For practically a century, the US greenback has dominated the worldwide monetary system. Purchase a few million barrels of oil, or a number of million tonnes of wheat, and there’s probability that the US buck will likely be a part of that commerce.

China desires that to vary.

Because the 2000s, China has been pursuing a sweeping marketing campaign to upend the established order and put its personal forex, the Chinese language yuan, on the heart of worldwide commerce, possible on the US greenback’s expense.

Chinese language President Xi Jinping hinted at this once more in a speech printed within the Qiushi journal (a Chinese language state publication) final month, saying the nation wanted to construct “a robust forex, which is extensively utilized in worldwide commerce and international alternate markets, and has the standing of a worldwide reserve forex.”

Ought to the Chinese language renminbi (the official title, that means “individuals’s forex”) upend the US greenback — and a few say it may occur round 2050 — it might mark the most important shift in world energy for the reason that Second World Warfare.

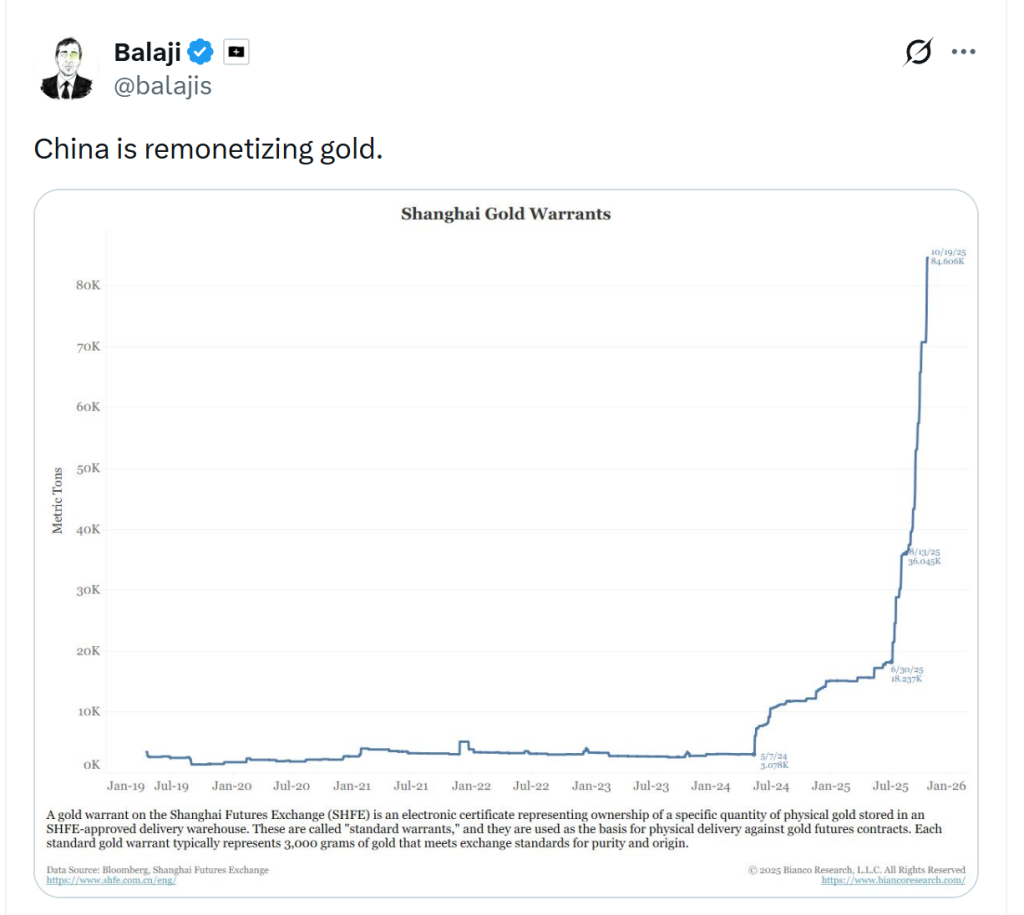

How wouldn’t it obtain this? Some analysts speculate China is secretly hoarding gold — excess of it’s disclosing — and can ultimately do an enormous reveal, creating a brand new world financial system backed by gold and represented by the Chinese language yuan.

Whereas there was hypothesis a few gold-backed BRICS forex, getting settlement and implementing a shared forex amongst greater than 10 nations is unlikely within the close to time period. A unilateral effort appears more likely.

