As capital flows sharply out of the crypto market in early 2026 and investor sentiment stays at excessive worry ranges, enterprise capital allocation selections have grow to be a invaluable sign. These strikes assist retail traders establish sectors that will nonetheless maintain potential throughout a bear market.

Latest stories point out that the crypto market setting has modified. The sectors attracting VC funding have shifted accordingly.

Sponsored

Sponsored

VCs Make investments Over $2 Billion in Crypto in Early 2026

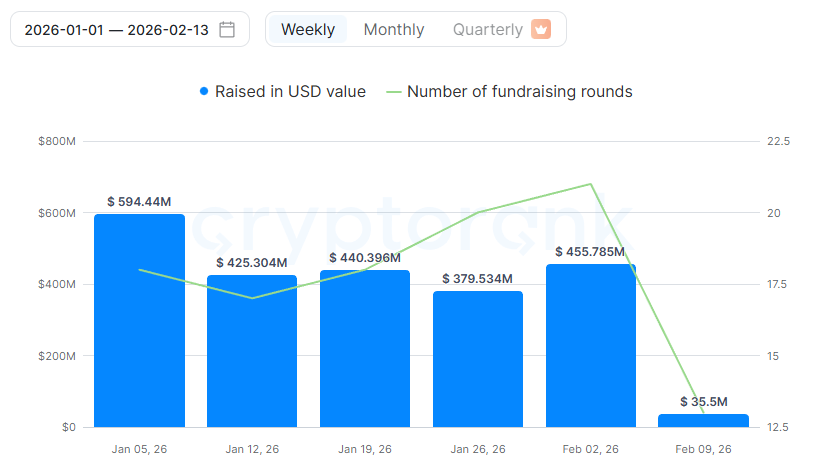

Information from CryptoRank exhibits that enterprise capital companies have invested greater than $2 billion into crypto initiatives for the reason that starting of the 12 months. On common, weekly inflows have exceeded $400 million.

