- LINK is up 5% on the week after defending $7.52 and rebounding towards $8.39–$8.42.

- Chainlink reserves and income surged, suggesting fundamentals are strengthening beneath worth motion.

- Liquidity is clustered at $9–$9.3, which might pull LINK greater if momentum continues.

Chainlink is beginning to present indicators of life once more, and never simply the “random inexperienced candle” type both.

Over the previous week, LINK is up round 5% after holding assist close to $7.52. As a substitute of breaking down and sliding right into a deeper leg decrease, the token bounced again towards the $8.39–$8.42 space. That transfer doesn’t magically flip all the pattern bullish, but it surely does shift short-term momentum in a extra constructive route. Cautiously, at the very least.

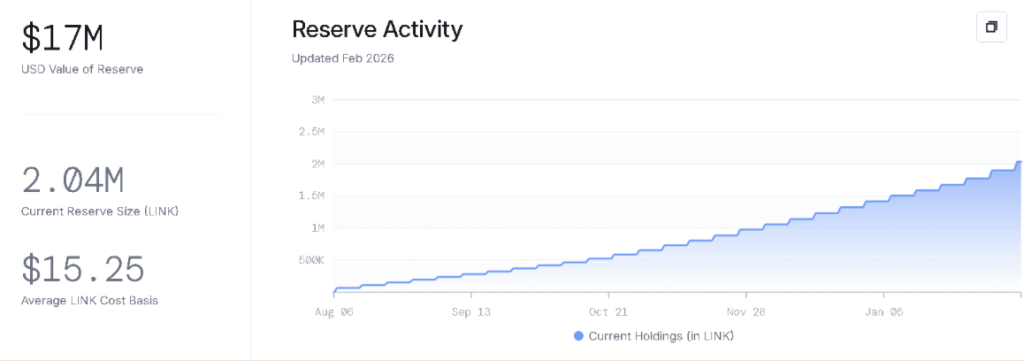

What’s extra fascinating is what’s occurring beneath the floor. Chainlink’s reserve reportedly climbed to round 2 million LINK, value roughly $17 million, and income jumped sevenfold. That’s not a small bump. It suggests one thing is accelerating operationally, even whereas worth motion nonetheless appears compressed.

LINK Fundamentals Are Quietly Bettering

This latest reserve and income development doesn’t appear like a beauty metric spike. It factors to precise protocol exercise selecting up.

Chainlink tends to maneuver in cycles the place fundamentals enhance first, then worth catches up later (generally painfully later). When reserves improve and income expands, it’s normally an indication that the ecosystem is doing extra enterprise behind the scenes, not much less.

That doesn’t assure a breakout. Nevertheless it does change the tone. It’s more durable to name LINK “useless cash” when the basics are actually heating up.

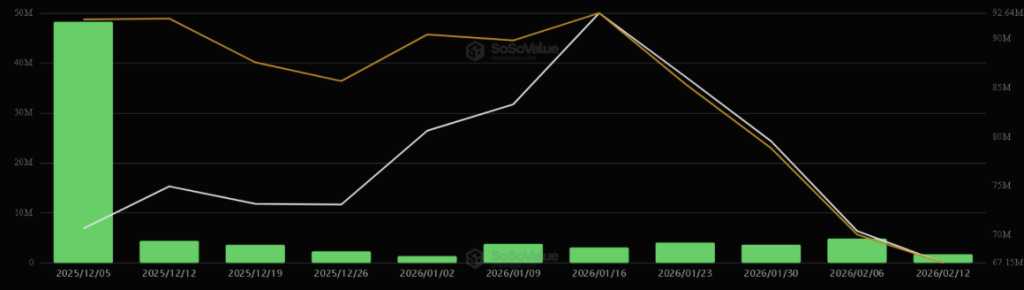

LINK ETFs Are Seeing Constant Institutional Inflows

One of many strongest information factors within the replace is the ETF circulate image.

LINK ETFs have reportedly recorded inflows each single week since launch. This week alone added round 1.71 million LINK, and there have been no recorded outflows thus far. That’s the sort of regular accumulation sample that tends to matter over time, even when the worth doesn’t react instantly.

It additionally reveals establishments aren’t buying and selling this like a meme coin. They’re not leaping out and in. They’re constructing publicity slowly, virtually boringly, which is normally probably the most bullish sort of shopping for.

In the meantime, retail participation nonetheless appears hesitant close to resistance. The worth is shifting, but it surely’s not euphoric. That disconnect usually occurs when “good cash” accumulates whereas the broader market remains to be cautious.

