- Injective’s $4B valuation collapsed to $300M as fundamentals didn’t assist the vertical rally.

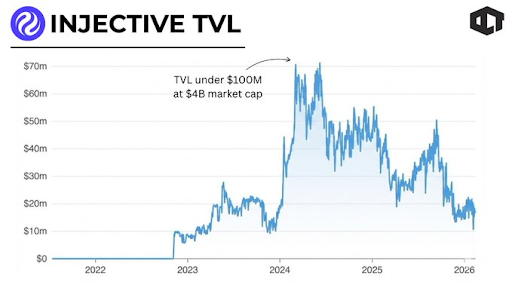

- TVL below $100M at $4B market cap uncovered a important hole that different DeFi chains exploited shortly.

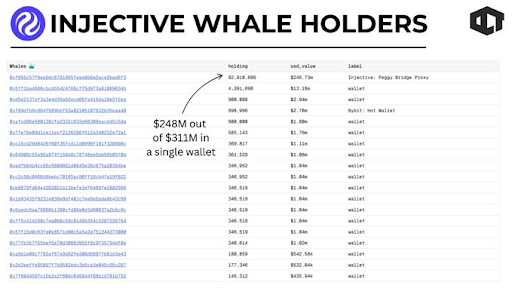

- Provide focus in infrastructure wallets diminished tradable float, amplifying volatility dangers.

Injective has misplaced 90% of its worth in a dramatic market correction. The token fell from a $4 billion market cap to roughly $300 million.

In response to Our Crypto Speak, the warning alerts have been seen all alongside. The collapse raises questions on what traders missed through the rally.

Valuation Outpaced Fundamentals

Injective’s market cap climbed near $4 billion in 2024.

The venture promoted on-chain derivatives and quick execution as key strengths. The rally appeared vertical on worth charts. However vertical strikes want stable fundamentals beneath them.

$INJ misplaced 90% of its worth

> A $4B market cap.

> Beneath $100M in TVL.

> Now sitting close to $300M.The warning indicators have been at all times there.

Let’s break them down 👇

1️⃣ THE VALUATION RAN TOO FAST

In 2024, Injective’s market cap pushed near $4 billion.

The narrative was sturdy.… pic.twitter.com/G9hJXiH7PE

— Our Crypto Speak (@ourcryptotalk) February 14, 2026

Our Crypto Speak identified that liquidity ultimately dried up. Danger urge for food cooled throughout crypto markets. Questions on utilization depth and capital retention surfaced.

The present $300 million valuation suggests the sooner price ticket mirrored future progress that by no means arrived.

Technical Construction Collapsed

The 2023 breakout zone served as a basis earlier than the rally. In late 2025, Injective tried to reclaim the $10 stage however failed.

Our Crypto Speak highlighted that this rejection mattered considerably. When a token can not maintain earlier breakout areas throughout market bounces, purchaser conviction is absent.

The development channel remained intact to the draw back. RSI indicators by no means regained significant energy. The shift wasn’t only a momentary dip.

Help ranges flipped to resistance. The trail of least resistance stayed decrease all through the decline.

TVL Hole Uncovered Weak point

At an almost $4 billion market cap, whole worth locked sat below $100 million. Our Crypto Speak emphasised that this hole was unimaginable to disregard.

DeFi operates in a brutally aggressive atmosphere. Different chains supplied cheaper charges and deeper liquidity swimming pools.

TVL measures how a lot capital trusts an ecosystem. When capital doesn’t stick round, costs can not maintain elevated ranges.

The market ultimately corrects these imbalances. That correction hit Injective laborious. The basics merely didn’t assist the valuation premium.

Provide Focus Created Vulnerability

One pockets holds roughly $248 million of the $311 million market cap. Our Crypto Speak recognized this pockets as a “Peggy Bridge Proxy.” This represents infrastructure fairly than a single whale. It probably includes protocol or bridge-controlled liquidity.

Even infrastructure wallets scale back the efficient circulating provide. When giant parts sit in structured wallets, the tradable float turns into thinner.

Skinny float creates larger volatility. It allows sooner drawdowns and makes recoveries more durable. The focus amplified Injective’s worth weak spot.

In response to CoinGecko information, Injective presently trades at $3.20. The 24-hour buying and selling quantity stands at $35.96 million. The token posted a 6.28% acquire within the final 24 hours. It’s up 1.25% over the previous seven days.

Our Crypto Speak outlined what a restoration would require. TVL wants significant progress. Derivatives quantity should broaden considerably. Broader participation past whales turns into important. The technical construction must reclaim misplaced ranges convincingly.

At $300 million, expectations sit a lot decrease than at $4 billion. The narrative premium has disappeared. Whether or not Injective can rebuild stays unsure. The market will demand proof of actual utilization and sustained capital inflows earlier than rewarding the token once more.