“I feel it’s the most important story in world finance — China’s accumulation of gold — and no one is taking a look at it,” monetary author Dominic Frisby mentioned throughout an look on the Triggernometry podcast.

Frisby has written 4 books on the historical past of taxation and on gold and Bitcoin, and has been a contributor to MoneyWeek since 2006.

On the finish of 2025, Beijing claimed it had solely 2,306 tonnes of gold in its reserves, rating it sixth amongst nation-state holders of gold, behind Russia, France, Italy, Germany and the US.

However some estimate China already holds greater than double that quantity, based mostly on how a lot gold it mines and imports every year. Bloomberg reported in January that China has purchased extra gold each month for the previous 14 months, regardless of costs reaching document highs. It then purchased extra gold in January.

Jan Nieuwenhuijs, a gold analyst at Cash Metals Trade, estimates that China holds 5,411 tonnes, greater than double its reported determine.

He tells Journal that China has been shopping for quietly to keep away from driving up costs (though the current surge in gold costs means that effort has been in useless).

“Covert shopping for permits the PBoC to purchase extra gold at decrease costs — getting extra bang for his or her buck,” he says.

“What makes this technique efficient is its subtlety,” says Charles-Henry Monchau, chief funding officer of the Syz Group, a Swiss banking group, as China appears to shed the world’s reliance on the US greenback over time.

“Not like dumping Treasuries, which may set off market panic and backfire economically, shopping for gold is a quiet, cumulative tactic. It exerts downward strain on the greenback over time, particularly if different nations observe go well with.

“By reworking a few of its surplus {dollars} into gold, China reduces world demand for the buck whereas constructing a financial buffer that displays actual worth.”

Learn additionally

Options

Play2Earn: How Blockchain Can Energy a Paradigm Shift in Constructing Sport Economies

Options

You don’t must be indignant about NFTs

Frisby estimated that China possible has 3 times as a lot gold as it’s letting on (and will have as a lot as 10 instances), which might allow it to assault the USD when the time is true.

“But when they ever go into battle, you may be certain China will use cash as a weapon of conflict simply as America does.”

There’s a number of circumstantial proof for the speculation, however given the dearth of transparency in China, it stays exhausting to show conclusively.

“Cash phantasm” is all about gold

To grasp how China may undermine the USD with a gold-backed forex, one first wants to grasp how the US greenback turned the dominant world reserve forex during the last 82 years.

In direction of the tip of the Second World Warfare, 44 allied nations signed the 1944 Bretton Woods settlement, which pegged world currencies to the US greenback at fastened charges, with the greenback itself convertible at a set charge of $35 per ounce.

The US greenback was interchangeable with gold at Fort Knox, and thus “nearly as good as gold.” Nations would use the US greenback to symbolize gold in worldwide commerce, whereas the US would settle its worldwide obligations in gold below a steady, fastened exchange-rate system.

Nevertheless, the system got here crashing down a number of a long time later, because the US began printing extra {dollars} than the gold it needed to fund its conflict in Vietnam.

Dealing with a possible run on gold, former US President Richard Nixon ended the direct convertibility of the US greenback into gold, successfully ending the try at a “gold commonplace.”

Fortunately, the US was nonetheless the world’s largest financial system and possibly nonetheless had numerous gold in its vaults, leaving individuals with no alternative however to proceed placing their religion within the US greenback regardless of it now not being pegged on to gold.

“It’s known as cash phantasm,” mentioned Frisby. “Even when there’s nothing backing the cash. We’ve to assume there’s something backing the cash for it to work.”

The US claims to carry 8,133 tonnes of gold, greater than half of which is supposedly held in Fort Knox. Nevertheless, there hasn’t been a complete audit for many years.

Frisby argued that: “if on the similar time China comes alongside and says, you realize, we now have 5 instances as a lot gold as we mentioned we did. Then out of the blue, China has an actual, tangible backing to its cash simply as America has now.”

Frisby’s preliminary estimates instructed China may maintain as a lot as 16,000 tonnes of gold in its central financial institution — which might be double the US’s reserves — however later revised the estimate to round 7,000 tonnes.

So the large query is, how a lot gold does China actually have?

Analysts say China’s gold stash might be 2x official figures

Final yr, a Chinese language coverage specialist advised Reuters that China’s reported reserves have been far decrease than what can be anticipated for the world’s second-largest financial system.

