- David Schwartz confirmed XRP can’t be clawed again as a result of it has no issuer.

- The Clawback function solely applies to issued tokens like stablecoins or wrapped property.

- XRP’s issuer-less design ensures censorship resistance, however eliminates reversal choices.

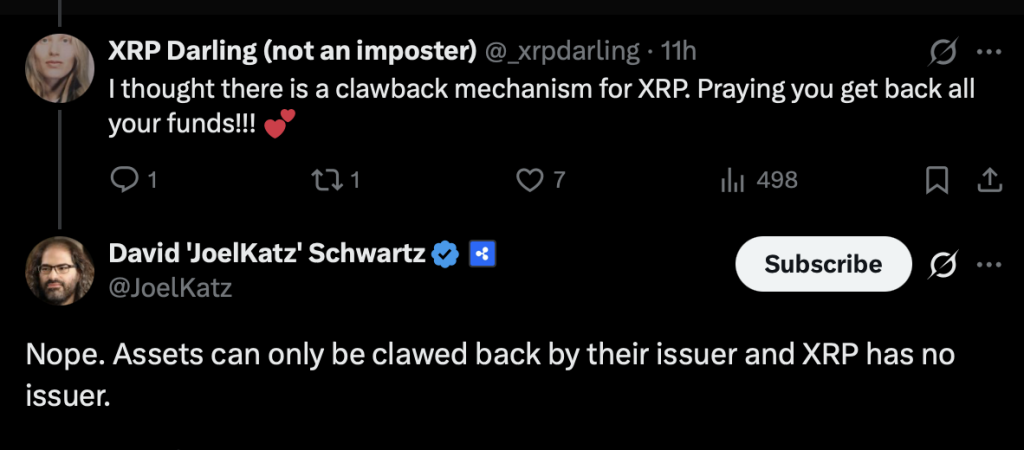

Ripple’s CTO Emeritus David Schwartz needed to step on this week to clear one thing up — and he didn’t sugarcoat it.

After a safety breach hit members of the GTF and Apex communities, some customers started asking whether or not stolen XRP could possibly be recovered utilizing the XRP Ledger’s “Clawback” function. Schwartz shut that down shortly. XRP, he reminded everybody, has no issuer. And with out an issuer, there’s merely no mechanism to reverse or forcibly retrieve native XRP transactions.

The Safety Breach That Sparked the Debate

The difficulty began when the X account for the World Commerce Finance (GTF) aggregator reported that its VC pockets had been compromised. In keeping with the publish, the assault concerned a “pretend NFT supply” and what was described as an “XRP Voucher Rip-off.” The breach reportedly impacted the challenge’s second-largest liquidity pool holder, which solely made the state of affairs extra alarming.

In a second of frustration, the account requested whether or not somebody might escalate the difficulty on to Schwartz, identified on-line as @JoelKatz. That’s when the dialog shifted. A neighborhood member steered that maybe the XRP Ledger’s controversial Clawback modification might supply an answer, expressing hope that the stolen funds would possibly in some way be retrieved.

It sounded cheap on the floor. However technically, it wasn’t.

Why the Clawback Function Doesn’t Apply to XRP

Schwartz responded clearly: “Nope. Belongings can solely be clawed again by their issuer, and XRP has no issuer.”

That distinction is crucial. Most tokens on the XRP Ledger — together with stablecoins like RLUSD, wrapped Bitcoin representations, and even meme tokens — are issued property. They’re created and distributed by a particular pockets deal with. To be able to maintain them, customers should set up what’s referred to as a trustline with that issuer.

If the issuer permits the Clawback setting (launched below modification XLS-39), they keep the technical means to retrieve these issued tokens from person wallets. This function is primarily designed for regulated property, like stablecoins, the place compliance could require freezing or reversing funds in circumstances of fraud or authorized orders.

However XRP doesn’t work like that. It was not issued by an account. There isn’t any issuer pockets holding a grasp key. There isn’t any centralized entity that may ship a clawback command.

XRP’s Construction Is What Makes It Completely different

XRP is the one asset on the XRP Ledger that isn’t tied to an issuing account. That structural design is intentional. It means XRP transactions, as soon as confirmed, can’t be reversed by any central authority.

Some see that as a power — censorship resistance, predictability, ultimate settlement. Others, particularly in conditions like this, see the draw back. If funds are stolen, there’s no backdoor. No administrative override. No “undo” button.

And that’s the tradeoff.

The current incident serves as a reminder of how crypto infrastructure really works beneath the floor. Options like Clawback exist, sure, however solely inside particular parameters. They apply to issued property, to not XRP itself. Schwartz’s clarification wasn’t controversial. It was technical.

Nonetheless, it highlights one thing the business continues to wrestle with: decentralization presents safety from management, however it additionally removes security nets. As soon as XRP strikes, it strikes.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.