Bitcoin checks long-term common as capitulation fades and accumulation strengthens.

Bitcoin could also be approaching a vital turning level. A technical mannequin that tracks its SMA on a four-year scale suggests the asset is coming into a section that normally marks the top of bear markets. On-chain metrics and worth motion additionally appear to type setups seen in prior cycle bottoms. Whereas affirmation continues to be creating, the construction seems extra mature than fragile.

Bitcoin Revisits Historic Backside Zone Round 4-12 months SMA

For readability, the 4-year SMA mannequin compares Bitcoin’s each day worth to its long-term common. It measures how far the value strikes above or beneath that common. Principally, massive gaps above the common typically imply the market is overheated. When worth strikes again nearer to the SMA, it normally alerts that valuations are returning to regular.

In previous cycles like 2014–2015, 2018–2019, and 2022–2023, Bitcoin peaked when worth moved far above its long-term common. After that, the value slowly fell and moved again towards the 4-year SMA. Every bear market ended close to that degree, the place Bitcoin traded sideways for a number of months earlier than beginning a brand new upward transfer.

📉 In accordance with this metric, which is solely based mostly on the 4 12 months SMA, we’re reaching a bear market degree.

This chart is constructed round that transferring common and its multiples.

➡️ The upper the usual deviation, and subsequently the a number of of the SMA, the extra Bitcoin seems… pic.twitter.com/AJFHoJLkFW

— Darkfost (@Darkfost_Coc) February 15, 2026

As per market analyst Darkfost, the present market construction carefully resembles previous late bear phases. At current, Bitcoin has returned to the mannequin’s inexperienced worth zone. In consequence, the value is approaching its 4-year SMA, presently close to $57,500. In the meantime, massive strikes far above the common have light. The worth is now step by step returning to its long-term common.

Traditionally, that zone has marked a shift from pressured promoting to quiet accumulation. Nevertheless, valuation metrics alone can’t verify a backside. Extra alerts are wanted to evaluate whether or not bear-market exhaustion is creating.

Realized Loss Spikes and Falling Open Curiosity Trace at Late Bear Section

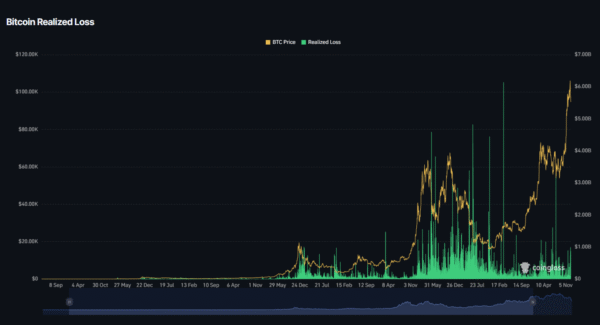

Realized loss knowledge exhibits a number of current spikes, with each day losses reaching billions of {dollars} throughout market drops. These losses occur when traders promote cash beneath the value they paid. In consequence, many of those gross sales mirror panic. In lots of instances, such heavy losses sign capitulation.

Picture Supply: CoinGlass

Massive waves of realized losses have typically appeared close to previous market bottoms. When these waves decelerate, weak holders are normally pushed out of the market. Not too long ago, realized losses jumped sharply, however worth will not be falling as quick as earlier than.

Promoting stress seems weaker regardless of massive loss numbers. Usually, this sample typically factors to a late bear section slightly than the beginning of a deeper drop.

Complete Bitcoin open curiosity is round $44 billion after a current each day drop. Funding charges have eased, and dealer positions look extra balanced than throughout earlier highs.

Bear markets typically attain a backside after sturdy liquidations take away too many lengthy positions from the market. Open curiosity has fallen from earlier highs, however it’s nonetheless above ranges seen at previous cycle lows. Positions don’t look overly bullish. On the similar time, market stress will not be excessive. From a market construction view, knowledge factors to a partial reset slightly than lively panic.

Lengthy-Time period Holder Provide and Capitulation Alerts Trace at Bitcoin Backside

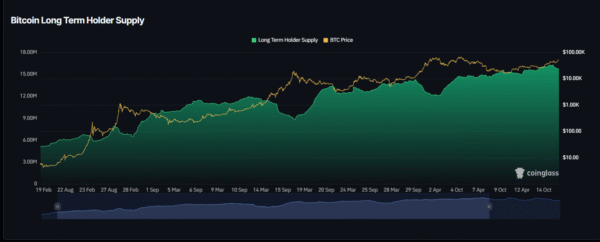

Lengthy-term holder habits strengthens the case for maturation. Provide held for at the very least 155 days stays elevated. Throughout previous cycle tops, long-term holders diminished publicity and distributed cash. Bear markets reversed that sample, as affected person traders amassed provide.

Market bottoms typically shaped when long-term holder provide reached cycle highs. Present knowledge exhibits sturdy holders are protecting or growing their cash regardless of volatility. This habits factors to accumulation, not promoting. When worth strikes nearer to the 4-year SMA whereas long-term holder provide stays excessive, it has typically signaled a bottom-building section in previous cycles.

Picture Supply: CoinGlass

When seen collectively, the alerts present worth transferring again towards its long-term common. Realized losses recommend capitulation might have already occurred. In the meantime, open curiosity has fallen from cycle highs. On the similar time, long-term holders proceed to carry and add to provide.

Nevertheless, none of those metrics alone ensures a confirmed backside. Open curiosity stays structurally elevated in comparison with earlier deep-cycle troughs. Broader liquidity circumstances should affect timing. Consolidation may persist earlier than any sustained enlargement emerges.

Even so, the construction not resembles early bear territory. Circumstances as a substitute resemble a mature compression section. Draw back asymmetry seems to be shrinking as accumulation step by step replaces distribution.

In accordance with analysts, transferring common fashions are sometimes seen as too easy. Nevertheless, when a mannequin matches previous cycle highs and lows and aligns with on-chain and derivatives knowledge, it turns into troublesome to dismiss.

If historical past repeats, worth buying and selling close to the 4-year SMA, together with indicators of capitulation and regular long-term accumulation, has typically marked the ultimate stage of a bear market.