LINK Defended $7.52 and Rebounded Into Resistance

Technically, the $7.52 degree was an enormous deal.

LINK tapped the decrease boundary of a symmetrical triangle and held it. As a substitute of a breakdown, it rebounded onerous towards the $8.39–$8.42 vary. That sort of response suggests patrons stepped in with intent, not worry. It wasn’t a weak bounce. It was a “nope, not in the present day” bounce.

Much more notable: the RSI reportedly dropped under 32 for the primary time ever. That’s a fairly excessive studying, and it normally indicators exhaustion fairly than contemporary panic. In that zone, sellers usually begin operating out of gas, and dip patrons begin sniffing round.

Nonetheless, reclaiming greater ranges stays unfinished enterprise. LINK has bounced, sure, but it surely hasn’t confirmed it might maintain momentum. If follow-through doesn’t present up, the market might simply sweep liquidity once more and drag worth again down for an additional take a look at.

So the construction held, however conviction nonetheless wants affirmation.

Bullish Flag Forming as Momentum Builds

On the decrease timeframes, LINK has been forming what appears like a bullish flag, a sample that has additionally proven up throughout a number of main caps not too long ago.

Traditionally, flags can result in sharp upside expansions as soon as worth breaks out. That’s why merchants are watching this setup intently. It’s the sort of sample that may go from “quiet” to “violent” in a rush.

On the 4-hour chart, LINK is hovering across the breakout zone. The MACD histogram has flipped constructive, which helps the concept bullish momentum is strengthening. Bulls aren’t simply defending assist anymore. They’re beginning to push.

Not aggressively, however noticeably.

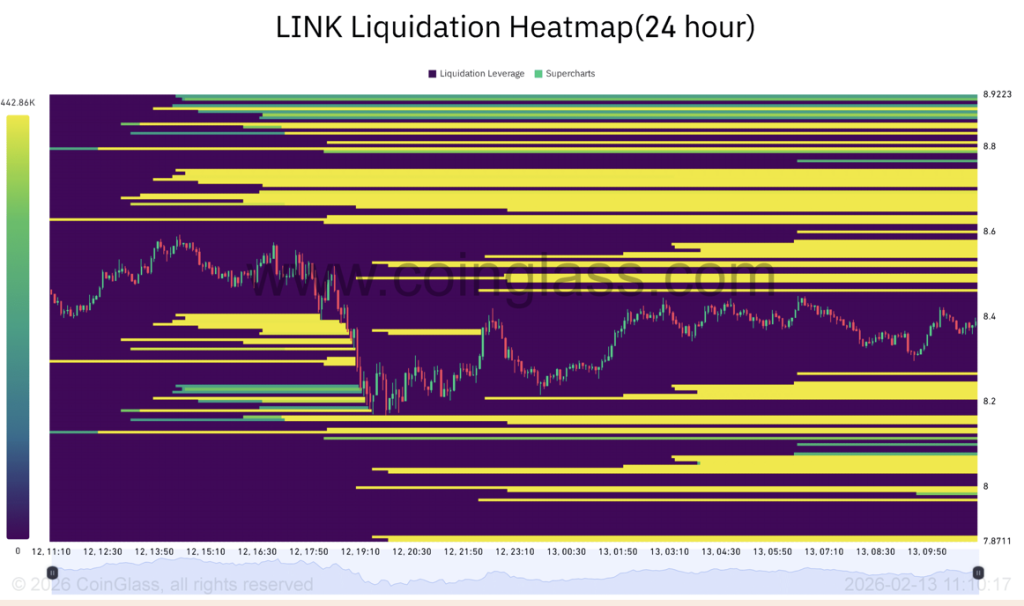

Liquidity at $9–$9.3 Might Act Like a Magnet

CoinGlass liquidity information reveals a heavy cluster sitting between $9 and $9.3. That zone is mainly a magnet. If LINK begins pushing upward with sufficient power, worth might speed up rapidly because it hunts that liquidity pocket.

On the identical time, there’s nonetheless liquidity sitting under, across the $7.8 to $8 space. So in typical market trend, worth is prone to hunt one facet first, onerous, earlier than making a extra directional transfer.

That’s the present setup. LINK is sitting in a choice zone, with robust basic tailwinds constructing beneath and a technical construction that’s beginning to tilt bullish.

The market simply hasn’t picked its route but. Nevertheless it’s getting shut.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.