- SUI is consolidating between $0.90 and $0.95, with $0.87 as the important thing assist degree.

- RSI is close to oversold whereas MACD stays bearish, signaling sellers nonetheless management momentum.

- Open curiosity and derivatives quantity are declining, however funding has turned barely optimistic.

SUI remains to be below stress, and the chart isn’t pretending in any other case.

As of Friday, February 13, SUI is buying and selling round $0.9250, down roughly 1.09% over the previous 24 hours, based mostly on CoinMarketCap information. Quantity has cooled off too, dropping about 17.64% to $523.19 million. Market cap slipped by round 1.01% to $3.55 billion, which traces up with the final tone proper now: sellers are nonetheless controlling the tempo.

It’s not a collapse, however it’s additionally not energy. It’s that gradual bleed that makes merchants impatient.

SUI Consolidates Close to $0.90 Whereas the Development Stays Bearish

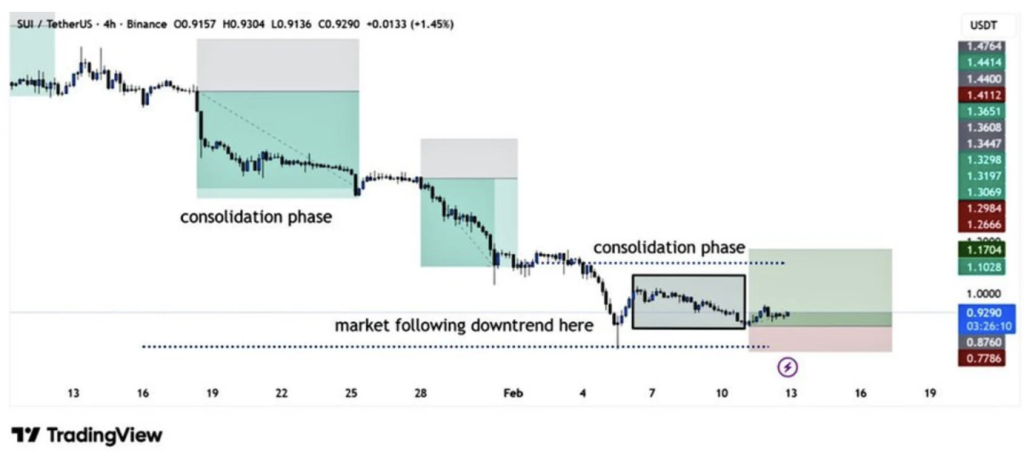

Crypto analyst BitGuru identified on X that SUI stays locked in a downtrend, transferring from one consolidation zone to the following… however at decrease ranges every time. That’s often what a weakening market seems like: worth pauses, breaks down, pauses once more, repeats.

Proper now, BitGuru highlighted the $0.90 to $0.95 vary because the lively zone, with $0.87 appearing as the important thing assist degree merchants are watching carefully. If SUI loses that $0.87 space cleanly, the construction may get uglier quick.

On the flip aspect, if SUI can maintain the vary and defend $0.87, BitGuru advised there’s an honest probability of a short-term push greater. Targets talked about embrace $1.10 and $1.17, which might mainly symbolize a reduction rally again into prior provide zones.

One other analyst, Transfer Insider, shared a extra aggressive upside projection, noting that if the construction stays intact longer-term, a transfer towards the $1.56 to $2.33 vary might be in play. That’s clearly a a lot greater leap, and it might probably require a broader market restoration, not simply SUI doing its personal factor.

For now, momentum is slowly constructing, however it’s nonetheless capped. Merchants are looking forward to volatility shifts as a result of proper now SUI is caught in “quiet bearish” mode.

RSI Is Close to Oversold, and MACD Nonetheless Favors Bears

The indications are giving combined indicators, however the bearish stress remains to be the loudest.

SUI’s Relative Power Index (RSI) is sitting round 29.80, which is correct close to oversold territory. The RSI common is round 26.59, exhibiting momentum remains to be weak and patrons haven’t actually taken management. Oversold circumstances can result in bounces, certain, however they will additionally keep oversold for longer than individuals count on. That’s the annoying half.

In the meantime, the MACD remains to be flashing bearish. The MACD worth is round -0.0046, with the MACD line at -0.1623 and the sign line at -0.1576. In plain English: sellers nonetheless have the benefit, and the pattern hasn’t flipped but.

So even when a bounce occurs, the technicals counsel it might nonetheless be corrective relatively than the beginning of a brand new uptrend.

Derivatives Exercise Drops, however Funding Turns Barely Constructive

CoinGlass information reveals derivatives quantity is falling too, down about 14.97% to $712.79 million. Open curiosity has declined by round 2.72%, now sitting close to $506.39 million.

That decline in OI is price noting. It usually indicators merchants are stepping again, closing positions, or just not keen to commit heavy leverage whereas worth motion stays unsure.

However right here’s the twist: OI-weighted funding is barely optimistic at 0.0040%. That implies sentiment amongst remaining derivatives merchants is leaning bullish, or not less than much less bearish than earlier than. It’s not an aggressive sign, however it hints that shorts aren’t completely dominating anymore.

Liquidations over the past 24 hours totaled round $710.83K, with $493.66K coming from longs and $217.17K from shorts. So sure, lengthy positions are nonetheless getting punished extra, which matches the general downtrend vibe.

Remaining Ideas: $0.87 Is the Line That Issues

SUI remains to be buying and selling below a downward construction, and the market is mainly ready for the following choice level. That call is $0.87.

If worth holds above it, SUI may stabilize and try a short-term restoration towards $1.10–$1.17. But when $0.87 breaks, the token dangers slipping right into a deeper leg down, particularly with quantity cooling and open curiosity fading.

Proper now, SUI isn’t “useless,” however it’s in a fragile zone. And in crypto, fragile zones don’t final lengthy — they both bounce exhausting, or they snap.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.