ETF outflows and leverage flush sign de-risking, whereas liquidity stays key to development reversal.

Practically $910 billion has been wiped off the crypto market in simply 30 days, marking one of many steepest drops in years. And as anticipated, the heavy sell-offs have triggered a cautious sentiment amongst institutional and retail merchants. As volatility elevated, leveraged positions had been liquidated throughout main exchanges.

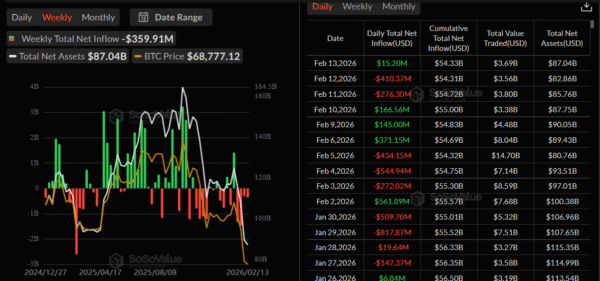

Institutional De-Risking Drives Bitcoin ETF Belongings All the way down to $87B

Bitcoin and Ethereum suffered in the course of the market drop. Curiously, smaller altcoins bore the heaviest brunt, with most tanking over 40%. Buyers rapidly exited positions as worry engulfed the market.

🔥 UPDATE: The final 30 days worn out $910B from the crypto market. pic.twitter.com/1yYLdeVyPc

— Cointelegraph (@Cointelegraph) February 14, 2026

Greater than $310 million in spinoff positions had been worn out inside 24 hours at peak volatility. Over 100,000 merchants noticed positions erased throughout that interval. Quick liquidations dominated the newest flush, following an earlier wave of long-side capitulation. Principally, brief positions had been pressured to shut as costs briefly bounced.

Picture Supply: CoinGlass

Macro elements corresponding to rising rates of interest and tighter financial coverage drove the latest market slide. In response to market volatility, traders have pushed capital towards safer property. Oftentimes, risk-heavy sectors corresponding to crypto are the primary to react to this liquidity shift.

Whale exercise and institutional promoting additionally intensified the downturn as soon as momentum turned unfavorable. Spot Bitcoin funding autos recorded heavy web outflows over the previous two weeks.

A number of single-day withdrawals exceeded $400 million and weekly web flows fell by almost $360 million. Complete web property dropped from about $115 billion to $87 billion. Information factors to systematic de-risking amongst giant capital allocators.

Picture Supply: SoSovalue

Revenue-taking additionally contributed to the drop, as many traders capitalized on months of early positive aspects. Cease-loss orders and buying and selling bots elevated promoting after costs fell beneath key help ranges.

Crypto Capital Rotation into BTC Fails to Sign Robust Recent Inflows

As per TradingView knowledge, Bitcoin dominance traded inside the 58%–59% vary in the course of the downturn. A quick break above 60% indicated capital rotation into BTC as a defensive transfer. Nevertheless, failure to maintain that stage signaled restricted contemporary inflows into the market. In the meantime, altcoins continued to underperform and take in many of the promoting stress.

Picture Supply: TradingView

Market indicators at present stay blended structurally. Institutional outflows verify threat discount. Conversely, a pointy decline in open curiosity and a latest brief squeeze point out that extra leverage has largely been flushed out. Traditionally, related deleveraging phases have preceded stabilization intervals.

Primarily, liquidity stays a major catalyst for a possible development flip. ETF web flows, funding charges, and macro indicators will form short-term momentum. Within the absence of renewed institutional inflows, upside potential might stay constrained.

Even so, blockchain growth and community exercise proceed throughout main ecosystems. Lengthy-term members view correction as a part of the broader market cycle relatively than a structural breakdown.