- BONK surged 11.5% as quantity spiked 157% and Open Curiosity rose 13.4%, signaling a pointy return of hypothesis.

- Worth broke above its descending channel, flipping short-term construction towards potential reversal territory.

- Trade outflows stay robust and funding is adverse, suggesting quiet accumulation but additionally crowded shorts that might set off volatility.

BONK simply snapped again to life. The token jumped 11.5% within the final 24 hours to round $0.0000057189, and the transfer wasn’t refined. Buying and selling quantity surged 157%, market cap pushed as much as roughly $632.66M, and speculative urge for food clearly returned after weeks of sluggish bleed.

Derivatives exercise additionally heated up. Open Curiosity climbed 13.4% to $7.63M, which tells you merchants aren’t simply shopping for spot. They’re piling into leverage too. And that’s the place issues get difficult, as a result of leverage can gasoline breakouts… however it will probably additionally flip them into violent whipsaws.

Proper now, BONK is sitting at an actual inflection level. Is that this the beginning of a structural restoration, or simply one other breakout that will get pale as soon as the leverage unwinds?

BONK Breaks Its Descending Channel and Flips the Brief-Time period Construction

On the each day chart, BONK pushed decisively above the higher boundary of its descending channel. That issues as a result of it adjustments the construction instantly. This isn’t a bounce that stalled underneath resistance, it truly cleared the channel wall that had been capping worth for a very long time.

Worth traded round $0.00000696 after reclaiming the $0.00000557 assist zone. Now, the subsequent quick pivot sits at $0.00000743. If bulls can defend that stage, the setup opens up towards $0.00001221, the place earlier provide zones capped rallies previously. Past that, $0.00001361 stands out as the subsequent structural ceiling, the sort of stage that tends to set off heavy profit-taking if worth reaches it.

The vital element is that this: BONK is now not trapped inside the identical downtrend construction. The technical bias shifts from “downtrend continuation” to “potential reversal territory.” It’s not confirmed but, however the tone is totally different.

RSI Is Recovering, However It’s Not Full Bull Mode But

Momentum indicators are bettering, however they’re not screaming “new bull development” simply but. The RSI is round 45.44, after rebounding from deeper oversold territory within the low 30s. That’s an early signal of momentum restore, not a breakout into robust upside management.

If RSI pushes above 50, it could be a cleaner affirmation that consumers are taking management once more. Nonetheless, even this rebound already alerts one thing significant: inner strain is shifting. BONK is now not compressing downward nonstop. Energy is rebuilding, slowly, underneath the floor.

Trade Outflows Recommend Quiet Accumulation

One of many extra fascinating alerts is going on in alternate flows. Spot netflows have remained adverse throughout a number of periods, with the most recent studying exhibiting roughly -$870K leaving exchanges. Which means extra BONK is being withdrawn from centralized platforms than deposited.

Over the previous a number of weeks, crimson bars have dominated the influx/outflow chart. Even throughout worth weak point, merchants saved pulling BONK off exchanges as an alternative of sending it in to promote. That’s normally a constructive signal. It reduces quick sell-side liquidity and might create a tighter provide atmosphere if demand returns.

Outflows alone don’t assure a rally, clearly. However it’s very totally different from panic inflows, which have a tendency to point out up proper earlier than breakdowns. BONK’s movement profile suggests holders are selecting custody over liquidation, which doesn’t match the concept of aggressive distribution.

Crowded Shorts Are Constructing, and That Can Get Harmful Quick

Now for the spicy half.

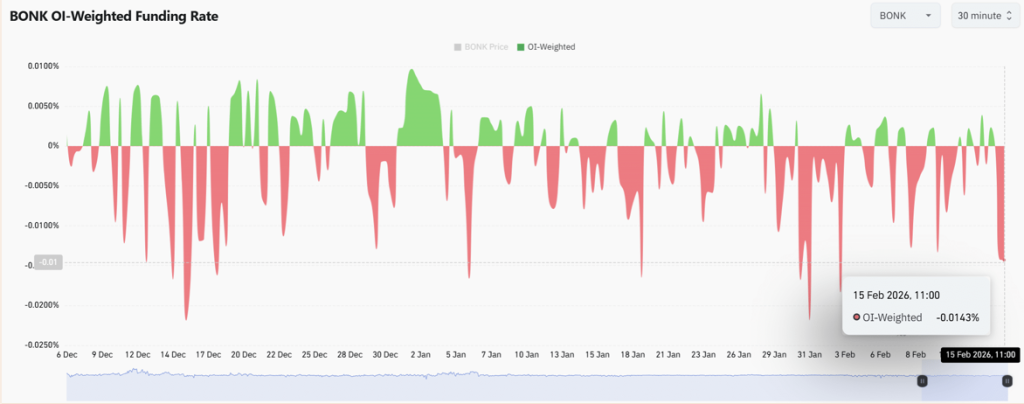

The OI-weighted funding price printed round -0.0143%, exhibiting a persistent adverse bias within the derivatives market. Shorts are paying longs, which suggests merchants are nonetheless leaning bearish, at the same time as worth construction improves.

On the identical time, Open Curiosity is rising. That mixture is vital. When funding stays adverse whereas worth climbs, it usually alerts crowded quick positioning constructing into the transfer. And if worth continues pushing larger, these shorts can get squeezed, forcing cowl and accelerating upside volatility.

After all, it cuts each methods. If BONK loses momentum and breaks again beneath reclaimed ranges, these bearish positions get validated, and leverage can unwind rapidly. That’s how these meme charts get ugly in a rush.

BONK Is Bullish on Construction, However Leverage Will Determine the Consequence

To sum it up, BONK has damaged its descending channel, RSI is recovering, alternate outflows stay robust, and funding continues to be adverse. Structurally, that leans bullish. However the rising Open Curiosity and short-heavy derivatives positioning inject critical volatility threat into the setup.

If BONK defends the reclaimed assist zone, momentum may prolong into the subsequent resistance bands. If it fails, the unwind might be quick, and the market will go proper again to chopping folks up.

Proper now, the technical shift carries weight. However the derivatives crowd will doubtless determine whether or not this breakout turns into an actual restoration… or simply one other fakeout.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.