ETF outflows take away key liquidity help, rising Bitcoin’s vulnerability to promoting stress.

Bitcoin opened the 12 months underneath clear stress as demand from funding merchandise weakened sharply. As per onchain experiences, capital that fueled a lot of the final two rallies is now retreating. And this drop, coupled with rising macro and geopolitical uncertainty, has triggered cautious sentiment.

Bitcoin Liquidity Contracts as ETF Momentum Reverses

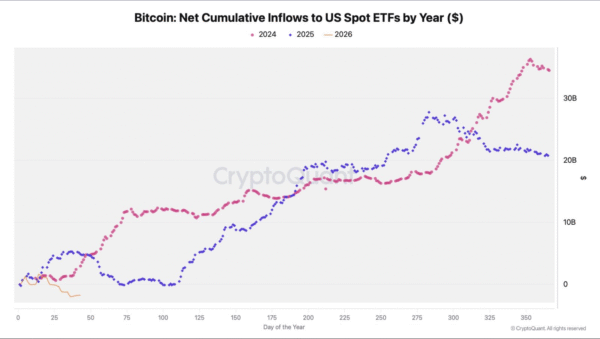

In line with an evaluation shared by Darkfost, cumulative spot Bitcoin ETF flows flipped to adverse inside weeks. In contrast with earlier years, BTC funding autos started 2026 with substantial funding losses.

The case was totally different in 2024 as cumulative inflows climbed all year long. Extra so, momentum accelerated within the last quarter, pushing BTC-tied funds to shut above $30 billion. Liquidity flowed into the sector as demand for these merchandise remained robust. Capital absorption helped help the OG coin’s worth.

Momentum carried into the primary half of final 12 months, throughout which cumulative inflows peaked close to the $27–28 billion vary. Much like the earlier 12 months, liquidity remained excessive, because the merchandise continued to soak up provide from the spot market.

Picture Supply: X/Darkfost

Nevertheless, these merchandise confirmed early indicators of fatigue in direction of the top of final 12 months. As per information, cumulative inflows dropped from a peak of $27 billion to close $20 billion by year-end. Movement information flattened earlier than trending decrease within the second half. Sadly, the noticed weak point in direction of the top of final 12 months now seems to be extending into 2026.

Present outflows take away a key marginal purchaser from the market. With out regular ETF demand, spot liquidity tightens. Value motion turns into extra delicate to promoting stress. Quick-term volatility tends to rise underneath such situations.

Liquidity Tightens as Crypto Funds Battle to Regain Demand

Buyers appear to be reassessing danger publicity, provided that world uncertainty has triggered a risk-off outlook. Sometimes, lowered urge for food for danger property is first noticed in crypto markets. In actual fact, stream information exhibits that many merchants are staying out of the marketplace for now.

The distinction between 2024–2025 and early 2026 stays stark. Prior years confirmed regular capital accumulation and increasing liquidity. The present 12 months exhibits contraction and capital withdrawal. Market construction seems to be extra fragile because of this.

Secure ETF flows might enhance sentiment. Rising cumulative inflows would sign that demand is returning. As well as, regular shopping for could assist soak up provide once more. Till that occurs, tight liquidity could proceed to exert downward stress on Bitcoin.

Darkfost’s evaluation frames the present weak point as a part of a broader slowdown reasonably than a sudden break. Final 12 months’s waning momentum has now been confirmed within the present market environment. For now, the urge for food for crypto-tied funding funds stays a key variable to look at.