The most recent market downtrend has not been type to Ripple’s XRP, whose worth slipped by almost 25% over the previous two weeks.

Nevertheless, some key components recommend the bulls might quickly regain management.

Rally on the Method?

Final week, Ripple’s cross-border token fell to nearly $1.10, its lowest level since November 2024. Within the following days, it recovered from the sharp decline and at the moment trades at roughly $1.40, nonetheless effectively under the degrees seen in earlier months.

Sure parts, together with the XRP change reserves, recommend {that a} additional revival could possibly be on the horizon. In keeping with CryptoQuant’s knowledge, the quantity of cash saved on Binance just lately fell to roughly 2.55 billion, the bottom mark because the starting of 2024. As of this writing, the reserves on that specific platform stand at round 2.57 billion XRP, or fairly near the native backside.

This development signifies that traders have been shifting from centralized buying and selling venues to self-custody strategies, which in flip reduces instant promoting strain.

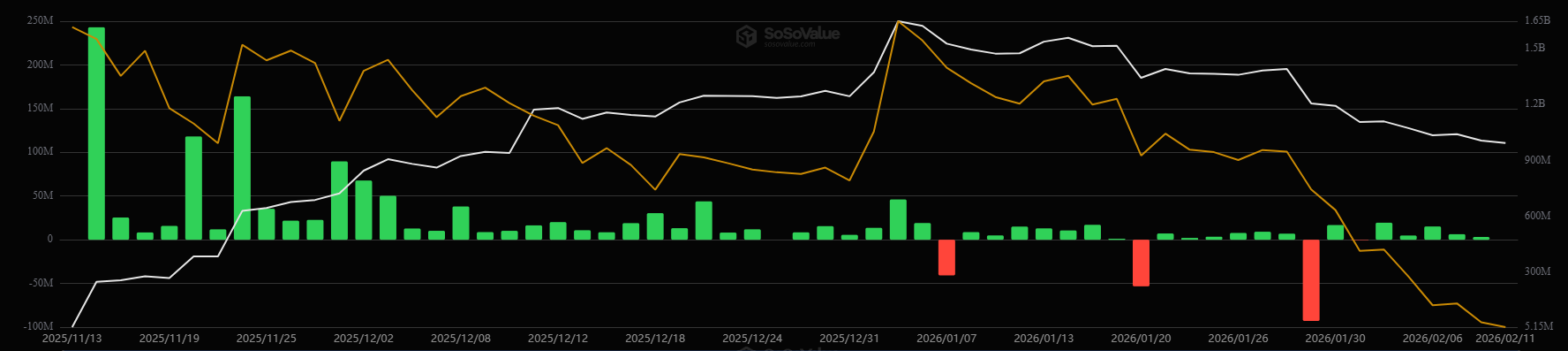

The spot XRP ETFs are the following bullish issue on the checklist. Recall that the primary such product within the USA, which has 100% publicity to the asset, noticed the sunshine of day in November 2025. It was launched by Canary Capital, whereas shortly after, Bitwise, Franklin Templeton, 21Shares, and Grayscale did the identical.

The funding automobiles have seen strong demand, with whole cumulative web inflows surpassing $1.23 billion. The final adverse each day netflow occurred on January 29, which means institutional investor urge for food stays excessive.

Some technical setups additionally trace that XRP may make a decisive transfer to the upside quickly. X consumer Niels noticed the formation of an “inverse head and shoulder sample” on the token’s worth chart. The configuration consists of three bottoms, with the center being the bottom, and a “neckline” that connects the highs between the dips.

Analysts imagine a breakout above the “neckline” may gasoline a considerable pump. Niels, as an illustration, claimed {that a} leap above the $1.44 stage is perhaps that spark.

One thing for the Bears

It is very important be aware that the surroundings of the broader crypto market stays predominantly bearish, so a renewed downtrend for a lot of main digital belongings (together with XRP) within the close to future will not be out of the query.

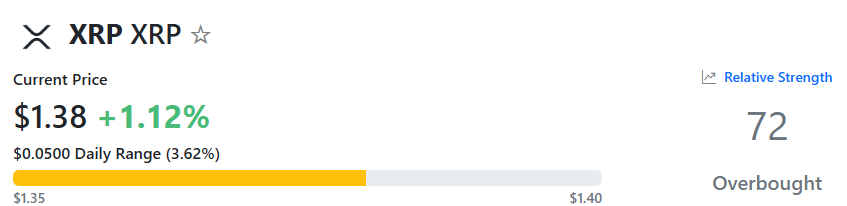

XRP’s Relative Energy Index (RSI) additionally means that the bulls might should take one other blow quickly. The technical evaluation software measures the velocity and magnitude of current worth adjustments and is commonly utilized by merchants to determine potential reversal factors.

It ranges from 0 to 100, and readings above 70 sign that the asset is overbought and due for a pullback. In distinction, something under 30 is taken into account a shopping for alternative. Information exhibits that XRP’s RSI at the moment stands at round 72.

The submit Is XRP Able to Blast Off? 3 Indicators the Ripple Bulls Are Again appeared first on CryptoPotato.