case?

A clear break and each day shut under $0.26, particularly if RSI rolls again towards 30 and ATR begins to broaden, would weaken the bull thesis considerably. That will verify that this was not a base, only a pause earlier than the subsequent leg decrease.

Bearish situation for Cardano

The bearish situation aligns with the present regime.

- $0.26 fails as assist with a decisive transfer decrease.

- Day by day RSI drifts towards or under 30, and volatility (ATR) kicks up from present subdued ranges.

- Hourly construction breaks down, with worth rejected from the $0.26 pivot and unable to commerce again above it.

Beneath that path, worth can rotate towards the decrease Bollinger band space round $0.22 on the each day as the subsequent logical draw back zone. This might nonetheless match inside the broader Cardano worth at the moment bearish atmosphere until larger timeframes flip.

What invalidates the bearish case?

If ADA cannot solely bounce from $0.26 but additionally maintain above $0.29–0.30 on each day closes, pulling EMA20 flatter and lifting RSI away from the 30s, the argument for a persistent downtrend weakens. A robust reclaim of $0.34 (EMA50) would straight problem the bearish construction.

Positioning, danger, and the way to consider ADA right here

This can be a traditional level within the cycle the place longer-term development and short-term construction disagree. The each day chart says the development is down, however intraday charts present compression and delicate bullish tilt. That rigidity typically resolves in a pointy transfer as soon as volatility returns.

Key takeaways for merchants evaluating ADA at the moment:

- Development vs. bounce: Any upside from right here, no less than initially, needs to be handled as a counter-trend transfer till ADA can reclaim $0.29–0.34 and maintain it. The each day EMAs are nonetheless overhead and appearing as dynamic resistance.

- Volatility danger: Very low ATR on intraday timeframes means breakouts might be abrupt after they come. Tight consolidation on the finish of a downtrend can ship both a reduction rally or an acceleration decrease.

- Macro backdrop: Excessive Concern and rising BTC dominance sign a risk-off crypto atmosphere. In these circumstances, altcoins like ADA are inclined to underperform until there’s a robust idiosyncratic catalyst.

Briefly, Cardano is buying and selling in a market that’s bored with promoting however not but keen to purchase aggressively. The broader construction continues to be bearish, and till the each day chart proves in any other case, rallies are responsible till confirmed harmless. Managing place dimension, respecting the $0.26 pivot, and being ready for a volatility enlargement in both course are extra vital right here than making an attempt to name the precise backside.