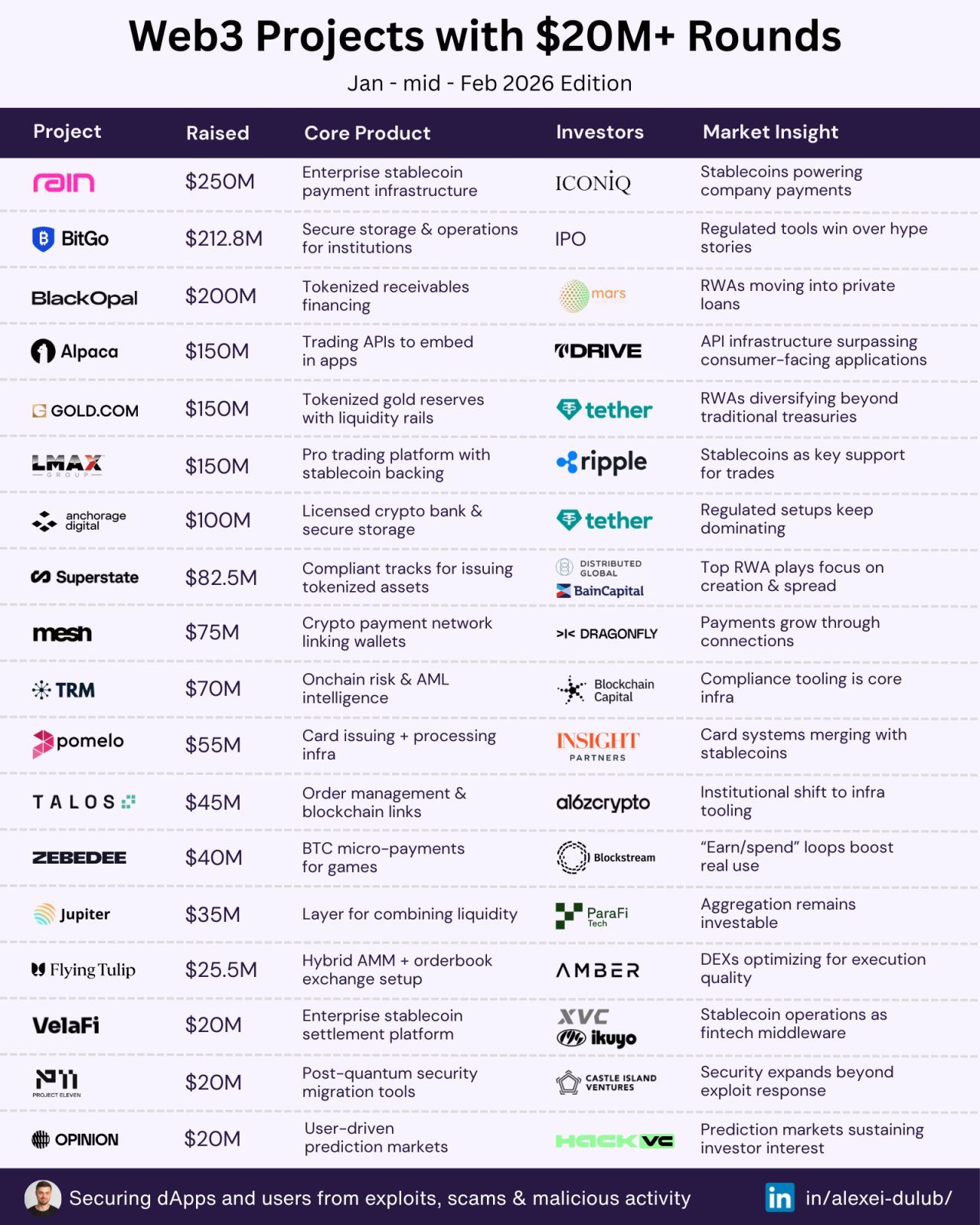

A number of giant offers stand out. Rain raised $250 million to construct enterprise-grade stablecoin cost infrastructure. BitGo secured $212.8 million by means of its IPO, reinforcing its function as a digital asset custodian and safety supplier for institutional shoppers.

BlackOpal additionally raised $200 million for its GemStone product, an investment-grade car backed by tokenized Brazilian bank card receivables.

Past these offers, Ripple invested $150 million in buying and selling platform LMAX. The transfer helps the combination of RLUSD as a core collateral asset inside institutional buying and selling infrastructure. Tether additionally made a $150 million strategic funding in Gold.com, increasing world entry to each tokenized and bodily gold.

Analyst Milk Highway notes that capital is now not flowing into Layer 1 blockchains, meme cash, or AI integrations. As an alternative, stablecoin infrastructure, custody options, and real-world asset (RWA) tokenization have emerged because the dominant funding themes.

Sponsored

Sponsored

Market information helps this shift. Because the begin of the 12 months, whole crypto market capitalization has fallen by roughly $1 trillion. In distinction, stablecoin market capitalization has remained above $300 billion. The overall worth of tokenized RWAs has reached an all-time excessive of over $24 billion.

What Does the Shift in VC Urge for food Sign?

Ryan Kim, founding accomplice at Hashed, argues that VC expectations have essentially modified. The shift displays a brand new funding commonplace throughout the business.

In 2021, traders targeted on tokenomics, neighborhood development, and narrative-driven initiatives. By 2026, VCs will prioritize actual income, regulatory benefits, and institutional shoppers.

“Discover what’s absent? No L1s. No DEXs. No ‘community-driven’ something. Each greenback went to infrastructure and compliance,” Ryan Kim acknowledged.

The most important offers listed above contain infrastructure builders slightly than token-driven initiatives designed to generate value hypothesis. Consequently, the market lacks the weather that beforehand fueled hype cycles and FOMO.

“Not on hypothesis. Not on hype cycles. They’re trying on the pipes, rails, and compliance layers,” analyst Milk Highway mentioned.

Nevertheless, analyst Lukas (Miya) presents a extra pessimistic view. He argues that crypto enterprise capital is in a state of collapse, citing a pointy, sustained decline in restricted accomplice commitments.

He factors to a number of warning indicators. Excessive-profile companies corresponding to Mechanism and Tangent have shifted away from crypto. Many companies are quietly unwinding their positions.

It might nonetheless be too early to declare the collapse of crypto VC, provided that greater than $2 billion has flowed into the sector for the reason that begin of the 12 months. At a minimal, these adjustments recommend that crypto is integrating extra deeply with the standard monetary system, a possible signal of long-term maturation.