- Coinbase’s This fall loss displays falling volumes, not a damaged enterprise

- Buying and selling charges nonetheless dominate income, proving crypto continues to be speculation-led

- The outcomes expose how fragile “utility income” stays in downturns

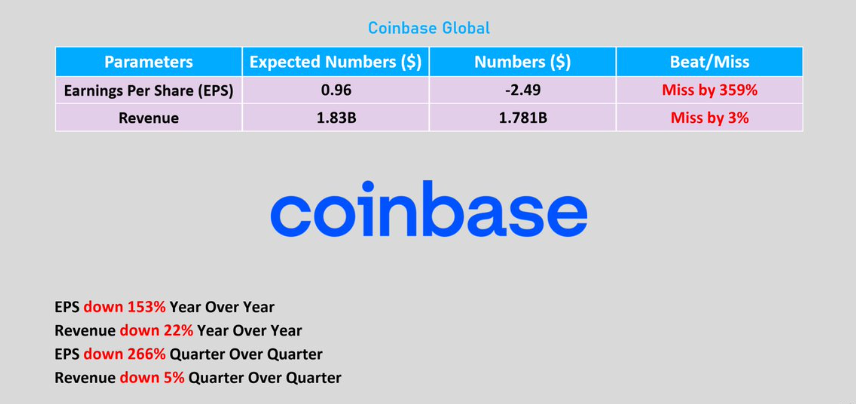

Coinbase posting a $667 million loss in This fall sounds just like the type of quantity that makes individuals yell “crypto is lifeless” into the void. However the actuality is method much less dramatic. This wasn’t a shock implosion, and it wasn’t Coinbase all of a sudden shedding operational competence. It was the fundamental math of a threat market cooling off: decrease volatility, decrease retail participation, and thinner buying and selling volumes hitting an change that also makes most of its cash when individuals are actively speculating.

Coinbase didn’t break. The market stopped feeding it.

Buying and selling Charges Nonetheless Run Coinbase’s Actuality

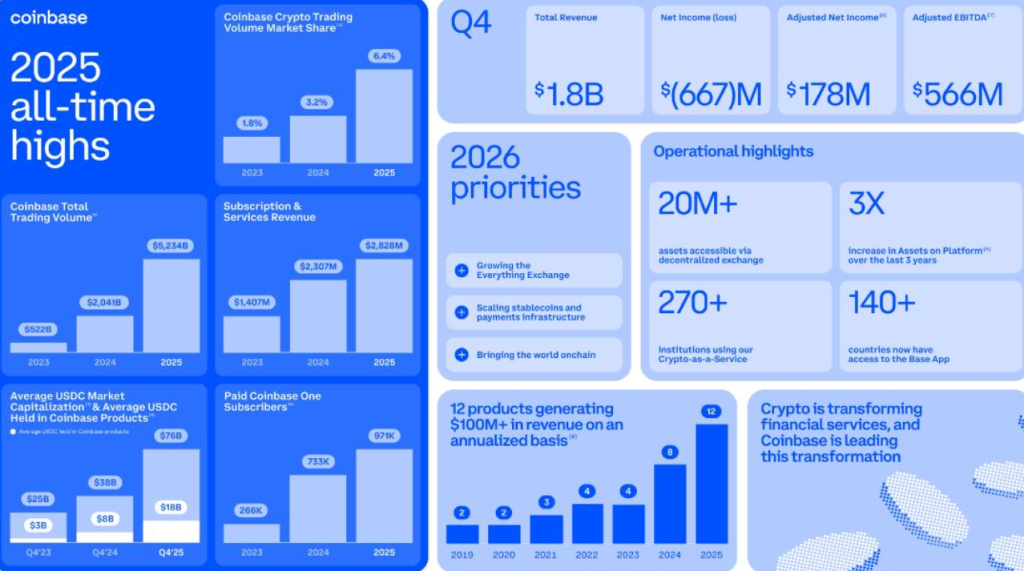

For years, Coinbase has tried to broaden the story. Subscriptions, custody, staking, institutional merchandise, Base, even prediction markets — the pitch has been “we’re changing into a diversified crypto infrastructure firm.” And sure, these income traces exist. However when This fall hits and volumes drop, the reality exhibits up quick: transaction exercise nonetheless dominates the enterprise mannequin.

That dependency is the true difficulty, not the loss itself. It exhibits crypto’s largest “infrastructure” companies are nonetheless tied to the identical factor as meme tokens: momentum. When the on line casino will get quiet, the home earns much less, easy as that.

Value Self-discipline Helps, However It Doesn’t Repair Cyclicality

Coinbase has lower employees, tightened bills, and leaned arduous into being probably the most regulation-friendly U.S. change. That positioning issues long-term, particularly if the U.S. continues pushing clearer market construction guidelines. However even probably the most compliant change on the planet nonetheless wants merchants to commerce.

Value self-discipline is survival. It’s not immunity. And This fall proves that the earnings curve nonetheless swings violently with sentiment.

The Market’s Misinterpret Is the Greater Story

Some individuals will use this earnings miss as proof that crypto is structurally failing. That’s lazy evaluation. That is what immature monetary markets seem like. They print cash throughout frothy phases, then look damaged throughout the hangover. Conventional brokerages and early fintech platforms went by related cycles when their markets have been nonetheless retail-heavy and narrative-driven.

Coinbase’s outcomes don’t present the tip of crypto. They present crypto nonetheless hasn’t totally grown right into a steady financial engine.

Conclusion

Coinbase’s This fall loss isn’t a warning siren. It’s a mirror. It displays a market the place hypothesis nonetheless drives nearly all of financial exercise, and the place “utility” income is just not but robust sufficient to stabilize the largest gamers. Till crypto generates regular demand past buying and selling and hype cycles, exchanges like Coinbase will preserve using these earnings waves, whether or not they wish to or not.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.