- Solana jumped 8.53% to $84.73, nevertheless it stays down roughly 31% in 2026 regardless of robust buying and selling quantity and market share.

- On-chain fundamentals look stronger than worth motion, with DeFi TVL hitting a brand new excessive and stablecoin inflows driving capital into the community.

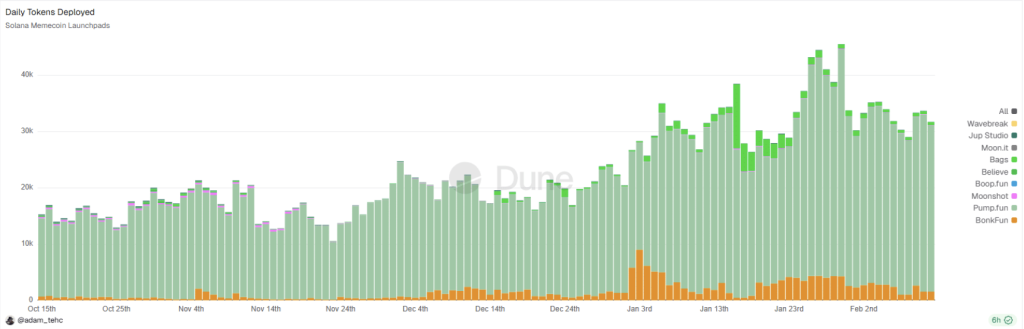

- Memecoin exercise surged with 30,000 each day launches and $100M each day quantity, boosting community utilization however complicating SOL’s valuation narrative.

Solana caught a robust bounce on February 14, climbing 8.53% to commerce round $84.73. Quantity got here in scorching too, with roughly $6.32 billion altering fingers in a single day, whereas SOL’s market cap sat close to $48.12 billion, or about 2.01% of the broader crypto market. On the floor, it regarded like a clear reduction rally… however the greater image nonetheless feels slightly messy.

SOL Value Is Bouncing, However 2026 Has Been Tough

Even with the most recent pump, Solana continues to be down round 31% because the begin of 2026. That’s a fairly ugly stat for a top-tier coin, particularly when a number of main names have held up higher this yr. So sure, SOL is shifting once more, nevertheless it’s shifting from a weaker start line than most individuals need to admit.

What makes this attention-grabbing is that the on-chain aspect isn’t matching the bearish worth story. Solana’s DeFi whole worth locked (TVL) has pushed right into a contemporary all-time excessive round $80 million, largely fueled by stablecoin inflows. In plain English: even whereas worth is sliding, extra capital is being parked contained in the community, and that normally doesn’t occur if confidence is completely useless.

Actual-world asset (RWA) initiatives on Solana additionally reached new highs, including one other layer to the “fundamentals are positive” narrative. Excessive liquidity plus rising TVL tends to imply traders are nonetheless deploying capital, not working for the exits. So the community is performing robust… whereas the chart is performing weak. That divergence is the place the story will get spicy.

Technical Patterns Trace at Accumulation, Not a Clear Reversal

Some analysts at the moment are leaning on historic fractals, principally evaluating Solana’s present cycle to its older boom-and-bust patterns. In Cycle 1 (2020–2021), SOL went completely nuclear, ripping from $1.07 to $260, a acquire of greater than 24,000%. Then it collapsed 97% to round $7.78, which was brutal but in addition very “crypto.”

Cycle 2 (2022–2025) was one other monster run, with SOL rallying about 3,700% from $7.78 to $295. And now, after topping out, the token is down roughly 77% from that peak, which places it in acquainted territory from a historic standpoint. It’s not fairly, nevertheless it’s not unprecedented both.

Crypto analyst CryptoPatel has steered that if the sample continues, SOL may drift down towards the 0.5–0.618 Fibonacci retracement ranges. That might place a possible accumulation zone someplace between $30 and $50, which… would positively shake the room. Lengthy-term targets, if historical past repeats, are being floated within the $500 to $1,000 vary, however these aren’t predictions, they’re extra like “if the cycle behaves just like the final one” hypotheticals. Crypto likes to humble individuals who communicate in certainty.

Technically, the most recent worth motion did print a robust bottoming candle with an extended decrease wick, which frequently alerts consumers stepping in aggressively at decrease ranges. SOL is at present sitting close to the 0.382 Fibonacci degree, tied to a high-volume zone between the S1 and S2 pivot factors. The each day RSI can also be sitting in oversold territory, which normally helps the case for not less than a short-term bounce.

Nonetheless, the pattern hasn’t flipped. SOL stays beneath its each day pivot and underneath the 200-day EMA, and that mixture normally means the broader construction continues to be bearish. It’s extra “accumulation vibes” than “bull market confirmed,” if we’re being sincere.

Memecoin Mania Is Exploding, and It’s Warping the Narrative

Whereas SOL itself has been struggling, the Solana memecoin machine has been doing what it all the time does: printing chaos at scale. Memecoin launchpads processed practically $100 million in each day quantity, and Dune information reveals new token launches averaging round 30,000 per day this week. That quantity is so excessive it virtually stops sounding actual after you repeat it twice.

What’s humorous (and type of telling) is that memecoins have really outperformed SOL these days. The memecoin sector market cap fell about 3.5% over the past 30 days to $30.2 billion, however SOL dropped round 8.5% over that very same window. So even in a weak month, the meme market held up higher than the chain’s native asset, which isn’t what you’d count on in a “wholesome” cycle.

One of many clearest examples was Pippin (PIPPIN), which surged over 100% in per week and pushed previous a $535 million market cap. In the meantime, older memecoin giants like Dogecoin and Shiba Inu posted declines. That distinction says rather a lot: merchants aren’t rotating into “protected memes,” they’re chasing the most recent shiny factor.

The issue is, excessive memecoin exercise is normally short-term hypothesis, not deep long-term conviction. So whereas the frenzy reveals Solana’s throughput and consumer exercise are robust, it additionally muddies the basics. In different phrases, Solana can appear to be it’s thriving, even when half the demand is coming from pure degenerate buying and selling.

The Huge Query: Is SOL Undervalued or Simply Lagging?

A very powerful takeaway is the divergence. Capital is flowing into Solana’s DeFi ecosystem even whereas SOL’s worth motion stays weak. That may be an indication of undervaluation, as a result of generally markets punish the asset earlier than they worth within the fundamentals once more.

When worth diverges from on-chain progress, it usually means long-term traders are nonetheless constructing positions quietly whereas short-term merchants are distracted elsewhere. However the memecoin hypothesis complicates issues, as a result of it’s laborious to separate “actual conviction” from “non permanent on line casino exercise.” Nonetheless, stablecoin inflows and rising TVL aren’t nothing, and so they have a tendency to stay round longer than hype.

For now, SOL is bouncing close to the mid-$80s, however the greater battle is whether or not it could actually reclaim key pattern ranges and rebuild confidence above main resistance zones. Till then, the community is likely to be successful… whereas the token retains making traders sweat.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.