- DOGE is testing long-term help close to $0.10, a stage some name a historic backside channel.

- Brief-term charts recommend a potential bounce towards $0.104–$0.11 to comb brief liquidations.

- Broader bearish construction and weak demand imply any rally might stay non permanent.

Dogecoin is hovering at a stage that long-term merchants are inclined to stare at just a little too intently.

Proper across the $0.10 zone, some analysts are calling it a “historic backside channel.” In easy phrases, that space has acted as main help earlier than, and now DOGE is again there once more. Whether or not that really marks a long-term market backside remains to be up for debate, but it surely’s not a random stage — that a lot is evident.

The broader backdrop doesn’t assist. The memecoin sector has been bleeding for months, and general crypto sentiment nonetheless feels heavy. Some market watchers are even projecting a protracted bear section stretching into This autumn 2026, possibly longer. That form of outlook makes each bounce really feel suspicious.

Brief-Time period Bounce, Lengthy-Time period Uncertainty

Even when the final word backside isn’t in, a short-term bounce appears believable.

Markets not often transfer in straight traces. When liquidity builds up overhead — particularly clusters of brief positions — worth typically pushes up simply far sufficient to set off liquidations earlier than rolling again over. That’s the uncomfortable half about buying and selling in a downtrend.

On the 6-hour chart, DOGE is clearly in a bearish construction. A current bounce towards $0.10 shortly pale, dragging worth again to round $0.0885. That drop successfully retested the session shut from the February 6 crash, which is technically significant.

There’s an honest argument that Dogecoin might drift greater once more to comb liquidity above $0.10 earlier than persevering with decrease. However calling for a full restoration? That’s tougher to justify. The longer-term construction stays weak, and on-balance quantity (OBV) hasn’t proven convincing demand returning to the market.

Fibonacci retracement ranges from the newest H6 swing spotlight $0.0989 and $0.1040 as key resistance ranges. If a bounce unfolds, $0.1040 appears to be like just like the magnet.

The 1-Hour Chart Tells a Delicate Story

Zooming in, the 1-hour chart offers a bit extra nuance.

The inner construction hasn’t absolutely flipped bullish, which issues. Nonetheless, worth motion is beginning to stabilize. The $0.094 stage stays a short-term resistance, however momentum suggests it might be cleared quickly.

The hourly RSI has climbed again above the impartial 50 line, which alerts short-term power returning. Extra importantly, the protection of the $0.0885 help and the formation of a better low close to $0.091 over the previous 24 hours trace that patrons are a minimum of attempting.

Nonetheless, this appears to be like extra like a tactical bounce setup than the start of a significant development reversal.

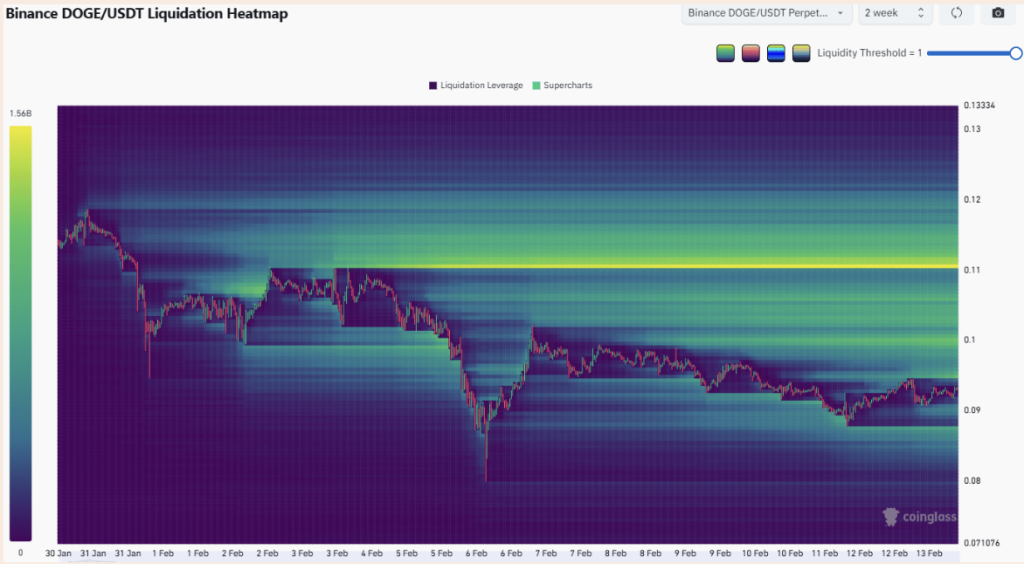

Liquidity Map Suggests a Brief Squeeze Setup

The liquidation heatmap provides one other layer.

Over the previous two months, there’s been a noticeable cluster of brief liquidations constructing above $0.10, notably close to $0.11 — the extent the place native highs fashioned in early February. Markets are drawn to liquidity like magnets. If sufficient shorts are stacked there, worth might spike upward to set off them.

That doesn’t imply it has to occur. However it’s a sensible state of affairs.

Proper now, although, the risk-reward profile isn’t particularly engaging in both path. Going lengthy earlier than affirmation carries draw back threat. Going brief earlier than the potential squeeze performs out might be painful.

And there’s the Bitcoin issue. If BTC breaks under $62K and accelerates downward, DOGE doubtless gained’t maintain $0.10 for lengthy. In that case, new lows change into way more possible, and the short-squeeze state of affairs fades shortly.

So sure, Dogecoin would possibly bounce. It would even pop above $0.10 briefly. However the broader development remains to be fragile, and till construction shifts meaningfully, any rally ought to in all probability be handled as tactical — not transformational.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.