- Ethereum fell 6.6% to round $1,947, however Coinbase information exhibits retail buyers growing BTC and ETH holdings.

- CEO Brian Armstrong highlighted “diamond arms” conduct, with most customers holding equal or larger balances than in December.

- Regardless of combined views and declining buying and selling volumes, regular retail accumulation might present a stabilizing base for future restoration.

Ethereum has slipped once more, down roughly 6.6% over the previous 24 hours and hovering close to $1,947. The broader crypto market isn’t precisely calm both, with macro strain and common risk-off sentiment nonetheless hanging within the air. It’s the form of setting the place merchants get jumpy quick. And but, in the course of that turbulence, Coinbase CEO Brian Armstrong is pointing to one thing surprising: retail buyers aren’t operating.

Retail “Diamond Palms” Are Nonetheless Shopping for

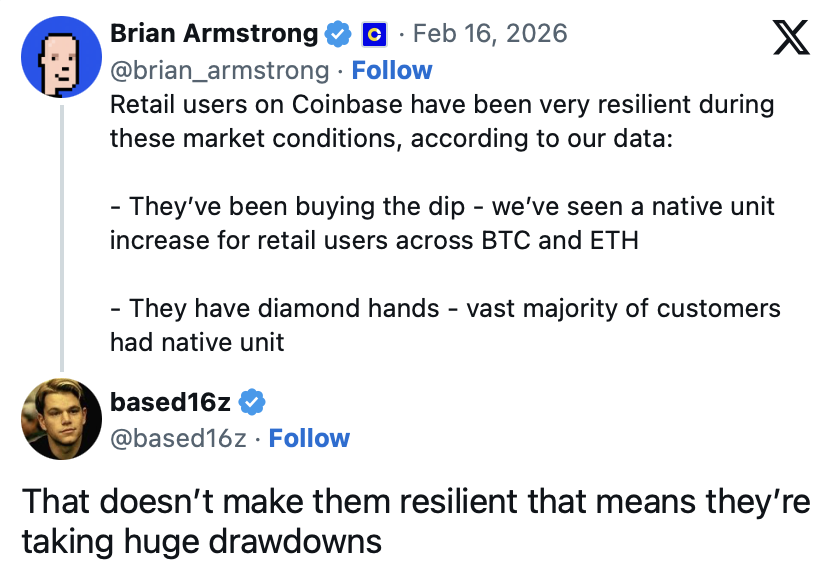

Based on Armstrong, Coinbase’s retail customers have proven notable resilience throughout this current downturn. As an alternative of panic-selling into weak spot, many have really been shopping for the dip, resulting in internet will increase in native unit balances for each Bitcoin and Ethereum on the platform.

“Retail customers on Coinbase have been very resilient throughout these market circumstances,” Armstrong shared, including that customers have continued accumulating BTC and ETH regardless of the drawdowns. In reality, he famous that almost all clients held equal or higher native unit balances in February in comparison with December. That’s not the conduct of a crowd in full retreat.

The phrase “diamond arms” will get thrown round rather a lot in crypto, generally jokingly, however right here it carries weight. Bitcoin pulling again towards the $68,000–$69,000 vary and Ethereum slipping under $2,000 would usually shake out weaker holders. As an alternative, Coinbase’s retail base seems to be leaning in, not out. That means conviction, or on the very least, a shift in mindset in comparison with earlier cycles.

A Maturing Retail Base… Or Simply Deep Drawdowns?

Not everyone seems to be satisfied that is purely bullish. Some critics argue that holding by means of sharp declines doesn’t robotically equal energy. It might simply imply buyers are already sitting on sizable unrealized losses and have little incentive to promote at depressed costs. That’s not resilience, they’d say, it’s inertia.

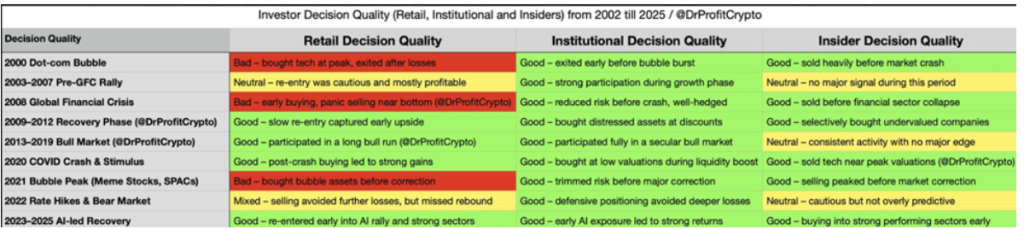

Nonetheless, the information exhibits accumulation. And traditionally, sustained retail shopping for in periods of worry has typically preceded stronger recoveries in a while. When establishments pull again and retail absorbs volatility, the market can quietly construct a base. It doesn’t at all times really feel dramatic within the second, however these gradual accumulation phases matter.

There’s additionally a broader coverage dialog occurring within the background. Commentators like Wendy O have argued that retail buyers deserve higher entry to yield on stablecoins and reforms round accredited investor legal guidelines. The thought is easy: develop participation, develop alternative. If retail has extra instruments to earn yield and handle capital effectively, confidence might deepen additional.

Coinbase’s Powerful Quarter, However Regular Inflows

The timing of Armstrong’s remarks is attention-grabbing. They arrive shortly after Coinbase’s This fall 2025 earnings report, which revealed declining buying and selling volumes amid an 11% drop in total crypto market capitalization. It wasn’t precisely a blowout quarter. Volatility tends to compress exercise, and exchanges really feel that straight.

But whilst volumes softened, Coinbase reported continued inflows of native crypto items from retail customers. That’s a delicate however vital distinction. Buying and selling might gradual throughout unsure durations, however accumulation can nonetheless rise. It hints at a flooring forming beneath the market, supported by smaller buyers who’re pondering long term.

If that dynamic continues, retail might more and more act as a stabilizing drive moderately than a supply of volatility. In earlier cycles, retail was typically blamed for euphoric spikes and panicked crashes. Now, the conduct seems extra measured, extra affected person, perhaps even strategic.

What This Means for Ethereum and the Market

For Ethereum particularly, the drop under $2,000 isn’t insignificant. It’s a psychological degree, and shedding it tends to amplify short-term bearish sentiment. But when retail accumulation continues beneath that worth, it might soften the impression of broader macro strain.

Bitcoin and Ethereum stay tied to bigger financial currents, from rate of interest expectations to world liquidity shifts. Value motion might keep uneven within the close to time period, and there’s no assure that resilience alone can reverse a downtrend in a single day.

Nonetheless, the sample is price noting. Retail buyers seem much less reactive than in previous downturns, extra keen to carry and even add throughout weak spot. If that shift holds, it could quietly change the inspiration of future rallies. Typically the true story isn’t the value drop, it’s who retains shopping for anyway.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.