TAO spikes 30%, but weak construction and brief squeeze indicators counsel warning forward.

Crypto AI tokens are exhibiting indicators of a short-term rebound after weeks of heavy losses. Previously 30 days, the overall sector market worth fell by greater than 30% to $14.66 billion. Notably, this has introduced renewed consideration to a number of main tokens.

Quick Liquidations Gas TAO Spike as Bitcoin Open Curiosity Declines

Since February 12, shopping for exercise has picked up throughout elements of the sector. Through the rebound, Bittensor (TAO) rose by over 30. As per market observers, the rally got here as capital flows into altcoins pushed Bitcoin dominance decrease.

Different AI-linked tokens additionally posted notable positive factors. Render (RENDER) bounced up 18% , whereas NEAR Protocol (NEAR) pushed up by 15%. Though the positive factors rekindled an AI-driven narrative, the broader construction warrants warning.

Even with the positive factors, TAO’s every day chart construction stays bearish as a result of its earlier losses. And at longer timeframes, sustained accumulation is absent.

For a confirmed bullish shift, TAO should shut a every day candle above January’s excessive at $302.4. Nevertheless, such an consequence seems far-fetched given BTC’s struggles and the present market setting.

As per onchain knowledge, complete Bitcoin open curiosity stands at $44.65 billion, down 2.22% over 24 hours. Drop factors to place unwinding slightly than aggressive new leverage. Market individuals look like decreasing publicity as a substitute of increasing danger.

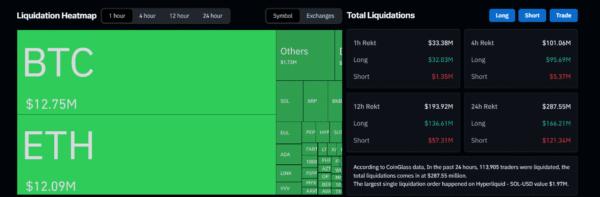

Picture Supply: CoinGlass

Liquidation figures help that view:

- Whole liquidations reached $208.76 million in 24 hours.

- Quick liquidations hit $119.96 million.

- Lengthy liquidations totaled $88.80 million.

- Quick positions had been pressured out at a better charge than longs.

Imbalance suggests a brief squeeze contributed to TAO’s rally. When pressured shopping for drives worth, power can fade as soon as strain eases. Such rallies typically retrace earlier than discovering steady help.

Bittensor Rally Cools as RSI Divergence Alerts Weakening Momentum

Relative efficiency towards Bitcoin stays blended. TAO/BTC pair printed a pointy spike greater however nonetheless trades inside a broader downtrend. Key higher-timeframe resistance ranges stay intact. A transparent breakout construction has not shaped on the relative charts.

Sturdy capital rotation normally seems via sustained outperformance versus Bitcoin. Present worth motion exhibits impulse adopted by cooling momentum. With out constant follow-through, breakout conviction stays restricted.

Trying on the TradingView chart, the RSI surged towards overbought ranges throughout the rally. Afterwards, it drifted again towards impartial. In the meantime, a bearish divergence shaped close to the current native high.

Picture Supply: TradingView

Normally, this setup hints at fading upside power. And cooling momentum raises danger of a short-term pullback.

Value has already moved above the $202 space the place many promote orders had been positioned. On the 4-hour chart, there’s a hole in buying and selling exercise round $170. That zone may appeal to worth once more if a pullback occurs. Space aligns with 20- and 50-period shifting averages, rising its relevance as a possible magnet for worth.

Even so, some throughout the crypto area imagine that an upside continuation stays attainable. If patrons keep in management, worth may transfer towards $241 and $268, primarily based on Fibonacci ranges.

A pullback towards $165–$175 seems believable earlier than any sustainable advance. Solely a decisive every day shut above $302.4 would invalidate the bearish swing construction. Till then, restoration appears to be like corrective slightly than structural.