ETF outflows and macro headwinds push Customary Chartered to decrease Bitcoin and Ether targets.

Monetary agency Customary Chartered has as soon as once more lowered its Bitcoin forecast after the weak market outing pressured traders into warning. Notably, this revised stance is pushed by elevated market swings, ETF outflows, and weaker danger urge for food.

And because of this, analysts are betting on additional southbound travels earlier than a possible pattern flip. In response to Bloomberg, the most recent resh projections marks the second value revision in lower than three months.

ETF Withdrawals Mount as Customary Chartered Warns of Bitcoin Capitulation

In its newest prediction, Customary Chartered believes Bitcoin will shut the yr at $100,000. Prior to now, the agency had pointed to a $150,000 end-of-year shut for the OG crypto. In actual fact, value estimates for December stood as excessive as $300,000.

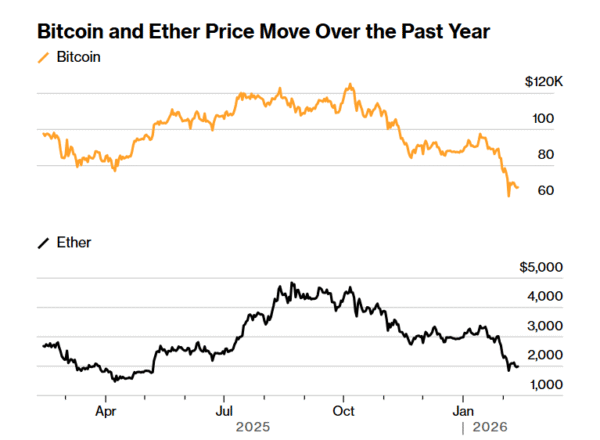

Bitcoin continued its weak pattern on Thursday after falling to commerce close to $67,939. The continuing swings have stored traders on edge.

Picture Supply: Bloomberg

Geoffrey Kendrick, world head of digital property analysis, warned of additional capitulation within the coming months. Kendrick talked about that strain may push Bitcoin towards $50,000 earlier than a rebound begins.

Holdings in US-listed spot Bitcoin ETFs have fallen by practically 100,000 tokens since their Oct. 10 peak. Traders have withdrawn nearly $8 billion over that interval, Bloomberg knowledge exhibits. Common ETF consumers entered close to $90,000 and now sit on losses.

In the meantime, US financial knowledge suggests slowing development, but markets count on no additional price cuts for now. As reported, Kevin Warsh is about to take over as Federal Reserve chair later this yr. Analysts consider that price expectations could restrict contemporary capital coming into crypto markets.

Ethereum at Threat of Additional Drop as Market Maturity Faces Take a look at

For Ethereum, Customary Chartered lower its end-of-year goal to $4,000 from $7,500. On the time of writing, Ether is exchanging palms beneath $2,000. Kendrick expects a drop towards $1,400 earlier than restoration later within the yr.

Bitcoin has fallen greater than 40% from its October peak close to $127,000. On the identical time, the broader crypto market worth has dropped by nearly $2 trillion, in keeping with CoinGecko. Efficiency now trails main fairness indexes such because the Nasdaq and S&P 500.

Regardless of sharp losses, Kendrick described the downturn as extra orderly than previous cycles. No main digital asset platforms have collapsed throughout the current sell-off. Market construction seems stronger than in earlier crashes. Maturity could restrict systemic dangers even when costs stay beneath strain.