China’s financial system, measured by gross home product (GDP), is estimated to succeed in 20.7 trillion in 2026, in accordance with the Worldwide Financial Fund. US GDP is anticipated to succeed in 31.8 trillion.

Utilizing the identical ratio, China’s gold reserves can be about 65% of the US’s 8,133 tonnes, placing them at about 5,300 tonnes of gold, double its reported quantity.

Analysts at Australia’s ANZ Financial institution have reportedly estimated an identical determine of 5,500 tonnes, putting it second amongst nation-states.

These estimates may probably be revised upwards when one realizes that China has been the world’s largest producer of gold since 2007.

Since 2013, China has produced round 4,811 tonnes of gold, including 380 tonnes in 2024 (equal to 10% of whole world manufacturing), with greater than half of its home gold mines state-owned, in accordance with Frisby’s weblog The Flying Frisby.

China can also be one of many world’s largest importers of gold, importing roughly 1,225 tonnes in 2024, with main sources together with Switzerland, Canada and Australia, with extra routed by Hong Kong.

On the similar time, since 2015, withdrawals from the Shanghai Gold Trade, which is the place non-official gold purchases move by, have averaged round 1,800 tonnes per yr.

Frisby estimates that the Chinese language authorities has 7,294 tonnes of gold.

His math is that the SGE has seen round 23,250 tonnes of gold since 2007; one other 2,500 tonnes exist as undisclosed gold bars in London; and one other 4,000 tonnes come from home mining and privately held jewelry, with about 23% of all this gold belonging to the central financial institution.

Learn additionally

Options

Story Protocol helps IP creators survive AI onslaught… and receives a commission in crypto

Options

Ordinals turned Bitcoin right into a worse model of Ethereum: Can we repair it?

Why China is hush about its gold reserves

Analysts consider China is deliberately preserving the lid on the true state of its gold reserves, as revealing it too early may hamper its technique.

Nieuwenhuijs believes the Chinese language central financial institution is ready till it may possibly comfortably shed its reliance on the US greenback earlier than revealing its true gold reserves — although he doesn’t see it as a lot of an assault on the US, slightly than a declaration of independence.

The most recent figures present China’s international alternate reserves are 3.4 trillion as of December 2025.

“One state of affairs is that the PBoC reveals its true gold reserves when China is just not depending on the greenback anymore — if the Chinese language really feel assured they’ll commerce in non-dollar currencies, and retailer surpluses in non-dollar currencies and gold.”

Jeff Currie, chief technique officer of power pathways at fund supervisor Carlyle, seems to agree, telling the Monetary Occasions that “China is shopping for gold as a part of a de-dollarization technique.”

One other state of affairs would possibly see China do an enormous reveal as a Hail Mary if belief within the renminbi declines, says Nieuwenhuijs.

“The PBoC’s gold reserves can assist the renminbi (present belief) and in the end again it ‘one on one’ [with] gold.”

Time to purchase Bitcoin, gold and silver?

Wealthy Dad, Poor Dad creator Robert Kiyosaki, Frisby and plenty of different market observers have urged their followers to purchase as a lot gold and Bitcoin as attainable (Kiyosaki now additionally recommends Ethereum attributable to inflated costs of the opposite two).

“For years, I’ve been urging everybody to build up gold and Bitcoin… They’re two confirmed non-government types of cash,” mentioned Frisby. “I can’t assist however assume they each have an important position to play sooner or later.”

Gold has seen document costs just lately, with many analysts linking them to the “debasement commerce” — the place traders pile into property they understand as hedging towards excessive authorities debt and geopolitical uncertainty.

Bitcoin has been having a more durable yr, buying and selling at $68,423 on the time of writing, down by one-third from a yr in the past, although it’s nonetheless up 16,500% from 2016.

“It’s why I like to recommend each gold and Bitcoin,” Frisby wrote.

“Each are cash in and of themselves: one is the product of nature, the opposite the product of extraordinary quantities of laptop energy. Neither depends on anybody else.”

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Felix Ng

Felix Ng is the APAC Editor and a author at Cointelegraphh. He first started writing in regards to the crypto and blockchain business in 2015 by the lens of a playing business journalist. Since 2022, he has served as Information Editor APAC and author at Cointelegraph. He’s additionally a options author for Cointelegraph Journal, with works together with Massive Questions, Journeys, and Insiders.